Hey Friends!

Today I wanted to go over my thoughts on the state of the overall #crypto market (Because of course we LIVE EAT and BREATH crypto), and what I think people can expect to happen in the near future.

Let's dive right in!

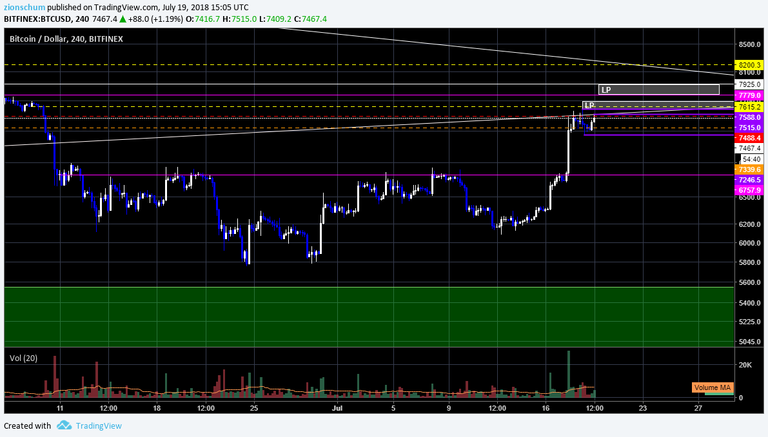

So after the run up we had on #bitcoin basically from 6100 to 7600 we rejected off of some major resistance overhead on HTF. It's not unusual when runs like this happen to consolidate for a day or so to cool off RSI and other indicator levels so we can continue to climb.

With the rise of BTC came the rise of most alts as well for a day or two. This doesn't necessarily mean "alts are back", but it does mean to watch out for possible trades on specific coins you like:). Alts have since cooled off with BTC since the climb, and seem to move directly in tandem with it. If we reach for the 7800 highs I would look to maybe enter a few alt trades depending on setups.

On the flip side, ETH and LTC are on the other side and not as strong as BTC on this ascent, but have followed suit and broke above previous early July highs. Stay vigilant on ETH/BTC and LTC/BTC pairings comparative to BTC strength and best trading opportunity in the coming week. ETH/BTC had a fall off yesterday, so stay on the lookout for how that plays into the alt scenario as well.

#bitcoin itself is in very healthy consolidation mode now hovering just above weekly resistance(Orange dotted line), and just below daily resistance(Red dotted line). We have yet to take out high 7700 highs which is likely where price is reaching for. There is LP's(liquidity pools) right above this previous swing high we just formed yesterday, and the highs in the upper 7700's. These areas provide significant opportunity for big players to fill their shorts if they so choose to distribute. So watch for potential short opportunities there.

In addition, the daily volume started to decline yesterday with a long upper wick of profit taking indicating decreasing buy pressure for the moment. This is noteworthy considering we haven't had long upper wicks on any of the ascending candles thus far on this breakout.

We are also at the daily Ichimoku Cloud resistance using the 20 60 120 30 settings. I use these settings for high market cap coins such as #bitcoin and #ethereum because they provide stronger signals and are tailored to crypto's hours of operation. Anyways, if we can break through and close above that resistance we would further strengthen the bull case if we can also get a TK cross. I didn't put the Cloud on this chart because it seemed too jumbled when you look at it.

The 4 hr time frame is looking like it's starting to form an equilibrium pattern, and is something to watch for a breakdown or breakout in the next day or so. Depending on volume, this could determine short term direction and momentum. We are also approaching the 4 hr resistance at approx. 7615. This is something to keep an eye on as well.

For now it would seem we are due for some more consolidation, but due to the institutional sponsorship behind this move, I wouldn't get too comfortable.

Usually when big players push the price this high they don't just let it retrace far without first distributing their longs, and 2 days isn't really long enough to do that in my opinion.

Not much news this week in crypto that excited me so far, but it is important to understand how the market sentiment has shifted from bearish to bullish. This is very evident throughout article titles and posts that highlight the bullishness of #bitcoin and the overall crypto market. Most titles are click-bait, but still can provide a great read on the overall consensus. I always look for a good sentiment gauge by checking out the main crypto news platforms each day to see what retail traders are reading about and thinking. The main two being Coin Telegraph and CoinDesk.

I'll continue to do updates on the crypto markets as I see fit throughout the week.

Continue to better yourself each and everyday and you will find success. I wish you luck on your journey friends, and I'll see you tomorrow.

-Zion

Not Financial Advice