Over the weekend, BTC-USD market cap dropped from $45 billion to a current (and still falling) market cap of $39 billion. BTC-USD brought the entire crypto market to a screeching halt as traders continued to see devaluations in nearly every tradable coin on the market. So, let’s take a look at what has happened and see just how bad this dive will be for BTC-USD and the other cryptocurrencies.

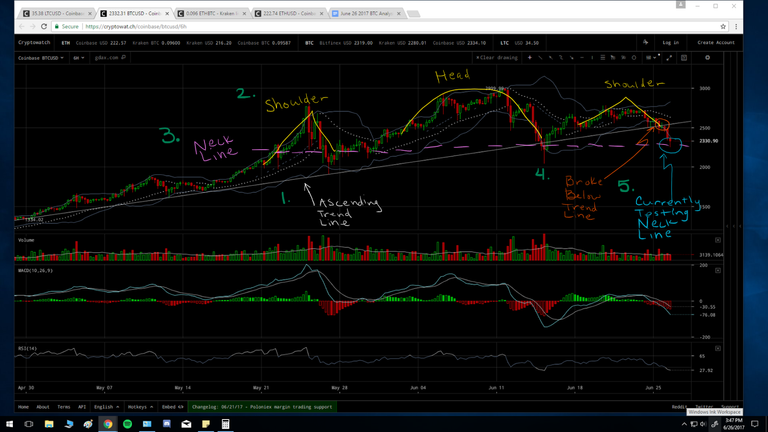

On a macro scale, BTC-USD has been in the process of making a massive Head-and-Shoulders (H&S) pattern on the 6-hour candles:

Figure 1: BTC-USD, 6HR Candles, GDAX

Head and Shoulders are common, highly predictable market reversal patterns. They have well-defined criteria for price movement and price projections once the pattern breaks to the bottom. A H&S pattern is characterized by the following, illustrated above:

There is typically an ascending trend line;

A left shoulder that is smaller than a central peak (head) and a right shoulder that is smaller than the central peak;

The two shoulders are connected by the “Neck Line” of the Head and Shoulders.

There is first a test of the ascending trendline. A test and rejection of the ascending trend line’s support will bring us to the test of the neck line.

A test of the neck line is usually the ultimate deciding condition for whether or not the pattern will continue downward.

At the time of this article, BTC-USD has broken the ascending trend line and is in the process of testing the Neck Line of the H&S pattern. If condition #5 is broken, the price projections are calculated in the figure below:

Price targets are not guarantees of price movement. Rather, a price target should be used as more of a target “zone” rather than a discrete point in the price-space. In our case, BTC-USD happens to have a price target with a very reliable, major support line in the $1800s. Whether BTC-USD drops that far down remains to be seen.

Summary:

BTC-USD completed a Head and Shoulders pattern that brought the entire crypto-market into a Bear Market.

Current price projection based on Fibonacci Levels and Head and Shoulders price target has BTC-USD on a course for the $1800s.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin-babe.com/2017/06/27/bitcoin-price-analysis-bear-run-shows-no-decrease-in-momentum/