My goal in market analysis has always been to keep things simple. In my humble opinion, markets are not made up of three types, which early teachers would name as Uptrend, Downtrend, and Ranging markets. Markets are of two types, Uptrend or down trend, the addition is that these trends keep moving from time frames to time frames, sectors to sectors, industry to industry. So you see, it is more difficult shooting a moving object, therefor explaining why trading can be difficult! having this kind of information helps us to know the kind of beast we are dealing with.

Gold in the past used to be a safe haven for investors to park their money. The success of cryptocurrencies, championed by bitcoin the pacesetter has created a new money parking lot for investors. A picture they say speaks louder than a thousand words.

XAUUSD

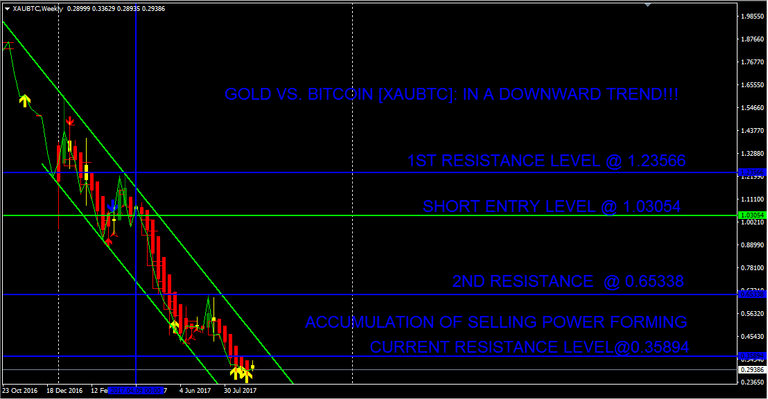

XAUBTC

The chart of Gold vs. Bitcoin shown above illustrates Bitcoin gaining strength against Gold. This trend view on the weekly chart simply translates to consecutive bearish bars (candles) on the monthly time-frame.

The chart currently shows an accumulation of sellers at 0.32977, 0.35659, and 0.30895. A price close above the highest of these 3 levels illustrates a weakening of this bearish weekly trend.

The chart of OILBTC is also in a bearish trend indicating money flow into Bitcoin. Currently there is a price close bellow the 1st trend line channel, which is an indication of take profit zone for the first trend. A close bellow the 2nd channel indicates 2nd take profit opportunity.

OILBTC*

CONCLUSION

As long as we keep experiencing a strength in Bitcoin against these two commodity pairs, Bitcoin will continue to gain even more strength against the U.S dollar.

Happy trading,

Cheers!

Disclaimer

This information is for educational purposes only, and should not be considered as investment advice. Trading leveraged and highly volatile investment vehicles like cryptocurrencies, gold, and oil has a high risk potential as well as high rewards.