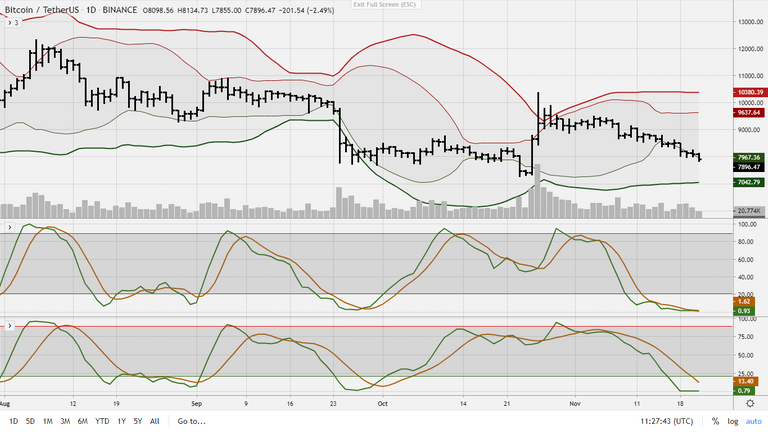

Severe pressure by the bears is put on the price of bitcoin. I had expected the 61.8% retracement level to provide decent support, but we're now testing the 78.6% Fibonacci support level at just below $8000.

The pretty wedge from last week has now metamorphosed into a rather ugly channel down.

We're also testing a longer term support line on the weekly chart. Although, it must be said, that support line can be easily drawn differently. In addition, note the H&S pattern when price should decide to drop below $7000.

Equally, the Renko chart looks quite bearish.

Consequently, the bitcoin greed & fear index is negative.

But so far for the bad news.

The good news is that the daily stochastics are now very oversold.

And the MACD's are diverging on the larger intraday time frames as the 3 and 8 hour chart

Both the total crypto market and the Huobi10 are still largely outside the down sloping resistance line.

Actually, I think this is a good time to increase your position. I won't, as I'm already pretty loaded, but I may buy some more once the downsloping resistance line at $8200 gets taken out.