I can prove what the maximum possible profits from Bitconnect's trading Bot!

I can prove what the maximum possible profits from Bitconnect's trading Bot!

Because Bitconnect is traded on a blockchain, coinmarketcap.com can record the price and volume moves each day, which will let us calculate the maximum profits the Trading Bot could be making.

First, let me explain what volume is for those that don't fully know.

Let's say I own five CharlieCoin (CC), and you want to buy some. So, we both make a transaction via a marketplace using something like Gemini.com or Kraken.com. I sell you 5 CC at the price of $10 each for a total of $50. Later in the day I decide I parted with my CC too eagerly and want to buy at least one of them back. You sell me 1 CC for $60. Then later I buy two more from someone else for $40 each and a transaction total of $80. Now there are 3 transaction worth $50 and $60 and $80, and a total of 8 CC were traded (5+1+2). The volume is just the sum of the total transactions that took place and can be represented in $ or shares or coins.

- 5 CC @ $10 each for a total of $50

- 1 CC @ $60 each for a total of $60

- 2 CC @ $40 each for a total of $80

- Total Volume is 8 CC or $190.

So how can we use this to prove the maximum profit the bot is earning each day?

Let's go back to the simple example to explain the concept. Let's pretend that the data below was published on coinmarketcap.com for the last 24 hours:

- 24 Hr Volume of $425

- CharlieCoin's low price was $10

- CharlieCoin's high price was $75

- Buying 5 CC @ $10 each for a total of $50

- Selling 5 CC @ $75 each for a total of $375

- Total Volume is 10 CC or $425

- Max profit is $375 - $50 = $325.

How much money could Trading Bot make from perfect day trading?

I went to coinmarketcap.com and exported the daily historical prices for Bitconnect Tokens and for Bitcoin. Virtually the only way to acquire Bitconnect Tokens is by using Bitcoin. There are other ways to acquire it, but those account for less than 1% of all transactions according to coinmarketcap.com and can be neglected for this calculation.

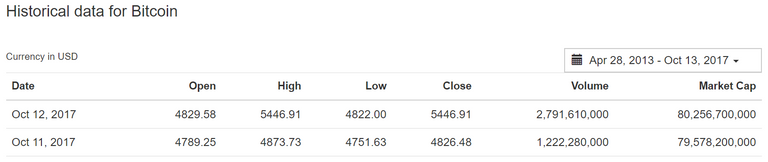

The data looks like the images below - just many more lines of it. Other than the dates all units are USD.

[caption id="attachment_1986" align="alignnone" width="1625"] Figure 1 Shows a snippet of the data that I exported for Bitconnect, priced in USD.[/caption]

Figure 1 Shows a snippet of the data that I exported for Bitconnect, priced in USD.[/caption]

[caption id="attachment_1985" align="alignnone" width="1631"] Figure 2 Shows a snippet of the data that I exported for Bitcoin, priced in USD.[/caption]

Figure 2 Shows a snippet of the data that I exported for Bitcoin, priced in USD.[/caption]

From these charts we cannot figure out the exact low and high price of the BCC/BTC ratio because the high and low prices of the two different coins don't typically fall at the exact same time. However, we can take the high of Bitcoin and the low of Bitconnect to find the lowest the BCC/BTC ratio could have been. So, for Oct. 12th that would have been $166.23/$5,446.91 = 0.03051822 BCC/BTC. In a similar fasion for October 12th the highest the BCC/BTC ratio could have been was $188.09/$4,822.00 = 0.039006636. That is a price change from low to high of (0.039006636-0.03051822)/0.03051822 * 100% = 27.8%! Now these exact ratio likely did not ever occur because the price of Bitcoin likely did not hit its high for the day exactly when Bitconnect hit its low etc.. In fact if we look at the daily chart available on coinmarketcap.com it will show us that the min and max of the ratio for that particular day was 0.0345370 and 0.03516540. That is a peak to valley price rise of 18.2%, which is less than the 27.8% that we calculated earlier. This is good because I don't want to short change the Bitconnect bot when I calculate the max profits possible. I think giving a price change of 50% higher than what actually occurred is rather generous. Also, since I see no way to export the high and low BCC/BTC ratio, I would rather estimate the max and min BCC/BTC ratio instead of reading it from the chart for each and every day. If you want to please do that and send it to me. I don't have the time and don't need it to prove my point, but I want that data if you get it!

Next using the volume of BCC/BTC, we can calculate the max daily profit. So, on the 12th of October we can see that the volume is $15,616,200 for BCC. Again, since BCC can only be acquired by BTC. Again, that is virtually synonymous with say it is the volume of BCC/BTC since BCC/BTC accounts for over 99% of all BCC transactions. Instead of using the 18.2% rise to calculate the Bot's max profits we will be generous to the Bot and use 27.8%. Now the question is, "how much money could the Bot have used at the start of the trade and at the end of the trade sold for a 27.8% profit, without having those two transactions surpase the daily volume of BCC/BTC?" I will spare you the details here though I will make them available later, but basic algebra tells us:

- $8,760,976.12 = $6,855,223.88 * (1+0.278)

- and $8,760,976.12 + $6,855,223.88 = $15,616,200 which is our total volume!

- So the max total profit is $8,760,976.12 - $6,855,223.88 = $1,905,752 on October 12th.

What is the total a perfect Bot could have earned since the BCC/BTC started trading?

$68,432,921.61 from January 20th, 2017 to October 12th, 2017! That is a lot of profit, but does that tell us anything? Yes, it most certainly does!

At the close of October 12th, 2017 Bitconnect had a total market cap of $1.183 Billion dollars and we said the max earnings on that day was $1,905,752. That means the profits were only about 0.16% of the total marketcap - if their bot made the perfect trades. If we calculate this for every day we find that the average max profit is 0.185% of the total market cap on that day. As you know 0.185% is much lower than the approximately 0.89-1% they pay each day.

Now you may know where I am going with this, but before we get there I need to remove one more thing I am sure people will try to say, "That is the % profit of the entire market cap not the total loan value, which is the value they pay interest on!" It is true, I know of no way to look up the total loan value. Please, if you know how, do tell! However, if only 21% of the market cap was lent to a perfect trading bot, that was able to buy at prices lower than existed through the day, and sell at prices higher than existed during the day, the Bot would just break even after the payouts.

What I think is really happening...

Let me paint a scenario for you. Say I want to make a new crypto currencies called CharlieCoin - the fake coin I chose earlier. I limit the total supply in the future to 28 million coins, and I do a pre-mine so that I have 5 million coins. I set the rules to have Proof of Stake. As time goes on I get more of the 28 million coins just buy holding my 5 million.

Unfortunately, I don't know any way to really make my coin better than Bitcoin. Instead I tell people that I have this great trading Bot that I can use and pay them 365% interest a year if they buy my coin from me and lend it back to me. The first person I talk to asks, "why do you need me to buy the coin from you and lend it back to you? You already own the coin don't you?" At that point I decide to move on to the next person who doesn't ask that question.

I find enough people who don't ask that question and just buy my coin, and call anyone who does ask that question a hater. As more people buy the coin they push up the price. All of the sudden the 5,000,000 coins I have that were worth nothing become worth $0.10 then $1 then $100 then $200... you get the idea. As this happens I become richer and richer. More people hear about my offer and more people begin to add money. How could a coin with the market cap in the billions be a scam? I even add in a little extra incentives to get more people to lend me the coin.

We all know how exponential growth works - really fast! Before you know it, I have run out of people who don't ask the question, "why do you need me to buy your coin from you and lend it back to you." All of the sudden my coins stop going up in price. My trading Bot - that either doesn't exist or doesn't earn enough - can't pay back the 365% interest a year (1% a day payout) on all the coins that people lent to me. As this happens I start to sell my 5,000,000 coins to pay the people back. As I do this the price starts dropping. More people sell the coin. Fewer people start investing. I realize that I can either sell the rest of my coins now and not pay the lenders back, or I can continue to sell my coins over time to pay people back as needed and eventually I will run out of coins. Either way it comes to an end. The question isn't whether the creators of Bitconnect are scammers or not. I have my own very strong opinion on that, but the real question we need to answer is, "Can Bitconnect sustain itself?" The clear and obvious answer is no. If you read this an even think Bitconnect might not be sustainable I encourage you to share this idea with people who are invested or are thinking about investing.

Thank you for reading. I hope you have enjoyed it and learned something. If you would like to take a look at the Excel sheet I used to produce these results just click the link. Bitconnect Proof rev 3 (public)

As some of you know, I do actively trade the markets of cyrpto currencies and stocks. If you would like to find more information like this I encourage you to follow my blog, twitter, steemit, or Collective2.

This was a fantastic piece of research. Thank you for the time and effort!

Putting to one side the implausibility of the high returns, an argument as to why it is a scam - and not an ingenious investment scheme that no hedge fund manager has ever thought of, is this: “If anyone discovered a way to genuinely make 365% profits a year, (or much more by daily compounding), why would they go to the trouble to set up a website to share those profits with everyone else?”

@charlestines, as you like research like this, you may want to look a study I did comparing wealth bands and bitcoin ownership penetration levels. I reached some conclusions on next year’s supply and demand for bitcoin. There are several posts on the same topic. The last one just deals with my conclusions, but the earlier ones have hard numbers and research.

@charlestines.com , you are a very patient individual. In my experience, it is almost impossible to overcome the juggernaut of Faith-based investing such as the type being perpetrated by Bitconnect. When I get exasperated by this topic (daily) I like to remind folks that less than 10 years ago, the same type of people who are "investing" in Bitconnect firmly believed that a $50,000 per year salary was sufficient to carry an $800,000 mortgage. Because the bank wouldn't approve them otherwise.

I like that comparison and thank you for the compliment. I don't know if I am patient or just like hitting my head against a wall haha. I have had people say it wouldn't be around this long if it was a Ponzi and it would be this big or look I got paid out. Seems like the same logic as 2008. I once had a family member get involved in the ZeekRewards Ponzi. This person told me for months that it was a good idea. After about 6 months my better judgement disappeared and I decided to listen to this authority figure/family member. I had to pay a $100 fee right away then wait for my $900 fee to get transferred. Fortunately the SEC shut it down the next day saving my $900. It was one of the best $100 lessons I could have asked for. I did go blow that money on a nice bicycle that I enjoy very much and call my Zeek Bike. It serves as a great reminder to only invest in what you understand and to be willing to stand against the herd.

There is one thing that I don't understand. Why are you calculating with the Bitconnect/Bitcoin prices. In my understanding, the "Trading Bot" buys Bitcoin cheap and sells off Bitcoin at higher prices. And that is how he generates profit. Not by trading Bitconnect Coin against Bitcoin. So all these calculations make no sense, because you totally miss the point. You should do them, with the volume of Bitcoin and then we might see, that Bitconnect could eventually be real. I do have an active loan on Bitconnect, so my view might not be clear. But I think that you missed the point in this article, though I enjoyed reading it ;)

Yes that is the most reasonable argument against this. They could be first trading BCC/BTC then trading BTC/USD, which would not be captured in the volume of BCC/BTC. I can almost guarantee that BTC/USD has enough volume as you suggest to make this work. Your reasoning actually is very clear on that aspect. I hate to say it but yes what you have pointed out is the flaw in the argument, and I will admit that I am rather biased to calling it a scam. I will say when I looked at the math I think in an ideal scenario the bot could have moved about $730 worth out of BCC to BTC and beyond. You seem like a reasonable person and I am interested in your opinion. I have two questions. Why do you have a loan rather than simply holding the token? In almost any period longer than about 6 months the token has outperformed the loans and does not require you to lock up your capital. Two, if they are taking the BCC selling it to get BTC then trading BTC against USD or other coins, why make you convert to BCC then lend it to them? Also, do you really think the bot is real and the source of the profits. If it isn't real I don't know how they could be profitable in the long term.

I think there is a way for me to figure out the max they could have been trading BTC with at any given time and do the same kind of analysis. However, the volume limit won't be that of BTC, but what was the most they could have converted to BTC and USD. Now if we can assume the Bot is only allowed to hold BTC, USD, and BCC in various amounts this might work. If you want me to check if they were trading other alt coins against BTC I don't think I can. It will probably be two weeks before I get around to it.

Well, I think they do have various ways to earn money to pay their customers. 1. trading bot who makes profit with their own and borrowed BTC. 2. they hold a few BTC that we lend and profit from good BTC Price raise 3. we use lending program, they sell BCC against BTC. We buy 1000 coins for 5k in may, 180 days later we made 10k profit via lendig and try to rebuy BCC from lending wallet, for 15k (with capital release) we get only 150 bcc cuz they are worth far more, so they can keep the rest and profit from bcc price raise 4. they keep 0.25% from each exchange BTC/BCC & BCC/BTC. 5. i bring in a new referral who loans 100$, Bitconnect keeps lets say 20% of his earnings, over 300 days this is almost 60$, i get 7% referral bonus, thry keep the rest! All together this is a lot of money which they make. Might be sustainable. I dont know yet..

And it is not true that holding/staking BCC is more profitable than lending, IF you reinvest daily. With compound interest you will earn far more after a certain period of time. And BCC increased its value drastically since Junuary, there is no warranty for this to continue. Though it is possible.

I agree moeter. It is the compound interest that is key.The interest on interest is what will blow out. Just depends if people keep investing and bitconnect survives long enough ;)

Holding the coin also gives you compound interest. See the calculationgs in the comment I made to Moeter and you can see that over most time periods the token did typically outperfrom the lending.

Charlestines.com is correct. Since the loans are pegged at the initial loan amount in $USD for the term, the lender is paid a percent of the initial dollar value. The staker is paid a percent of BCC. So since if you loaned over $10,000 it would take 120 days for a ROC, the BCC price 120 days ago was about $50 (early July), so $10,000 would be 182 BCC tokens. 120 days later ( early Novemeber) the price of BCC is about $250, so to "return" the lender's capital Bitconnect would pay the user about 40 BCC ($10,000/250{$/BCC}). What happened to the other 142 BCC? The staker would've taken $10,000 worth of BCC in July, which would have been 182BCC. Fast forward 120 days, and they would have a BCC wallet with 182 BCC of principal. So assuming compounding (ignoring the $100 minimum) the lender would total $ 34,000 (($10,000 x 1.0125^120)-1) of interest, wheras the staker has made $14,500 (58BCC x $250{Nov. Price};58BCC = 182 BCC *(.08+.08+.08+.08{monthly stake interest})).

However, the lender's total is $44,000 ($10,000 principal + $34,000 interest), whereas the staker has $60,000( $250 * 182BCC principal + $250 * 58BCC interest). This even ignores the compounding of staking interest ((1.08^4)-1)

TL;DR take away over the last 4 months a staker would have $60,000 whereas a lender would have only $44,000 starting with the same $10,000 initial amount.

I agree that it won't continue haha. In all serious this though I think the results of lending and the coin are closely tied together. Using the volatility software on their site it says over the last six months the interest rate was 0.93%. So, if you were able to lend back every single dollar you earn $100 * (1 +0.0093)^(6*30) = $529.24. The coin last I check was $193.95 and 180 days ago (April 21st) it was $9.87. So, again if you invested $100 * $193.95/$9.87= $1965.05. Over any reasonable time period the coin has largely out performed the lending. Now I agree that won't last. In fact I speculate this is how they are making most of their money. Not from a bot. When token price increase no longer increases more than lending that to me is a signal it is about to end.

Over the last 30 days interest was 0.87% daily and the price of the token went from $106.84 to $193.95.

Lending: $100 * (1+0.0087)^30 = $129.68

Token: $100 * $193.95 / $106.84 = $181.53

Again I don't think it will last. However, if the token return doesn't do well and it is a Ponzi that won't be good. If it is a Ponzi it will have the same problem that Bernie Madoff did. Is started to collapse because the market turned and people wanted their money back.

I've made more then I lend, though I want to take it out my money stuck for a few more months.

ALSO I HAVE RESTEEMED YOUR POST AS I DO BELIEVE IT IS HE RIGHT ACTION TO MAKE THE PUBLIC KNOW THAT THESES SCAMMERS ARE STILL PLAYING IN THE AREA

I HAD A GOOD FEELING THAT THIS BOT IS A SCAM, SO I THANK YOU AND PROCEED TO ANOTHER POST.

I FOLLOW YOU

THANK YOU

red rose is a good name.just like you

Solid breakdown and analytics...

The CryptoVerse is very much like Westworld, as it continues to emerge.

Bitconnect gives me the thought of a Crypto Credit Union, providing to cavalier crypto users a model as banks once offered: daily interest payments (in USD) while lent principle (in BTC) is being grown on the BitConnect community's behalf.

Another way to make money daily, like mining... But the kick is the full principle returned. That was my most skeptical piece...

But users regain the initial principle, store and grow their returned interest value in the BCC coin, (which chart wise grows linear)...

Should make it through most of 2018 at least...comparatively, in my opinion there are ICOs that are way worse for the Cryptoverse in their utility.

Keep Steemin!

Sure, but even in the darkest days of the dreaded "thrifts" (remember them?) they still left an audit trail. There is simply no evidence, positive or negative, as to what Bitconnect is doing with their BTC deposits. Or who they even are...

I understand that everyone that's not into Bitconnect wants it to fail and wants to keep everyone out but saying they're trading bit is going broke is crazy. Honestly just watch their live interest charts if you want to see how their trades are going. I know I've have some low interest day hell all the down to 0%. Ithey pay what they can it's not like how Control-Finanace was giving 1% no matter what daily.

I don't want Bitconnect to fail - I don't think anyone wants thousands of people to lose their hard earned money. This is simply a case of those of us who have lived through dozens and dozens of similarly structured investments - where the returns are better than any other possible PREDICTABLE investment wanting to protect those who may not have had that experience.

Thanks for the comment and the title is a little misleading since it doesn't prove it. However, the daily interest chart they print doesn't prove it either. Control-Finance had trade reports that didn't prove it either.

Good job. Bitconnect is going to fall. IDk when. However , they sustain themselves longer doing these three thing.

POS obviously limits trading of the coin so created more scarcity creating more price for the coin.

Aka banner ads. ad networks. I not even counting those sponsored posts. Here how much they could make with ad networks alone http://www.statshow.com/www/bitconnect.co

pictures of ads=

if they add masternodes you know the end is coming...

why you said beautiful girl

I know very little about Bitconnect so I cannot say much. All I am saying is that people . successful traders have managed to go from $50,000 to $50 million trading options. So if the Bitconnect people can trade in the forex market they can employ professional traders that can make them that kind of money. And in the forex market there is 100 x leverage. So your 0.18% profit can become 10% per day with leverage.

I think you are missing the point of volume that I made. If you have 100 times leverage then instead of making a trade worth $1 you will make a trade worth $100. Whether you make the $1 or the $100 both will get counted in the total volume. I am not saying people can't make fantastic returns, but there must have been enough volume in the market for those returns to be possible. Right now you are essentially saying that someone could have made $10,000,000 by selling a house for $100,000 dollars. It doesn't matter if you bought the house for $1 or $100,000. It also doesn't matter if you paid cash or put zero down. You would not be able to buy a house then sell it for $100,000 and make $10,000,000.

over time..and i mean alot of time. in 3 months nope. in the currency market on bitcoin in 3 months hell no. They also say crypto trading bot

They have a capitalization of $1.4 billion dollars. As I say I know nothing about Bitconnect but what I am saying is that they can have enough capital to employ professional traders to bring in say $10 billion dollars of revenue if they want to . Microsoft brings in revenues of $100 billion or so selling software!!! Just a thought.

Bitconnect certainly does have a large market cap. However, based on the same logic why did Bernie Madoffs scam collapse. He had far more than $1.4 billion dollars of capitalization but failed promising returns of only 10% a year. I have seen this argument more and more but believe it has no merit. I really do appreciate your comments I just don't agree that they give Bitconnect a leg to stand on.

It is not sustainable but for how much longer will it last is the real question. If it lasts just a few more months, anyone can still earn quite a profit just by taking out every penny that they possibly can. I'm personally taking the risk because based on the data there's enough money being made to last a few more months to retrieve profits. It is a large risk and I don't recommend it to anyone who doesn't have money to spare.

I don't disagree that you can make a lot of money. However, when I think about how I am getting the money I find it not worth it. If the Bot isn't real or doesn't have high enough profits that means money from new investors is just being used to pay old investors. You may feel like it is different because because the token makes it feel a bit like you are just speculating on any other crypto or a stock. However, buying or trading another crypto or stock is something that you are fairly trading with someone else on an open market place. With Bitconnect profits you receive is just money deposited by new investors. Some of the new investors may understand the system like you. Others, likely have no idea and are investing based on a lie. I don't blame you for doing it, but I don't think it is worth it in the end to invest in these scams nor does it feel right to me. As much as promoters like to recommend to not use money you don't have to spare, it is inevitable that people will not hear that disclaimer over, "LOOK HOW MUCH MONEY I MADE!" I think people just say that as a moral justification in their mind. I hope this doesn't sound judgy I am just saying my thoughts on this attitude.

It seems that for some reason you believe that the bot has some sort of max profit. What about when STR just went up 100% in 24 hours? What do you think that does? The bot could take all the money that has been lent to it, and double it, and pay back 1% and keep 99% for the day.... As far as I know, nothing forces the bot to trade only on value of bitconnect tokens... So theoretically the whole value could be held as btc while they trade and they could be gaining 10-100%+ a day... Could... Im a trader and I understand how much money can be made with a simple human brain even with tons of mistakes made, bots should be more consistent.

You are correct this proof only works if you assume they are only trading BCC/BTC. However they do claim they are trading BTC which would to me indicate that are either holding BTC BCC or USD and not trading another coin. I do believe this is a proof that I can do but it will be much more complicated and take me some time.

Did you take into account all the Bitcoin they take in? You don't think they just hold onto that, do you? They make backend deals with exchanges to provide them with bitcoin to sell for the current price plus part of the exchange fee.

First this proof is not complete, because they could be the path could be you deposit bitcoin convert to BCC then lend to them, then they could convert to BTC. They could convert back and forth between BTC and BCC and all those transactions would be caught by my research. However, if they take the BTC and change it to USD or another crypto currency that is not caught by this research.

They do take in a lot of bitcoin and I have heard this idea of them doing backend deals with exchanges to provide them with bitcoin liquidity. I believe the first youtuber I saw suggesting this was Ryan Hildreth. This is not how exchanges work. Even if it was then coinbase would simply buy the cheapest bitcoin they can find. They would not pay premium prices to Bitconnect when they could pay a lower price at another exchange.

@cryptotim market makers, exchanges, brokerages etc. try to keep as few shares or coins as possible on hand because they assume more risk by holding more. In fact if they have to hold more that means they will increase the bid ask spread. If you read this link, read the whole thing, it may make more sense why Ryan is definitely wrong http://www.investopedia.com/terms/m/marketmaker.asp As a general "sniff" test to see if what Ryan and others are saying makes sense think of Bernie Madoff. He had multiple billions of dollars of securities under his control and promised only about 10% a year, yet could not maintain the Ponzi once the market had a downturn. I suspect this will likely be the case with Bitconnect. I think in the long term the crypto market will go very high. However, at some point I think there will be a significant drawdown. When that happens Bitconnect will likely collapse.

"My trading Bot - that either doesn't exist"

This. What can be asserted without evidence can be dismissed without evidence. If there is a bot like thing at all, I believe it is used for BCC price manipulation purposes. I wrote a blog post that lays out some evidence for that conjecture here. Great article. I agree with your overall rationale, however in my opinion you likely put too much faith in the data published by Bitconnect.co (bear in mind with over 95% of BCC volume on their site, they have near total control over the data that ends up on Coin Market Cap). So, I'm not so sure they are going broke yet, depending on how fake the data is.

Hi Charlestines, thank you for a wonderful piece of research. I'm looking into ways to prove that Bitconnect was a Ponzi and would love to hear your expert opinion on this...

With the numbers of people loaning BCC tokens to the BCT bot in the last quarter of 2017, there would have had to have been far more liquidity in the BTC USD market than there was for it to trade. By Dec 2017, wouldn't the bot have had to have been trading with upwards of $100m daily? Where would it find an exchange or market to do this?

Thank you for your time and I apologise if my reasoning and knowledge is inadequate.

Dev

Hi Dev,

You are right there would have to be a lot of liquidity in the BTC USD market taken up by them. However, because they are so vague and followers are willing to defend them to the bitter end it is hard to pin them down without seeing their books. For example, when people were sending them BTC people claim that some of it was then used to trade other coins etc. Also, it is hard to know if the bot was day trading or taking longer term positions. Now that they have ended the lending I am sure you have seen the coin drop to around $10. I predict that they will try and use the coin to get more money into their new BitconnectX platform and take more money from people. As always it is hard to know if the creators had bad intentions or of they somehow actually thought they had a sustainable business model and one lie has led to another. Personally I would stay very far away from bitconnect.

Thanks. Much appreciate your reply. Personally my feeling is that all the lending platforms are basically Ponzi. Dev

This is the absolute best free guide to get the most bitcoins the easiest way possible. Nothing to lose and everything to gain. Never worry about the market going up and down again. Get over 1600 Gh/s Cloud Mining For Free and be on your way to Financial Freedom! http://goo.gl/XTCLAi

Spamming comments is frowned upon by the community.

Continued comment spamming may result in action from the cheetah bot.