Content adapted from this Zerohedge.com article : Source

A few weeks ago we presented anecdotal evidence from Joseph Borg, director of the Alabama Securities Commission, suggesting that people are taking out home equity loans and cash advances on credit cards just to purchase BitCoin in the hopes of getting rich quick (see: "It's In The Mania Phase": Securities Regulator Warns That "Mortgages Are Being Taken Out To Buy Bitcoin")

"We've seen mortgages being taken out to buy bitcoin. … People do credit cards, equity lines," said Borg, president of the North American Securities Administrators Association, a voluntary organization devoted to investor protection. Borg is also director of the Alabama Securities Commission.

"This is not something a guy who's making $100,000 a year, who's got a mortgage and two kids in college ought to be invested in."

"You're on this mania curve. At some point in time there's got to be a leveling off. Cryptocurrency is here to stay. Blockchain is here to stay. Whether it is bitcoin or not, I don't know," Borg said in an interview with "Power Lunch."

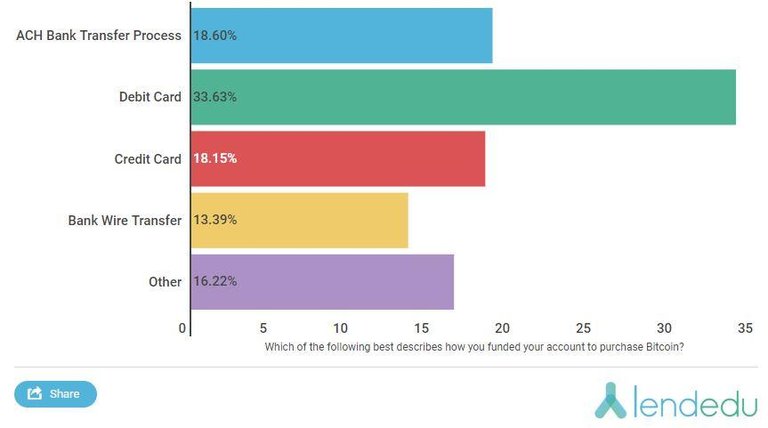

Now it seems that the speculation by Borg has been confirmed by a new survey conducted by LendEDU which found that, among other things, nearly 20% of people who have purchased BitCoin have done so using their credit cards.

First, more than half (51.78%) of respondents stated that they either used a credit or debit card to fund their account to purchase Bitcoin. Specifically, 33.63 percent of investors were using debit cards, while 18.15 percent were using credit cards.

Why is this concerning? The virtual currency exchanges where Bitcoin is bought and sold will charge conversion fees when either a credit or debit card is used to find an investor's account. Coinbase, the largest of the cryptocurrency exchanges, charges a conversion fee of 3.99 percent when a user uses his or her credit or debit card to bankroll their account.

Obviously, this is not the most financially-savvy move on the part of of a sizable percentage of Bitcoin investors; no one ever wants to pay extra than what is necessary, especially when dealing with something as volatile as Bitcoin. The wisest and most frugal way to fund a virtual currency exchange account would be through an ACH transfer, which is completely free of charge. Only 18.60 percent of our 672 Bitcoin-invested respondents were paying for the cryptocurrency in this fashion.

Meanwhile, nearly a quarter of the folks who bought BitCoin using their attractive 25% loans admitted that they're now stuck rolling their new debt month-to-month...

However, this was not even the most pressing concern coming from the LendEDU poll. That recognition belongs to this data-point: 22.13 percent of Bitcoin investors did not pay off their credit card balance after purchasing Bitcoin.

Going into debt to buy Bitcoin is not a wise decision no matter which way it is spun. There is no guarantee that Bitcoin investment returns will be profitable in the long run, but one can guarantee that the credit card company will need to be paid back. Considering the average annual percentage rate (APR) on a credit card is 15.07 percent, a Bitcoin investor that finances their investment at the wrong time will find themselves in serious debt.

And while that fact should be deeply troubling to anyone with even a modest understanding of basic financial concepts, apparently the average American BitCoin buyer is more than eager to continue buying up the digital currency using 25% loans.

Of course, there is no risk in these transactions because BitCoin will just always go up in perpetuity, right? After all, making massively-levered, speculative bets on bubbly assets pretty much always works out well...just ask home flippers from 2007.

Really thanks for the deep report and stats, and yes people are trying to break their all savings to buy Bitcoin and altcoins, it's good and bad both, good because it's new investment trend which could profitable in both short and long term. And bad because people are investing in a hurry after listening of speculations and when it highlighted in the news and all. Every financial investment surrounds with risk, so study of Cryptocurrency trends is really important and diversifying of investment in different Cryptocurrency is safe choice, these are my opinions. Thanks for sharing.

Have a great day and stay blessed.

This is alarming. If the Bitcoin price goes down people will sit on their new credit card debt and blame Bitcoin even though it is a recurring pattern of people's behavior.

They can blame bitcoin all they want, the banksters will still want their money.

I agree. Speculation with debt is certainly a recurring pattern with whatever the latest buzz in the investment world is. Scary that people have mortgages for Bitcoin.

It was bad enough when they had mortgages on houses they couldnt afford that were crashing in price. Now they have mortgages on bitcoin, one of the most volatile assets out there.

Pure stupidity.

Get rich quick is the mindset.

Yes, you are so right. I hope this mindset does not destroy the concept of crypto currencies before they can change the world.

This is what happens when people buy Bitcoin as an investment. It's more of a currency than an investment. Why would you sell off your Bitcoins for currency which is centralised and has no backing whatsoever?

Using credit cards to buy an amazingly volatile asset can. Go very right or very wrong! Risky strategy to say the least. What's the interest rate on a credit card these days?

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

www.zerohedge.com has confirmed that they have not given any permission for their content to be reused for profit.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

dig hole, close hole

that's the saying I hear if we take a loan to the bank.

if you want to be sustainable you should use the cash you have, no need to force. greed will destroy us.

Most people don't understand that cryptocurrency is currently in a bubble, most people are buying in on a lot of coins just because of the hype surrounding it.

It is true that bitcoin and blockchain is here, but my question is "how far will this crypto bubble go before bursting"

Cryptocurrency is not in a bubble. To start, technology does not bubble and that is what crypto is since you cannot separate it from the blockchain.

Secondly, even if Wall Street 10 X crypto in the next 12 months, blockchain is going to 1000X in terms of the progress it makes. Wall Street can raise enough money to outpace what is going on with blockchain.

Sure, BTC could collapse as could any individual token. But as a group, there is no chance of it.

You know that the burst is coming soon if people are using their credit cards to "invest", when the average joe who is stupid starts putting all their money in something it won't be long until that speculative bubble bursts, like the stock market in 1929. I knew the real estate market would implode in 2002 because people were buying multi family properties for prices so high they rent did not actually pay the mortgage, that is not sustainable.

I doubt the burst is anywhere close....Wall Street is still pumping a ton of money into BTC (and other currencies). We will see it go higher before the potential pop.

When people are buying any crypto on credit cards, then you know the end is near.

"When people are buying any crypto on credit cards, then you know the end is near."

Wasn't this article suggesting that people are buying crypto on credit cards?

"Now it seems that the speculation by Borg has been confirmed by a new survey conducted by LendEDU which found that, among other things, nearly 20% of people who have purchased BitCoin have done so using their credit cards."

I am still not convinced it's a bubble with all cryptocurrency combined worth less than Google. Bubbles tend to go up violently blockchain goes up and down violently.

People need to follow a very simple rule, you only risk what you can lose and financial transactions are always risky, even more if you are talking about cryptocurrencies that not very much people understand what it is (something intangible it´s hard to get in some people mind).

The Ironic end of the post just killed me!! :DD

Thanks for the valuable post

"As of January 4, 2018, Wave Crest Holdings and the issuer of the Xapo Card Program received instructions from Visa to cancel all its effective programs immediately. As a result, all Xapo software cards have been deactivated. We are already looking for alternative solutions to those cards. But we are not ready to announce anything yet, and the search for two more new cards is still at the forefront of our mission "

Other providers of similar debit cards issued similar statements, reassuring their users that they will seek new ways to provide discount card services to users. The Bitwala team explained that after issuing a declaration from the card issuers on behalf of Visa European, Bitwala cards will be disabled and the Bitwala team is holding an emergency meeting to discuss the problem and seek a solution that is in the interest of cardholders.

Contrary to analysts' expectations, the sudden suspension of the VISA partnership with Wave Crest did not affect the digital sector and the companies investing heavily in it. With the exception of TenX, which operates the digital currency from itself, and only works on the company's debit card project, Visa's termination of the DCR services did not have a significant impact on the bitcoin price. The disappointment caused by Visa and Wave Crest to users and investors in the digital currency market has shown that bitcoin trading does not rely on a single company or a single service provider to maintain a user base or user activity. @zer0hedge

This is the late 1990s all over again. I recall people were not only buying stock on margin during the dot com but also pulling out the credit cards to purchase. While this makes a lot of sense when things are going up, when heading sideways or down, it is a stupid move.

There are so many who are living close to the vest financially and yet they are the ones who do this. What happens if BTC tanks to $3,000? It is not unheard of in the crypto world. These people will be sunk. They will be left with an asset that is worth 20% of what they paid for it while owing on the balance which is adding 20% interest annually.

And we thought people being upside down on their mortgages was bad...this will be horrific.

It is sad what desperate people will do.

But one day blockchain is going to right this ship and then these poor people won't be in such dire straits. This is another reason to promote Steem. Let these people know they can get involved in crypto for free.

Desperate moves aren't required.

I don't know if buying Bitcoin on a credit card is a good idea, after all most people do not earn the amount of money that allows them to have a small interest charge on their card if it's not paid off so we are looking at people buying Bitcoin and then paying the money back at something like 29.6% per month interest ( using interest rate for one of the cards for high risk or bad credit ) which in turn will make their purchase very expensive. So they buy them - then what ? Sell them straight away for a quick profit or hold on to them in case the price goes up and they can make more ? Most people are not knowledgable enough to know what to do with them once they have them ( myself included )

what if it's a bad month for cryptocurrancies ? Do they then try to buy more hoping to recover their money if the market takes off again or do they sell and try to recoup something yet end up with debit for the balance ?

It really could end up a big financial mess for so many people

@zer0hedge...yes bro its correct most of the peoples are using to put a investments in crypto by their salary debit cards and more people of getting more money either profit or lose they are taking a risk and put their entire money limit of credit card in month ..only hope is that if get profits they felt happy ..or if they lose they felt sad and not compramise again they put a money next month in crypto...most of the middle class peopls are present invesing the money in the crypto according to the survey taken by the america they said that most of the middle class peoples are intrested to put a money in crypto to get a huge profits.. the total reason for the craze is 2 months back sudden raise of btc from around 4k to around 17k so the entire the world turn into the crypto ..and all are starting to invest in crypto and also in present market day by day most of the coins come and trde the money and some give profits and some loses but most people get profirs..so that is the reason most peoples use their entire money to get huge profits....

Bitcoin may hit a dead end but there are many amazing projects people can invest after buying Bitcon. BAT already comes with an ad blocking privacy focused Btave browser and they'll pay a portion of ad revenue to ad viewers.

Bitshares can handle NASDAQ volumes and can become the gold standard of a DEX and EOS could run FB, Google, Twitter, Amazon and Netflix on it and still have enough space for DAPPS.

STEEM hasn't even hit 1 million users and Smart Media tokens aren't out yet. I'm also a big fan of WTC supply chain management and fog computing of SONM. MaidSafe is older than Bitcoin and they are trying to build a whole new internet.

Bitcoin may have peaked. But Alt coins are just starting.

You are absolutely right.

What gives these things value is their utility and the market. And as long as WE find utility in them and endorse them government and the banks can do nothing.

A few people making poor financial decisions isn't going to stop this wave.

Many thousands of people day trade stocks on margin, I'd worry about that bubble first.

My experience is that fundamentals always catch up. You can only build so far based on feelings. You need something solid backing things up. As for cryptos there is math and utility backing up. Utility is outdone by better utility and math is outdone by.... NOTHING. Math is absolute.

We need to be very wise and sedate, so as not to lose your caution in the pursuit of welth People are now befuddled by the high jump of bitcoin. They believe in assurances that the coin will turn into a liquid currency. But you need to be very attentive to the real facts and the grounds for further action.

as for me, so the high growth of the coin is provided by panic and people's agiotage, and not by real facts. And as soon as such panic goes away and people come to the clarity of the whole absurdity - the coin will burst.

Thank you very much my dear sir @zer0hedge for sharing this news with us. have a nice day.

Like your post

Bitcoin is here to stay but i advice people to invest what you can afford to loose . thanks for sharing this amazing article

how do you think or your prediction about bitcoin price in 2018 whether it will be increasing or going down.

I just want to survey some people's opinions

I'm interested to see what happens to bitcoin in 2018 as well. I think that savvy investors have seen that bitcoin is simply the namesake that has promoted blockchain, even satoshi probably didn't expect it to be where it is today. Those 'savvy' investors as well as myself have diversified their coin holdings, I'm feeling good about steemit since it has a few interfaces allowing actual user interactions.

For those just hearing about bitcoin and to my horror have invested funds which they cannot afford to lose into it in hopes of being a part of the next wave may find themselves cursing bitcoin and blockchain. Though This is likely not the year of the crash it would be wise to observe catalysts from previous bubbles such as DOT com and tulip mania. How can we prevent such massive losses as seen by previous bubbles? OR do we let those with ignorant knowledge lose their shirts?

Steem's price would have to go to 500 usd to match the ethereum max market cap. OR 2100 usd to reach facebook's market cap. I think that means steem has lots of growth potential and would be a good place to transfer some of the btc people who bought it with debt might still be able to pay it off

I agree @macmaniac. There is a huge upside to STEEM. I am on record with $100 by year end....there is nothing that can stand in the way of that.

The user growth is incredible and as long as people are making money, that will continue. We are seeing a lot of development coming out on the app side. There are exciting updates which will be added to the blockchain, hopefully, this quarter. And the world is embracing crypto more each day.

That is an excellent idea. Otherwise these people will lose everything.

I already promote Steem to people when they ask about btc. No need to buy cryptos. Join for free. Comment and earn.

This is what Steem was designed for after all, a free on ramp into the crypto economy.

That's not good, there is a reason they don't let you gamble with your credit card in casinos.

I liked the amazing bitkayn cryptocurrency news post, so I liked a post on the post and followed the share, thank you so much for giving me the post.

I just love it sir.....

Thank you sir for sharing

Outstanding perfomance for bitcoin...

Thank's for sharing

Good Post 👍👍👍

Thanks! I wrote about this as well recently. It's a very worrying development. For some people crypto will change their lives and make them rich and others will become indebted.

The revelation in this write up is that it is wise (in practical terms) to borrow on interest to buy bitcoin. And the risk is truly minimal as bitcoin, from all strategic observation, will keep going up in value.

Idiots. They shojld be buying steem on their credit cards not bitcoin. lol

Awesome Job My Friend...

Awesome Job My Friend...

Cryptocurrencies is pure speculation, you cant really rely on it.

I got 2 kids and a house but nowhere near the 100k income and im deffinently not risking rent and bills on it, too risky to risk the kids home, its like a lottery.

The virtual currency exchanges where Bitcoin is bought and sold will charge conversion fees when either a credit or debit card is used to find an investor's account. Coinbase, the largest of the cryptocurrency exchanges, charges a conversion fee of 3.99 percent when a user uses his or her credit or debit card to bankroll their account.

Obviously, this is not the most financially-savvy move on the part of of a sizable percentage of Bitcoin investors.

Resteemed and upvoted!

fantastic post well done

Thanks for your Cryptocurrency news @zer0hedge

Good post, I am a photographer, it passes for my blog and sees my content, I hope that it should be of your taste :D greetings

Çoğu kişi,aslında bilir,Reddit isimli platformda "Reddit Man" isimli bir kullanıcı var ve çok öncelerde bitcoin alabilmek için evini sattığını duyurmuştu. Bu riski göze aldığında ise bitcoin’in değeri sadece ve sadece 3000 dolardı. Bu riski aldı ve şu anda koyduğu paranın altı katını kazandığını söylemek yanlış olmaz. Eğer Joseph Borg haklı çıksaydı şimdi Reddit Adam bir evsiz olabilirdi. @zer0hedge

I think it is wrong to invest with debt. people should invest in capital that they can remove from the eye.

Now Im reading your post.My attention section,''The virtual currency exchanges where Bitcoin is bought and sold will charge conversion fees when either a credit or debit card is used to find an investor's account. Coinbase, the largest of the cryptocurrency exchanges, charges a conversion fee of 3.99 percent when a user uses his or her credit or debit card to bankroll their account.'' Thats important for me.Its interesting..Thanks for information sir @zer0hedge

Given this trend, an ETF called IPAY might make sense to invest in. Or to invest in credit card companies. However, if you think the system is gonna go down, then going into cryptocurrencies, and then moving to a hardware wallet for at least some of your networth might be a good strategy. Keep your hardware wallet in a LEAD BOX in case there is an EMP attack. Or, better yet, buy lots and lots of solar panels and stock pile them in a metal shed.

This is not terrifying at all...while stupidity should not be rewarded I would really have to question the responsible lending practices of those granting home equity loans to purchase such a volatile 'asset'...

I had heard about google searches picking up for the term using my credit bard to buy bitcoin but had no idea how prolific it has been lately the use of credit cards. Considering the price is going sideways to slightly down this would be hard for people with higher debt repayments to now justify. Thanks for the post

Visa is a prime example of a middle man which is going to be eliminated.

The more they fight it, the worse it will be for them.

At some point, as more cryptocurrency gets in the hands of people, Visa will become useless. Facilitating payment is not needed when you have crypto especially the visa debit cards. That will be done in a few years.

We won´t get rid of the old world too fast as that´s just a task that´ll take years to get done but I agree that middleman like VISA will disappear pretty soon already as there´ll be new ways to handle your money. Maybe through crypto debit cards that just send your coins after you swiped :)

Also I've been. @faissalchahid

Let all the multi-million users of Xapo, TenX, BitWala, BitPay know that they are no longer able to use their digital debit cards. Xapo, which has one of the most widely used bitcoin pads, told users in an official statement that it would find new ways to re-issue its digital debit card. Anni Rautio, president of Xapo Discount Cards