Content adapted from this Zerohedge.com article : Source

Authored by Simon Black via SovereignMan.com,

The same day Bitcoin cracked its all-time high above $11,000, the government dealt its first blow to the crypto world...

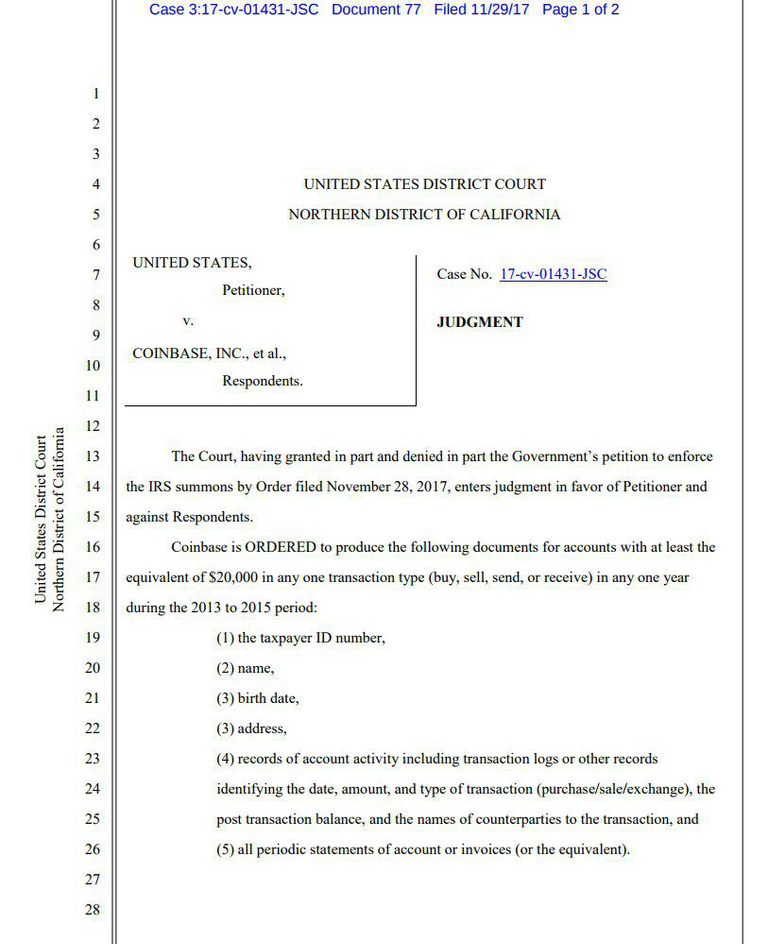

On Wednesday, a federal judge in San Francisco ordered the popular Bitcoin exchange, Coinbase, to provide the IRS with information on over 14,000 account holders.

The taxman noticed that only 800-900 people reported gains related to Bitcoin in each of the years between 2013-2015. It seemed unusual given Bitcoin's meteoric rise.

So the IRS went for its pound of flesh.

Initially, the government wanted complete data on every Coinbase user that transacted between 2013 and 2015. The exchange's website says it has 13 million users (more than the number of Schwab brokerage accounts).

But Coinbase pushed back… and the government agreed to only take limited data (including name, date of birth, address, tax ID number, transaction statements and account logs) for accounts that have bought, sold, sent or received at least $20,000 worth of Bitcoin in a given year.

Don't say I didn't warn you about Coinbase. I told Sovereign Man: Confidential readers last month:

If you're tempted to purchase Bitcoin from the popular Coinbase exchange, don't bother.

They've sold out to regulators.

The IRS is calling this a "partial win."

But you can be sure, there will be a public beheading. This is something governments almost always do.

They'll find a prominent Bitcoin person, someone that's polarizing to the public – like "pharma bro" Martin Shkreli.

It will be a very public trial… and they'll throw his ass in the slammer.

Government's always do this because they want to scare people.

Kim Dotcom is the perfect example. Kim founded the popular file-sharing site Megaupload.

The government wanted to stop illegal downloads, so they raided his guy's house in New Zealand for violating US law.

The government also does this for taxes… everything, really.

Look at Wesley Snipes. The IRS accused him of felony tax evasion. He spent three years in jail.

They had to take a celebrity and throw him in jail to scare everyone else.

Back to Bitcoin…

Now that it's at all-time highs, the government wants its piece.

I read the 400+ pages of the proposed tax code. How many lines in there do you think deal with cryptocurrency? ZERO.

How many lines deal with e-commerce? ZERO.

The government had every opportunity to set the rules for the 21st century. And they failed miserably.

So the rules remain as clear as mud.

Instead of trying to make it clear, their tactic is intimidation, force and coercion.

This is just the beginning. There will be more.

And my advice is don't be one of those guys.

Every transaction that you make in Bitcoin is potentially a taxable event.

Let's say you bought Bitcoin for $1,000 and after it went to $10,000 you buy a business class trip to Australia for $10k. When you pay the airline with one Bitcoin, you've just triggered a taxable event.

The IRS would say that you essentially sold your Bitcoin, have a $9k gain and used those proceeds to buy the ticket.

Which means you owe the IRS capital gains tax on $9k, which is 20% plus the Obamacare surcharge.

So, don't be that guy. If you've been doing this, trust me, you don't want the IRS find out.

You'd rather come forward yourself and disclose it and pay taxes… Rather than be the next Martin Shkreli.

And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide. Because... If you live, work, bank, invest, own a business, and hold your assets all in just one country, you are putting all of your eggs in one basket. You're making a high-stakes bet that everything is going to be ok in that one country — forever. All it would take is for the economy to tank, a natural disaster to hit, or the political system to go into turmoil and you could lose everything—your money, your assets, and possibly even your freedom. Luckily, there are a number of simple, logical steps you can take to protect yourself from these obvious risks.

Coverage of this news by Tone Vays

Thanks @transisto for posting this video. It is a great followup to what is written in this article here.

I think Tone and others like him are going to stir up a revolution around the world. There are more people who are getting into cryptocurrency and if the government makes it illegal to hold, there will be a major backlash.

The thing about the cryptocurrency market, it is still a great deal of anti-government people who are very wealthy, now, and have a lot of computer/programming skills. The politicians/government will realize these people are a lot smarter and vicious than they could be.

This is just the beginning, Bitcoin is popular but with a small number of people. It is necessary to throw paper money out of use, until that moment a hymn about decentralization, money in the hands of the people, etc. is being sung. Like the Coin Base, as well as all other sites, stock exchanges will eventually have to register people's property, number of truncations, etc. The law is passed, people are scared as you cited the example of Wesley Snips for tax evasion, and that's the whole story. Now we need to be smart, to concentrate on the investment while Bitcoi is rising steadily, and then we are smart to invest. In the extreme case, if I invest $ 100,000 and earn $ 10 million, a tax of 10-20% is not terrible. Thanks for useful information @zer0hedge

whats the best way to but btc or ltc? ive used coinbase in the past but dont want to now :P

Bitcoin is designed to accommodate peer to peer transactions.

People living in larger metropolitan areas use "Local Bitcoins"

to arrange meet-ups in well lit and populated public locations

to buy and sell Bitcoin:

https://localbitcoins.com/

they will never take my private keys even if i have to hold them with my life...

@zerohedge what can the people themselves do about it seems coinbase is the perfect wallet for them.

Very informative article about bitcoin, thank you!

BTC's price hasn't reached its peak yet and as its price continues to shoot up, you can bet your bottom dollar that the government will come up with more creative ways to get their fair share no matter what.

If the IRS gets access to CoinBase,every other aspect of crypto will be next!! Eventually there will be nowhere to hide. Which is EXACTLY what the banks and governments want!

The IRS are thieves who set up the fraudulent banking system . The irs is an illegal institution just the like the federal reserve & you know what they both have in common? The federal reserve and the irs both came on the scene in 1913 THE GREATEST MOST FRAUDULENT INSTITUTIONS PERPETRATED UPON US U.S. CITIZENS IN OUR AMERICAN HISTORY.

This is not true.

First off, I encourage people to pay taxes & be forthcoming.

Yes the blockchain is a public ledger, but this is a good thing, because it prevents exactly the kind of cheating you mention in your comment above. The ledger is secure because it is governed by math, and we know that the laws of math are immutable. In other words, they cannot create crypto out of thin air and no one can touch your crypto without your private "keys" even if they can see the balance in one of your wallets via it's public address. Your crypto wallet cannot be seized, like your bank account can.

As for privacy, there are sectors of the cryptocurrency market delivering this valid feature. Monero, XMR, is one of the privacy coins. Z-Cash & BitcoinDark are others. I believe Dash offers a certain level of privacy as well.

There are well over 1200 crypto assets existing at this very moment, with under 800 at this time a year ago. The genie is out of the bottle and ideally crypto will enable the ending of the Fed's reindeer games.

Preach brotha! Most people don't know this, it's straight up theft. They're like a giant leech.

If I am not mistaken, a deal put together in the middle of the night outside the prying eyes of the public.

And that's all we need to know. Secret deal with no chance for the public to find out till it's to late.

Yeah the public finds out only after they are totally screwed.

I was reminded of that reading that the Senate passed the tax bill...in the middle of the night where it couldnt be opposed.

Watching politicians fight over tax will ruin your day!

Pretty polarizing as a subject. I mean, crypto is all about decentralization, and no absolute authority. It has this systemic anti-white-collar in it. Yet paying taxes is a duty. Go figure!

Block chain has the power to solve problems for places with extreme poverty. The government should not be fighting bitcoin but instead come up with solutions fair for both sides of the coin.

It is normal to see that kind of stuff, governments will push back ! We will see stuff like that more often in the future. Information is the most valuable thing nowadays, and if they dont know where you spend, you are harder to track down.

Agreed. This was coming and is no shock.

Copying/Pasting full texts without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

This post has received gratitude of 15.76 % from @appreciator thanks to: @zer0hedge.

good for steemit

Same thing or worst is going to happen with Steem since it has almost no anonymity.

I think we will be fine as long as we keep our funds in some crypto currency and don't give away information which link our account names (pseudonyms) with our personal data.

Read more in my new post: https://steemit.com/cryptocurriency/@tombort/inportance-of-separating-our-personal-data-from-account-names

No surprise there.

The banksters get threatened and then the government hacks are sent in to seize control.

Regulation is code for putting it over bankseter oversight.

That's a great news of crypto currency I love your good work really it's helpful post keep it up on Steemit I appreciate your post steem on @zer0hedge ✌✌

This are going to be my next reading material so thank you for being so timely. Thank you for putting in the resources to make this happen and mostly thank you for creating an access to the mastery of self. I am Waiting for another.

@xyzsteemit123

I think that decentralized exchanges will help people to control paying taxes. BitShares DEX is an excellent example. Chines people adopted it because there you are safe and no tax collecting agency on the world can't get data about you trading as long as your account name can't be connected to you.

On BitShares there is no company or other entity behind the DEX. Tax collectors simply have no one to address its demand to him, for give personal data away.

More in my post: https://steemit.com/cryptocurriences/@tombort/why-irs-can-bust-you-on-centralized-exchanges-and-not-on-bitshares

I also wrote post about personal data safety:

https://steemit.com/cryptocurriency/@tombort/inportance-of-separating-our-personal-data-from-account-names

Please review and comment!

Wow!

It will be helpful

In my opinion the turning point for US regulatory position to BTC and crypto was the request to Coinbase exchange to give more info to fiscal authority. Particulary, coinbase was asked to implement know-your-customer measures (KYC) to identify big users.

This means that, for the moment, US are taking the road of exchanges regulation, not complete ban as China.

Some of the banks in Denmark actually refuses to receive large amounts of profits from people trading bitcoin. its ridiculous! and its all because you they can't figure out where the money actually came from. thats actually a good thing in my opinion.

bitcoin will keep going

@zerohedge what can the people themselves do about it seems coinbase is the perfect wallet for them.