Content adapted from this Zerohedge.com article : Source

by Tyler Durden

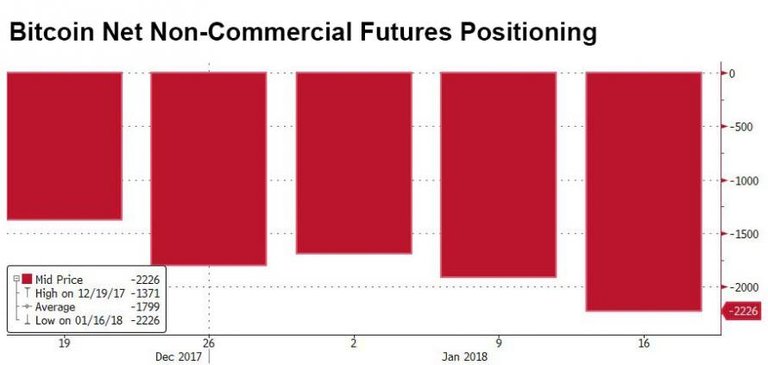

Two weeks ago, when bitcoin was trading in the $15,000 range, we published what in retrospect was a warning to bitcoin investors, highlighting that traders of bitcoin futures appeared to be quietly building a net short position. As we reported on Jan. 7, CFTC data for leveraged funds - which consists largely of hedge funds and various money managers - showed a short of around $14mm, or around a quarter of the total open interest. "In other words", we summarized, "spec investors have used the futures contracts to establish Bitcoin shorts."

Just a few days later, following what in retrospect appears to have been overblown and misinterpreted news out of South Korea that the country was preparing a bill to ban bitcoin exchanges, something it has since denied (for now, at least), as well as frayed nerves after the shuttering of the allegedly fraudulent crypto-exchange platform BitConnect, those bitcoin shorts were generously rewarded, generating profits as much as 40% when bitcoin tumbled to a low of $9000 last week, before rebounding modestly since.

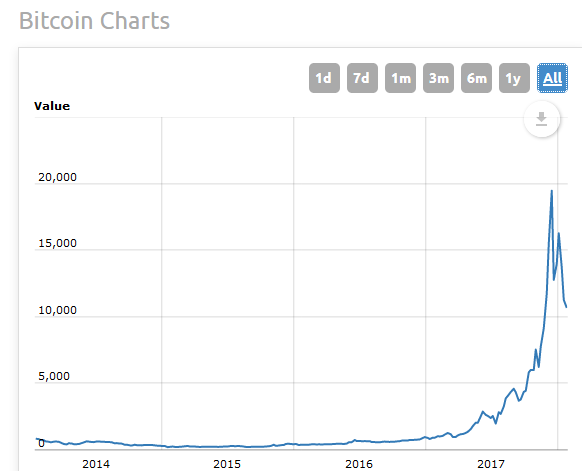

To be sure, the decline in prices across the crypto space last week was broad-based, with the aggregate market capitalization of cryptocurrencies declining by around 35% from a peak of around $800bn on Jan 6 to around $520bn on Jan 16. Cryptocurrencies eventually recovered on Jan 18 although the the recovery in Bitcoin was more modest, leading to a decline in the Bitcoin share of the total cryptocurrency market cap to below 30% for the first time.

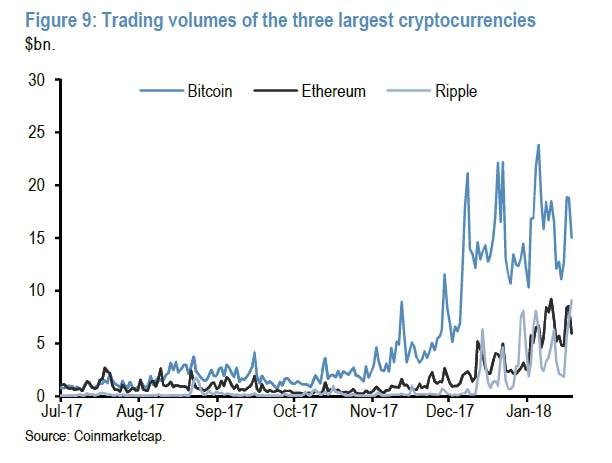

And while some had already written off bitcoin futures barely a month after their launch due to lack of volume and trader participation, the recent sharp movements in crypto prices saw a rebound in trading volumes across the three largest cryptocurrencies, as the next chart from JPMorgan shows.

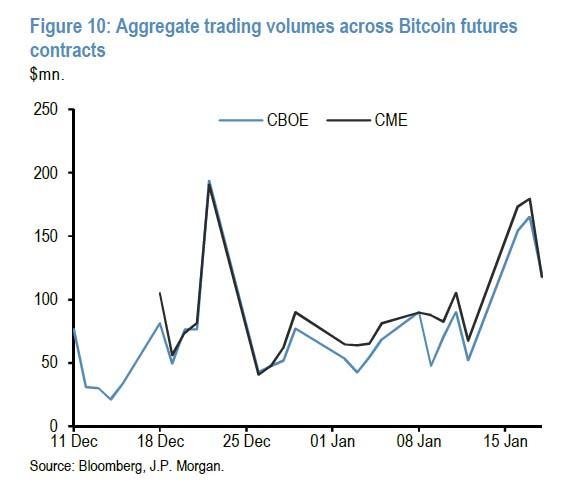

Trading volumes in Bitcoin futures on both the CME and CBOE also rose significantly, to $180mn and $165mn, respectively, approaching the highs of around $190mn on Dec 23, compared to average daily volumes of around $80mn and $70mn respectively between these two peaks.

While volumes picked up, overall participation in the futs markets remained shallow, with open interest on the CME at around $80-90mn, broadly consistent with its average since the start of the year. By contrast, CBOE contracts saw a significant decline in open interest to $20mn compared to its average of around $60mn this year, though this was likely related to the expiry of the CBOE January contract on Jan 17 than the sell-off in cryptocurrencies more broadly on the previous day.

The fact that less than half of the open interest from the January contract was rolled into subsequent contracts is **also suggestive of the CBOE futures contracts at least thus far having been used to establish short-term speculative positions. **

Finally a look at net positioning, which reveals that the trend first highlighted two weeks ago has accelerated, with recent CFTC data showing that the net short positions held by non-commercial positions was nearly $30mn as of Jan 9, or around 40% of open interest. This "push" by shorts only extended in the subsequent week ending January 16 as bitcoin suffered its worst crash in years. The continued press by shorts is shown in the chart below, which while only allowing for 5 weeks of data, demonstrates that bitcoin shorts are clearly becoming more aggressive by the week.

And with the short overhang growing weekly, one wonders how long before a short squeeze - whether due to some long-overdue bullish catalyst or for some other reason - in unleashed first in bitcoin futures, then quickly cascading into the spot market, potentially unleashing the next move higher in the cryptocurrency space.

Step one: establish short position in bitcoin futures.

Step two: call you buddies in gov. agencies to start making threatening statements, or alternatively, get your compatriots in various media organizations to star pumping out scary stories.

Step three: collect profits.

Personally I´m convinced that the shorts will get overrun by a bullish trend pretty soon. The interest in Bitcoin is just growing every single day and people are probably just waiting for the next signs of an upwards trend to get back in big.

The current prices around the 10k USD are pretty stable as it seems. I mean Bitcoin ATM´s in Singapore seem to be bought dry, which shows the huge confidence of people into an upwards trend rather than a further push down. Wall street guys will feel the power of crypto in case the don´t take them seriously yet.

Bitcoin lost 22 percent in 2018.

Bitcoin contracts for January 26th, traded at CME, climbed to $ 11,130, up 1.7 percent from a contract worth 550 contracts. The total transaction volume of the previous season was 2,657 contracts. The CME contracts represent five Bitcoins.

Bitcoin futures contracts traded at Cboe on February 14 matched up to $ 11,120 with a 2.8 percent increase in contract volume of 3,273 contracts. The transaction volume of the previous session was 9,230 contracts. The contracts traded at Cboe represent a Bitcoin.

I hope you will see the comment. I could not post the comment early due to the bandwidth problem. @zer0hedge

I think bitcoin is going to keep going down, for me it looks like it reached its max and then BAM! all the way down now, maybe it hit too high.

There will probably also be more government involvement on bitcoin that will make it drop further.

I wish I could invest here 3 years ago.

@zer0hedge....bro You've been well programmed.Wall street haven ruined anything, all they have done is opened even more eyes to their scams and games and people are even more prepared to risk everything to get out of their clutches. Stop valuing everything in terms of bankster fiat or you will always be a banskter slave..There is no such thing as a short squeeze in futures. If I own bitcoin and it is in my wallet and I want to lock in my profits or I am at breakeven and want to protect from losses, I would by put options. Fully hedged I could care less if prices go up or down as I will make money either way. My maximum ..When BTC goes down, so do all of the other cryptos. Just like gold and silver always seem to move in tandem, and stocks broadly move in tandem. It is ironic that virtual currency true believers don't see that there is no spoon...thank you for sharing with us...

Yeah I also think that @zer0hedge is well programmed.

At the moment there is not much understanding or divison of good and bad cryptos. When BTC goes down, everything goes down - that is a great buying opportunity for those, who don't understand crypto in general.

What exactly is a short squeeze?

It would be nice to see BTC getting bullish and heading back to previous highs, but the market seems easily influenced by any amount of FUD, there are a lot of players and factors affecting price, but I think most of us believe there's no way we don't see ATH's eventually

A short squeeze is when an asset is heavily shorted and the price starts rising. This causes the shorts to have to cover which results in more buying. This cycle repeats itself by speeding up so that shorts are all caught looking down when the price is heading up. In essence, they have to come up with more capital.

thanks for the info! I have a lot to learn in regards to trading

There is a chance that Bitcoin miners hedged the price of BTC (while shorting). Around the China BTC miners drama this all happened, so it's not out of the ordinary. This reaction triggered other sellers and ther eyou have it.

This makes a lot of sense. Shorts tend to get caught with their pants down and it tends to be a hard move when they do. With so many looking down, the rats jump ship when the price starts moving upwards.

We watched the weak hands get flushed out. Granted there might be a few more who throw in the towel meaning the price heads a bit lower. However, when it does bottom, cryptos make a hard turn.

We see 40%-50% declines come about rather quickly...runs of that much or more can come just as fast.

The shorts could have another week or so to enjoy it but then it is gloves off.

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

www.zerohedge.com has confirmed that they have not given any permission for their content to be reused for profit.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Hi. I'm also a big fan of www.zerohedge.com. But I was a bit surprised that someone, who even though they are up front about it, is making big $$$ simply re-posting someone else's content (Your use of the zerohedge logo and name is borderline plagiarism though IMHO).

I suppose I should congratulate you though since I admire capitalism and the free market has decided they value your cut-paste work.

It is what it is but it's certainly frustrating that I work tirelessly to create original content that no one even hardy reads let alone up-votes (unless it's a paid bot that costs me money)

In the long run I think this practice will drive masses away from Steemit and I hope that the administrators do something about it.

In the meantime all the best, I suppose...

I'm also a big fan of @zer0hedge.

All this is more or less the illustration of a battle , how mainstream wants BTC down by misinfromation and how markets and small holders react .... In the long term the blockchain tech will always win as it is going to come and invade our everyday life .

A revolution is on the way and blockchain along with A.I as one of the most important of the 21 century .

You r right a revolution is really on the way.

What are the main exchanges people are shorting on?

"[Blockchain] is a very important, new technology that could have implications for the way in which transactions are handled throughout the financial system. We're looking at it in terms of its promise in some of the technologies we use ourselves and many financial institutions are looking at it. It could make a big difference to the way in which transactions are cleared and settled in the global economy."

Bitcoin is one of the biggest opportunities since the invention of the internet itseif....great times to be around..............................

Yeah these cryptocurrency is really the biggest opportunities.

i really like your post and i enjoy it very with all post 👍

i think Bitcoin is the king of coinworld. thanks for your helpful post

For this, I'll need to quote Baron Rothschild "The time to buy is when there's blood in the streets." @zer0hedge

This new year certainly is bringing some new tricks to the Bitcoin game as the major player start to make their moves and government rushes to throw down regulations...

Maybe Lightning Network will influence a bit Bitcoin's price, but I still don't believe in it for the long run. It is old technology there and the world needs to evolve from PoW.

What exactly is a unexpected squeeze?

It would be user-likable to see BTC getting bullish and heading promote to previous highs, but the push seems easily influenced by any amount of FUD, there are a lot of players and factors affecting price, but I think most of us believe there's no pretension we don't express ATH's eventually

bitcoin value is down day by day.lets see what will happen.good job in the artical

I thought this was official zerohedge account , anyway you summarized everything pretty well . Keep us updated on Btc futures , I hope they go long , contract expires on 26th . I think we may see a bull movement till contract settlement . Lets see what happens in coming days .

ts posting on the steem paying ? if so then how to post best ?

this post its to ask those who have more experience to share how and make it easier for everybody .

those who dont know how will appreciate it , thanks for the help guys .