THE BIG SHORT is here.

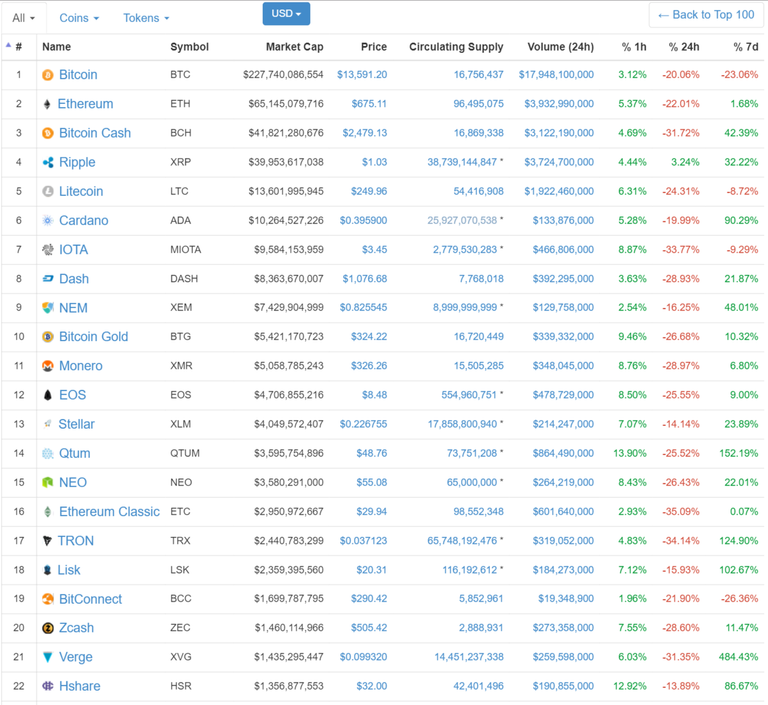

A massive deflationary event in the crypto space was expected, due to hyper-inflationary trades that took place in the last two weeks, many currencies traded well above their realistic valuations.

A lot of money entered the market, with Christmas wishes of great riches and a new Lamborghini.

Do not panic. Hold on to your investments. You will have presents aplenty next Christmas.

This was of course a pre-planned event, and coincided interestingly with the drop in the US Dollar Index (dollar lost value against other currencies).

CoinSpot and BTCMarkets stopped deposits in Australian Dollars, via Poli payments, claiming the banks had pressured them to do so. This means that all those keen investors, signed up to these services, who could have gotten into the market at historical lows (because AUD was trading at 77.185 cents to the dollar), were not given the opportunity by these exchanges (due to what I believe to be collusion).

Coinbase and their friends HitBTC have also come under fire recently for insider trading. The Bitcoin Cash pump was timed perfectly to coincide with massive drops in the altcoin market and a selloff of Bitcoin (which also clogged the network and sent fees skyrocketing).

Ripple, the banksters' love-child, was the only crypto that continued surging through the altcoin selloff. EVERY altcoin saw red today, except Ripple. I wonder who orchestrated this scheme... I suspect it won't end well for those thinking to buy into Ripple now because it's godly and will eat Bitcoin for breakfast. There will be an equal shake-up to the price of Ripple in the coming weeks. Stay away from this one.

Litecoin saw double the damage, with large sell-offs following news of Litecoin's creator saying he sold / gave away all of his Litecoin. Of course the FUD media only gave you the snippet that made you think Litecoin is being abandoned, and not the part where he says he's working on new tech that will revolutionize Litecoin and he doesn't want to have conflicts of interest promoting it to the public. There are also rumors that Facebook wants to partner up with the Litecoin developers for integration with the platform (using MAST smart contracts for Litecoin, I suspect).

In Australia, you could have snapped up some Litecoin for AU$320 on CoinSpot (that's if you had cash deposited already, and bought at the peak of the AUD/USD volatility). I'm a big fan of Litecoin, I think it will see excellent growth in the new year.

Another favourite of mine, SkyCoin, has shut down their OTC (over-the-counter trading platform that accepts Bitcoin and deposits SkyCoin into your wallet).

SkyCoin also lost about 50% of it's value in just 2 hours. This seems to happen to my favourite coins for some reason.

.

The reflation has already begun. You can see by last hour's action, which altcoins have been favoured for the reinflation event. Be careful trading at this time, I expect a lot of volatility during the holidays, because this is when most regular investors are distracted with family matters. Hold onto your coins, hold onto your children, and don't stare at the charts!

.

In other news, Hashgraph sets its sights on dominating the Distributed Ledger Technology (DLT) market.

It's not blockchain, like Ethereum; it's not a Directed Cyclical Graph (DCG), like Byteball Bytes; It's not the Tangle (IOTA);

The Hashgraph team's claims are yet to be proven against the existing technologies, but you should see for yourself.

https://hashgraph.com/

.

Disclaimer: none of the above is financial or investment advice. I encourage you to do your own research and make your own conclusions. I also hold Litecoin and SkyCoin (and have no intention of selling them!).

You're right, it really felt like it was orchestrated... hard done by it! BTC is dead! Long live BTC!

Hashgraph looks really interesting as an alternative technology, great pick!