Content adapted from this Zerohedge.com article : Source

by Tyler Durden

Update: A massive ($110 million) transfer from Coincheck's Ripple wallet has sparked speculation that the exchange may have been hacked...though this apparently hasn't impacted prices yet...

110 mil usd in #Ripple (XRP) were sent from the Japanese cryptocurrency exchange Coincheck to an unknown address. Hacking suspected.

— Costin Raiu (@craiu) January 26, 2018

All major cryptocurrencies tumbled on Friday morning after Tokyo-based Coincheck - one of Japan's biggest crypto exchanges - abruptly halted withdrawals, triggering a panic as investors feared the exchange may have experienced a Mt. Gox-style hack.

"Coincheck is a very well-known exchange in Japan," said Hiroyuki Komiya, Chief Executive Officer of Tokyo-based Blockchain Technology Consulting. "We've seen several outages at various crypto exchanges recently, so the extent and seriousness of Coincheck's halt isn't yet clear. We're all very eagerly awaiting to hear more detail on what's happening."

It has been almost four years since Mark Karpeles, Gox's CEO, announced that his company was filing for bankruptcy after losing bitcoins worth hundreds of millions of dollars. The news ended a sharp rally that had briefly sent bitcoin above $1,200 - back then that was an all-time high - before ushering in a two-year bear market that would persist until early 2016.

The exchange said in a series of tweets that it had suspended all withdrawals, halted trading in all tokens except Bitcoin and stopped deposits into NEM coins. Employees at the exchange appeared to avoid Bloomberg's repeated calls and emails for comment.

"Investors and traders are very sensitive to any news involving the big exchanges," said Peter Sin, a trader and co-head of the digital currency sub-committee at ACCESS, a Singapore-based cryptocurrency and blockchain industry association. "This will accelerate price declines."

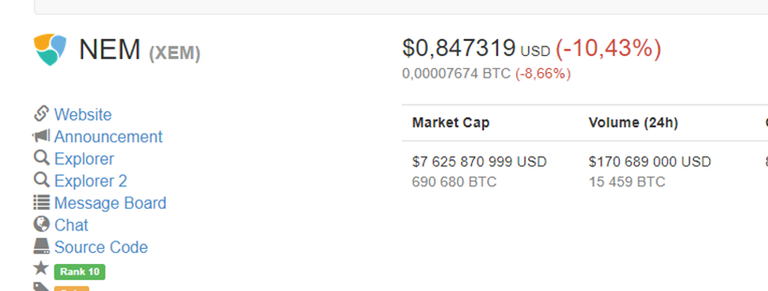

NEM, the 10th-largest cryptocurrency by market value, fell 15% in the 24 hours through 5:52 a.m. New York time, according to Coinmarketcap.com. Bitcoin dropped 6.5% and Ripple retreated 11%.

Cryptocurrency exchanges, many of which operate with little to no regulation, have suffered a spate of outages and hacks amid the trading boom that propelled Bitcoin and its peers to record highs last year. As we pointed out, a recent survey found that 10% of all ICO tokens have been lost or stolen by hackers.

Still, the risk of a Mt.Gox repeat in Japan is small. In Japan is one of the world's biggest and best regulated markets for cryptocurrencies, policy makers have introduced a licensing system to increase oversight of local venues, seeking to avoid another Mt. Gox-like collapse that nearly killed the crypto market back in 2014.

Additionally, Coincheck was yet to receive a license, according to the website of Japan's financial regulator.

According to Bloomberg, Coincheck was founded in 2012 and had 71 employees as of July with headquarters in Tokyo's Shibuya district, an area popular with startups that was also home to Mt. Gox, according to Coincheck's website. Last year, the exchange began running commercials on national television featuring popular local comedian Tetsuro Degawa.

WE HAVE CONTACTED WWW.ZEROHEDGE.COM AND RECEIVED CONFIRMATION THAT THEY ARE NOT AWARE THAT THEIR CONTENT IS BEING USED ON STEEMIT AND THAT THEY DO NOT CONSENT FOR IT TO BE USED HERE FOR PROFIT.

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

It is a shame that Coincheck lost this money. I imagine that Ripple and NEM will be most affected, but there is also that BTC futures contracts just expired, which means that the two events together will likely negatively affect the entire market.

Thanks for the update as always, they are always very helpful for keeping up to date with what is happening in the market. I woudl really appreciate any feedback that you have on any of my posts!

Yeah biggest shame..

We now know why they halted the trading on that currency...there was nothing there to trade. Another centralized exchange that is hacked. This is becoming commonplace.

In the end, this will only help push the idea of decentralized exchanges. We should see many popping up over the next six months. As the regulators around the world seek to get their hands around crypto, people should look for options outside that arena. Decentralized cant be hacked nor can it be controlled.

It always makes me smile when they say to an unknown address - they must know the address cos they sent it there !!! With all the professional hackers out there surely they can find one to work FOR them instead of against and find out where the money has gone ? The fact they were still trading bitcoins says a lot about the security of bitcoins.

The threat of someone hacking crypto is scary for the uneducated and ones like me that are new to all this, but with enough information the fear can be overcome as we come to realise that centralised and decentralised are completely different things

The recent hacks and other losses on exchanges has spurred me to get most all of my coin off them. Security is, and always has been, a huge part of owning coin and it will only become more important from here. For an exchange to be truly successful, security over the long term will be vital.

I was very surprised that Bitcoin held so nicely ! It bounced from around 10,000 and is preparing for a green bar - I surely didn't expect that.

As far as the japanese exchange is concerned, I really hope everything is okay, because it might get pretty crazy if something happens. People will lose even more faith in cryptos and we don't want that.

We certainly don't need another Mt.Gox !

I also didn't expect that bro.

@zer0hedge, I remember when ETH was hacked and they voted for rollback and them create ETH and ETC.

I always think if that will be possible today, because, things like that make the pillars of cryptos tremble.

The Tokyo-based company is said to have no licenses from Japanese financial institutions, according to Bloomberg, and yet the country's most popular crypto money market.

On the other hand, the US Department of Finance's terrorism and financial intelligence department also favors Asian banks and financial authorities to do more to oversee crypto-currency activities.

According to The Washington Post, Assistant Finance Minister Sigal Mandelker said, "There is a need to organize all over the world." said.

As will be remembered, South Korea followed the decision of the Chinese government to prohibit the trade of anonymous Bitcoin and to close down the stock market by violating the rule, and Bitcoin lost more and more blood by losing its value of $ 20,000 at the end of last year.

This is the same as last year. These are the interventions of people who play with large amounts of money. We can benefit from this. Everybody doing their own analysis. It can make new investments. To me and my analysis, the Japanese stock market has suffered major blood loss. As the prices have been falling, buying is possible. Again, according to your own opinion, it's time to get Ripple in a 2-month period. @zer0hedge

@zer0hedge...bro The fact that humans are pigeon-holed into investing in the stock market using 'dollars' speaks volumes....and last time i checked, criminals are included in that bunch. Its ok to be a criminal as long as you use 'dollars'.If you're not using, or at least looking at using, a decentralised exchange you are harming crypto by helping these scum bag exchanges stay in existence. If everybody stopped keeping coins on exchange and withdrew to a wallet, we would finally see which (if any) of these big exchanges are actually solvent. Stephen Poloz, governor of the Bank of Canada, recently stated that Bitcoin trading is “gambling.” For the central bank governor, cryptocurrency buyers should “beware,” as cryptocurrencies aren’t neither assets nor currencies. To him, they’re more like securities.Poloz added that he is currently working with global regulators to develop regulations around cryptocurrencies. Notably, he joined a group of personalities, including central bankers and Nobel laureates, claiming Bitcoin has no intrinsic value.But as soon as you try to explain this to any member of the bitcoin witness sect, they will immediately start dragging the conversation into the plane of bitcoin technology.They, like any sectarians blindly believe and therefore do not want to talk about the most important thing - about the financial nature of bitcoin. ..thank you for sharing with us...

I agree with u bro about this fact.

Nothing travels faster than bad news. Buyers in other markets are shaken because all crypto is based upon the same basic premeses. The implementations differ, but they are the same kind of thing. So if a heist happens to one, fear grips the others. You didn't see other assets drop similarly because they do not share any commonality to cryptos. If this were a big enough deal I'd expect to see an uptick in gold as people temporarily exit crypto to watch and see if it's all OK - and then pop back in later. But a heist on an exchange isn't a big enough deal.I think this also shows uncertainty and maybe overextension. The higher they go the more people will be on edge to protect their wealth.The thing that gets me is that they have this email being sent out, when it should be automated. Those coins are probably all laundered already. Happened at light speed dontchaknow.

@zer0hedge

Ya, word travels fast and any news of regulation or hacks or theft reaches most who are in crypto. These exchanges need their security in order, first and foremost.

Yeah I agree with u.

Understand that the banking monopolies that have wielded the worlds money supply for decades, even centuries, are not going to roll over and surrender their power so easily. We are going to see country after country coerced by bankers into cracking down on crypto currently. In the end the people will only triumph if they refuse to be intimidated by such tyrannical power on a large enough scale. I will stay the course.

The news is all about trading you some news that is affected in the market

Warren Buffett

Warren Buffett, the most famous Wall Street billionaire, said that "what is happening now will certainly lead to a bad end," referring to the huge rises and huge profits recorded by digital currencies in the world. Buffett, the chief executive of Berkshire Hathaway, said his company had no interest in encrypted digital currencies and was not considering investing or dealing with them. "We do not have any digital currency, and we do not think about it anytime soon. We will never have a place in this market," he said.

Janet Yellen

Federal Reserve Chairman Janet Yellen described the digital currencies as "speculative" and that they are not a stable source of value and are not legal currencies. In her last press conference as president of the US Central Bank, she described the risks posed by " Plays a small role in the US payments system and has responded to fears of losing money in such financial instruments by saying: "I do not see a major risk to financial stability."

Jimmy Demon

JPMorgan's chief executive, Jimmy Demon, regretted describing it as a means of fraud that would benefit some in countries such as Venezuela, Ecuador or North Korea, and drug dealers and killers could also benefit from it. Demon likened it to being worse than "tulip flowers," referring to the "tulip frenzy" or so-called "manic obsession" that formed one of the worst economic bubbles in the world during the 17th century.

Stephen Menuchin

WASHINGTON (Reuters) - US Treasury Secretary Stephen Menuchin warned on Tuesday not to allow the digital currency to be used to disguise illegal activities, pledging press statements to work with other governments, including the G20 governments, which include the world's largest economies to monitor the activity of those investing heavily in the encrypted currency. "We have to ensure that bad people can not use this currency to do bad things," Menuchin said.

@zer0hedge

Yes, what do you think will success? BarterDEX, Bisq, Waves, Openledger...

Hopefully, in February they will recover...

Long term, Bitcoin is going to continue to increase in value. If the lightning network is successful, welcome to the good times!

https://steemit.com/coincheck/@paperball/coincheck-what-happened

its very valuable post about cryptocirrency.. so thanks for sharing..i am waiting your next post..good job

damn this is why my nem is not well today!

we can show downtrend bitcoin sad

if you have the means... buy buy buy buy!

There is some suspicious that NEM might have been hacked and there is already a lot of people panic selling:

@zer0hedge, I recall gone ETH was hacked and they voted for rollback and them make ETH and ETC.I always think if that will be doable today, because, things serve on that make the pillars of cryptos tremble.

i think ripple will take other coin market place and i heard that some bank are collecting ripple exchange of bitcoin ..