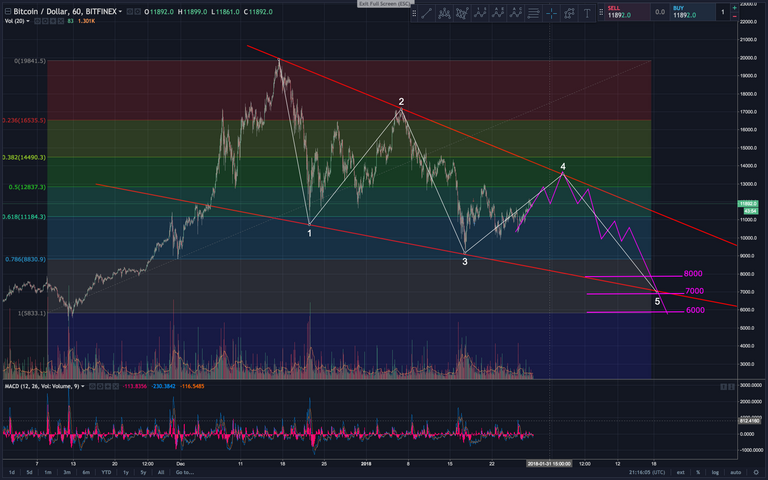

Maybe laddering would look like something like this?

Any position 'missed' during the laddering would provide for some cash in the portfolio.

So of what I understood, if we aim at let's say 10% cash, that would be the ladder for the most improbable scenario, let's say at 6000.

You would ladder the main % of your portfolio in the most probable position, etc.

like this?

like this?