After recording a new all-time high at $4,410, bitcoin price fell to $4,070, experiencing a minor correction. Amidst a strong rally triggered by the lock-in of the Bitcoin Core development team’s scaling solution Segregated Witness (SegWit) and rising demand from institutional investors, bitcoin has demonstrated a slight setback.

In a weekly basis, bitcoin price still recorded a staggering 24.35 percent increase, surging from $3,273 to $4,410 in a relatively short period of 7 days. Although bitcoin price demonstrated a $300 decline over the past two days, in consideration of the imminence of SegWit activation and continuous increase in demand from large-scale investors, bitcoin price will likely recover in the upcoming week.

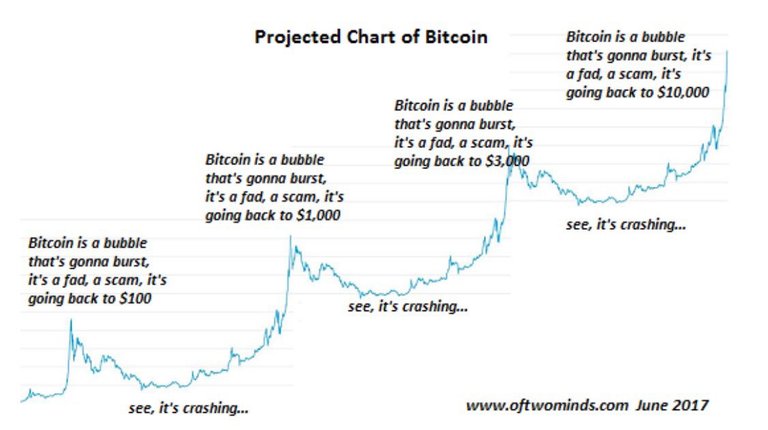

As financial and bitcoin analysts including Max Keiser and Andreas Antonopoulos previously noted, there exists a trend in bitcoin’s minor corrections and its recovery from short-term decline. Earlier this year, Keiser revealed chart which demonstrated bitcoin’s resilience to global markets instability and its ability to recover beyond its previous all-time high after going through minor corrections.

Shown in the chart above, in previous rallies, bitcoin price has always recovered beyond its previous peak and established a new all-time high. The bitcoin price cycle mentioned by Keiser has been evident since 2013.

In fact, on July 26, bitcoin and security expert Andreas Antonopoulos told the bitcoin community that a minor correction in the bitcoin price should not be considered as a negative indicator if bitcoin’s rapid growth rate is taken into consideration. For instance, in the last week of July, bitcoin price decreased from $2,700 to $2,400, by $300. At the time, Antonopoulos noted:

“The reason bitcoin price is dropping is the rapid 1500% rise in 2 years, especially the last 3 months. The scaling debate is just a trigger. Relax.”

As it did since 2013, after dipping below $1,800 and struggling to recover for two straight weeks, bitcoin price went on to recover beyond the $2,700 mark and establish a new all-time high at $4,410. Hence, a minor correction in bitcoin price after a strong rally should not be a concern for investors and traders.

Despite the recent decline in bitcoin price, highly respected analysts and strategists from major multi-billion dollar financial institutions have raised their short-term price targets for bitcoin from $5,000 to $7,000, as Cryptocoinsnews recently reported.

Throughout 2017, investors and traders are anticipating the activation of SegWit and the integration of bitcoin by major markets including the Chicago Board Options Exchange. Some analysts noted that the bitcoin development community’s role after the integration of SegWit is vital. If the potential of two-layer solutions such as Lightning can be maximized, transaction fees of bitcoin transactions will likely decrease significantly.

Already, startups like Zap are developing innovative Lightning-based applications including a user-friendly Lightning wallet platform which users can rely on to process micropayments with lower fees. Building on that, if Lightning-based wallet platforms and technologies can be commercialized at a larger-scale by existing companies and leading startups, a post-SegWit bitcoin ecosystem will provide improved infrastructure for both businesses and users.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/bitcoin/@ryanreynolds/bitcoin-price-records-minor-correction-and-falls-to-usd4-070-potential-factors