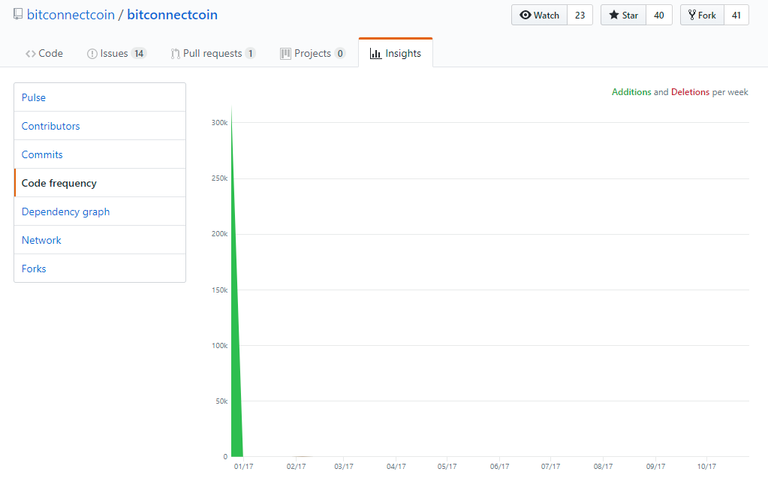

You could try compiling from the the src folder, and see what you get (probably nothing but a bunch of errors).

You are definitely correct about the lack of source code development. However, there are 3 different websites (bitconnect.co, bitconnectcoin.co, and bitconnect.com), which is strange and confusing. The Mac, Windows, and Linux Wallets from the '.com' direct download hasn't been modified since 2/8/2017, 1/10/2017 , and 12/29/2016 respectively. The ".co" sites point to the Github here, which also has had no updates since that time:

Per these links on staking , and POW mining, all mining[i.e. running the network, and adding blocks to the chain) is through aforementioned desktop wallets in theory.

One should be able to setup a wallet and do both POW mining and staking, and verify they operating on the same blockchain.

Regardless, this coin is almost certainly a huge scam. Examining the source code you will find that it is simply a copy and paste Zerocoin(the predecessor of Zcash) clone, with additional Novacoin and Bitcoin code added (and altered by Bitconnect)

It is clearly a classic multi-level marketing/pyramid scam per their own materials:

Bitconnect.co controls 95% of all exchange volume on it's own website's BCC exchange:

Since Bitconnect.co processes(or fabricates) and publishes the data for almost all exchange volume it could easily control the price. Only Bitconnect would know if exchange transactions were fabricated or shilled, since their website privately holds all user data. Note that this sort of manipulation has nothing to do with the wallet software or code parameters.

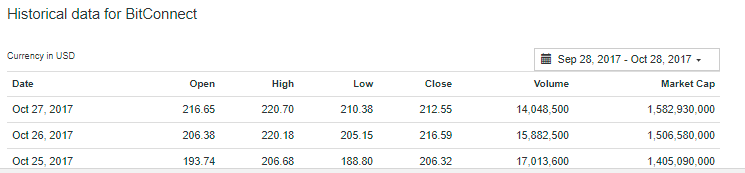

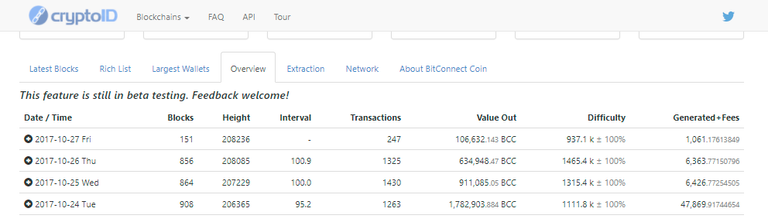

Alarmingly, compared to the exchange volume the amount of off-exchange (dark) volume on the blockchain comprises up to 80% of all volume:

Note that per the blockchain there were about 600,000 and 900,000 BCC transacted on the 26th and 25th. Total exchange volume was $15,882,500 and $17,013,600 on those dates, and the lowest price was $188. Therefore, the maximum exchange BCC volume was about 84,500 and 90,500 BCC coins respectively. Nearly ten times these amounts is being transacted off the exchanges for some crazy reason.

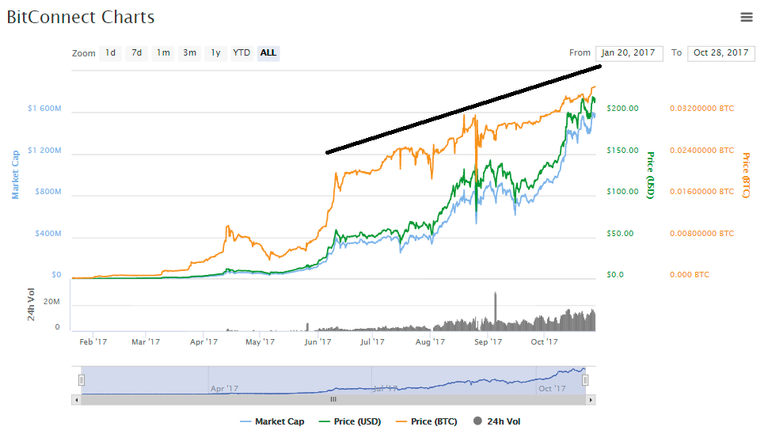

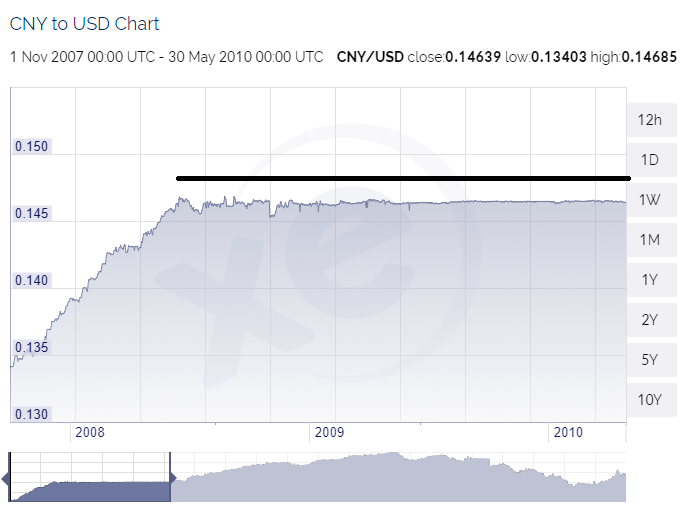

The price really seems fixed/rigged since about June. Do you notice anything funny about the following charts?

The first chart shows the BCC/BTC price going back to January. The second chart shows the price of the Chinese CNY against the US dollar during a period of known currency manipulation to peg the CNY to the USD.

It's important to realize that the loans are pegged to USD, such that if you lend bitconnect 100 BCC when the BCC/USD price is $100, when they pay you back if the price has risen to $200, they would only pay you 50 BCC and keep the rest. Thus as long as prices can be made to rise steadily over the loan term (about 1 year), Bitconnect can be guaranteed to have to pay out fewer BCC than it was initally loaned. So, Bitconnect sells the initial investor (sucker) BCC , immediately borrows it back, gives the lender less than they were given, and then takes the remainder perhaps to help pay it's dubious interest to other investors (Ponzi scheme).

I would stay as far away as you possibly can from this coin. If the Bitconnect becomes unsolvent and their website and BCC exchange goes down this coin will have essentially no exchange value (even if you were fortunate and smart enough to hold them in your own local wallet).