So one of your mates keeps telling you how much they have made with Bitcoin and you have decided to enter the world of Crypto trading.

I understand it can be a daunting experience, it was for me, so I have written this guide to help you get started. My assumption is that you are here for one reason, to make money. You have heard about the incredible returns from Bitcoin and other Cryptocurrencies but please be warned, this is not a get rich quick scheme, there are significant gains to be made, but the markets are incredibly risky. Yes, there are many people making good money but there are also people losing money too, sometimes scary amounts.

The following is me sharing my experience with you to help you avoid silly mistakes and get up to speed quicker.

There are two deciding factors which will affect your Crypto experience:

- What the market does

- What you do

It all comes down to those two things.

You can make smart decisions, and the market turns against you, and you can make stupid decisions and make money. Over time, smart decisions will see you right, but like poker, the size of your gains will come down to a combination of skill and luck. My approach is to rely on skill as much as possible and enjoy the luck when it happens.

You need to be self-aware of what is down to luck and what is because of smart decisions else you may get greedy and do stupid things.

Timing is everything, especially with Crypto markets being so volatile. An individual coin can jump 25%, 50% or even over 100% in a single day; equally a coin can also drop by more than 50% in the same time period. One new investor may join the market at the start of a rally and think they are a genius while another may join just before a crash and get burnt.

You cannot control the markets, you can only control you and the decisions you make, as such you need to be prepared for the high-risk nature of an unregulated, decentralised global market.

Okay, moving on, I imagine you are eager to get going but the market is often bubbly and it is therefore important that you take a slow and careful entry into crypto.

Even if you are just planning on buying a couple of coins and holding for the long term, I guarantee you will start checking the prices more than you will have planned to and you will naturally be drawn in and want to start making new investments.

This guide is meant to ease you into the crypto market and avoid making the mistakes that I and many others have made.

So, before you carry on, please make sure you read my beginners guide, specifically the section on security and my article about getting hacked. From day one, security must be your primary concern, and I hope you have purchased yourself a hardware wallet, such as a Nano S or a Trezor.

Week 1

I have broken this guide into specific time periods. To begin with, we will focus on your first week.

So you have an amount of money you want to invest that you can afford to lose, I talk about this in the beginner’s guide. Whether you are starting with £100, £1,000 or even £10,000, I want you to invest only 10% of this in your first week.

You may think you are ready to go and invest your whole pot now, you may be scared of missing out on returns. It isn’t worth it; it is much better to take your time. Yes, it might go up during your early days, but it may also go down.

Your first week is about getting a basic understanding of crypto markets and building a discipline around your trading. If the price shoots up in this first week, ignore it, don’t think about what could have been because equally, it could have dropped.

Step 1 — buying your first coins

Open an account with Coinbase and go through all the security requirements, including the setup of two-factor authentication (2FA). Make sure you that you use Google Authenticator 2FA instead of SMS 2FA as it is more secure.

Please note, I always recommend Coinbase for beginners as it is much easier to use than any other exchange I have found. They have focused on user experience over the number of coins available to trade. If you decide to find another exchange to make your initial purchase then no worries.

Once you have completed your setup, you are ready to buy your first coins.

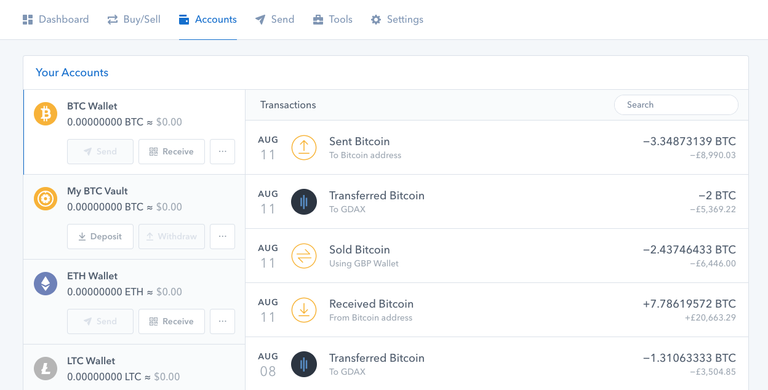

Enter the accounts section, where your wallet for each coin exists. It is important you understand what a wallet is and how it works. There is a good explanation of wallets and how they work here:

Now let’s go and buy some coins. You can do this either on the website or via the app. I would recommend starting with the website for now.

I’ll imagine your investment budget is £1,000, as such, 10% is £100 so let’s buy £50 of Bitcoin, £25 of Ethereum and £25 of Litecoin, don’t worry too much about what this means as a portfolio, they are all decent long term investments. Also, do not worry about the initial investment, just reconfigure based on 50% Bitcoin and 25% each of Litecoin and Ethereum.

You can buy coins by entering the Buy/Sell section on Coinbase, selecting the coin you want to buy and how much you want to spend. You can then enter your card details and make the purchase. In future, I would recommend setting up a bank transfer as the fees are lower, for now, a card payment is a good start.

If you have completed this then congratulations you now own your first cryptocurrencies.

Step two — setup your portfolio tracking

Now you are in the game and own some coins it is important to become disciplined about tracking your portfolio. Of course, you can ignore this step, you can ignore any step but if you are here to make money, then discipline around your investments is important.

There are two things I do to track my portfolio. Firstly, I use the Blockfolio app. Please download it and add each coin you have just bought. You do this with the little + button on the top right and search for the coin. I advise you always track prices in your local currency, £ for me. Some people track in Bitcoin prices because on some exchanges you buy in Bitcoin. I don’t do this for two reasons:

- While some coins are purchased in Bitcoin, if the price of Bitcoin changes then the fiat value of the coin tends to adjust to reflect it

- Until coin prices become stable and there is a wider adoption of crypto for real world payments, my crypto strategy it to grow my fiat pot, because this is what I live on

When you have added your coins, you will be able to see your total portfolio value.

Secondly, setup a spreadsheet and become disciplined about recording your trades. As a minimum, I would recommend the following:

Tab 1: Portfolio

Enter a row for each purchase you have made, if you make multiple purchases for a coin then you should have a separate row for each trade, then record:

- Currency bought (Bitcoin)

- Coin Code (BTC)

- Where stored (Nano S)

- Date bought (16th Aug ’17)

- Amount purchased (0.1btc)

- Cost (£320)

- Bought at price (£3,200)

- Current price (£3,300)

- Value owned (£330)

- £ Profit (£10)

- % Profit (3.13%)

I then think it is a good idea to auto colour your profit cells based on whether they are in profit (green) or loss (red).

Tab 2: Performance

This is a daily and monthly chart for tracking the performance of your portfolio. Here you create a separate row for each day with the following:

- Date

- Starting balance

- Closing balanced

- Profit £

- Profit %

I then have a separate section where I aggregate each month and count the same, including an average daily return.

One additional thing you need to consider is, if you ever sell off a coin into fiat or add new investments then you need to account for that with money in and money out columns for each day so the profit margins are accurate.

Tab 3: Closed Trades

This is the same as Tab 1 but is for any trades you close. Here you need to also record:

- Date closed

- Price sold

- Closing profit £

- Closing profit %

- Daily profit £ (£ profit per day held)

- Daily profit % (% profit per day held)

The daily is dividing the profit for the time you own it to allow you to track the performance of an asset over time compared to others.

Tab 4: Watch Trades

This is optional but is a separate tab where I keep track of those coins I am watching and considering entering. For each coin I also keep notes on my thoughts about the coin and possible entry point.

Step 3 — setup your news sources

It is important to keep up on market news, and I would recommend the following news sources:

- Coindesk: I think, for what is regarded as the flagship site for Cyrpto news, that the standard of journalism is quite low. They do though seem to pick up the main news so it is worth following.

- Flipboard: this app is an excellent way to aggregate Crypto news by following Bitcoin and Cryptocurrency topics. Flipboard will pick up news from specialists sites but larger news sources such as Forbes and Techcrunch.

- Google news alerts: here you can setup a daily or weekly email for Bitcoin and Crypto related news.

- Reddit: here you can subscribe to a subreddit for each coin you are interested in and general ones such as cryptomarkets, cryptocurrency and altcoins. Also for something like Ethereum, there is the central Ethereum subreddit as well as Ethtrader.

It is easy to get sucked into reading loads of news. I don’t; I tend to scan through for half an hour to an hour each day and keep notes on the things which will affect my trading, things I want to watch and record etc. This may seem like overkill for those who think they are just going to just buy and hold a few coins for years. Fine, please feel free to ignore this but I guarantee, everyone I know who has invested becomes obsessed and starts trading more.

Be careful with Reddit, do not get sucked into arguments, memes about Lambo’s and ignore most of the bullshit about which coins are about to explode. Use it as a source of finding interesting things you are unaware of, then do your research.

For the rest of your first week just ensure that you are being disciplined about keeping records, tracking news and seeing how prices change.

Before your first week is out you need to try moving some coins. I suggest sending them from your wallet on Coinbase to your Nano S or Trezor as this will give you a feel for how transactions happen. My suggestion is always to move a minimal amount first, wait for it to have confirmed and then move the full amount. Ideally, you will be moving all your coins off Coinbase onto your hardware wallet. Don’t worry; it is quite easy, you will figure it out.

Please note: you should always be careful moving funds, if you ever get an address wrong you can lose the coins you transferred.

Weeks 2–4 (rest of month one)

This is where you start building your portfolio and buying other coins. I would recommend you only use 50% of your portfolio in the month. Therefore you have the remaining 40% to play with.

You may be happy with a portfolio of just Bitcoin or a combination of Bitcoin, Ethereum and Litecoin. I advise a diverse portfolio so you can ride out the waves of the volatile markets. Being tied to one coin can you leave you with negative and static growth where as there is usually always something up each day. A diverse portfolio is what has provided me with relatively stable growth, even during market dips.

Before you start building your portfolio, I would recommend you prepare yourself emotionally for your crypto journey. As such, these are the two most important things you can do:

- Learn patience: you might have heard of stories of people getting rich quick, it happens, but this isn’t a get rich quick scheme. Remember, nobody knows what the fuck will happen, you are investing in something high risk. My belief is that the market will grow but with many spikes and dips along the way.

- Remove emotion: accept that things go up and down, this can feel emotional, but you need to get used to it. If you can’t, you are either investing more than you can afford to lose or you are investing in something which is not right for you.

So how do you build a portfolio when you are new to crypto, my advice is slowly. I would recommend a split of 70% in stable coins, 20% in growth coins and 10% in small up and coming coins. The way to do this in the early days is to consider your investment like an index fund with some minor investments in coins with potential big gains. An index fund is where you invest broadly across a market to ensure you grow with it, rather than investing and hoping on individual coins.

The simplest way of choosing these coins is as follows:

- Stable secure coins are the top 10 coins by market cap but have been in existence for over a year. As such, in the top 10 at the moment I would include Bitcoin, Ethereum, Dash, NEM, Litecoin. I don’t include Ripple because there are some weird fundamentals about it and I don’t include Bitcoin Cash and Ethereum Classic because they are forks of other coins and I am leaving them to do their own thing for now.

- Growth coins are top 50 coins which have seen solid and steady growth over an extended period, such as Neo, Monero, Stratis, Waves, Iconomi, Augur, Golem and Siacoin. There are new entrants such as OmiseGo, Qtum and IOTA but their growth has been so rapid I would avoid them for now.

- Smaller up and coming coins are any coin under $50m market cap which appears to have a good trajectory of growth.

I understand this is all quite daunting and I have missed out a whole bunch of coins in the top 100 market cap which is neither not top 50 but over $50m market cap. In time you will be able to start researching and understanding the whole market but for now, I suggest you are patient.

When researching coins, I would advise you to do the following:

- Look at their website: does the project make sense? Is the website professional? Does the team appear solid? What is the roadmap like? If it is a good project, you can get a feel for it.

- Check out their social channels: Twitter and Facebook are a good start. Are they posting regularly? Do they respond to people? Some like Slack but I think this is too advanced for now.

- Check their subreddit out: how active is it? Look for individuals who like it and hate it, get a well-balanced feel for the coin.

My suggestion is to stay simple and only make a few investments at first but ensure that everything is setup to be recorded in your spreadsheet and Blockfolio. In time you will become better at researching coins as you become more in tune with the market.

When you are ready to start buying your coins then you need to do three things:

- Find an exchange you want to buy from

- Find an entry point

- Store your coins securely

In terms of exchanges, there is a lot to choose from. Even though I initially liked Poloniex, I would be cautious as there are many concerns with its operations. There are lots of options out there. I never recommend exchanges as they are like cars, you need to try them out and find the one which is right for you. Here is a good breakdown of the main ones:

Exchanges

Remember, to follow the security recommendations with passwords and 2FA.

Now you need to go and buy your coins, but here you need to find an entry point, this is by looking at the charts. If you are buying for the long term then arguably any entry point is fine, but I would say avoid buying any coin which is in a spike.

The simplest way you can do this is going on Coinmarkcap and selecting your coin, look at the last year, draw a mental line across where the price has hit low points and see if it is spiking. I use a website called Coinigy.com and you can see a very simple chart for OMG.

You will see above that it is in a spike. If you do want to buy OMG then you would need to accept it may drop back in the short term and thus you will need to hold long and be patient. Longer term you will become better at reading charts and entry points but this should help you in the short term.

Once you have bought your coins, you need to store them securely. This means transferring them onto your Hardware wallet or a desktop wallet. For each coin you purchase, their website will have a list of wallets, and you should be able to follow the instructions for setting them up. Again be super diligent about where to store them.

For the rest of the month, keep your records up to date and monitor the prices.

Month 2

Your second month should be a lot simpler. You have invested 50% of your portfolio and now have 50% left. It now is about you about getting a feel for the market, for coins and where you should be investing. The reality is that I am writing this guide at a time when the market is bubbly, it may continue to go up, down or sideways. I don’t know what the state of the market will be when people read this, so I want a guide which works whenever.

It is important not to throw your entire investment in at once. If the market dips, then you may be in for a long journey waiting for it to recover. If it goes up and you missed, so be it, accept it, the decision was right.

It is now time to build your crypto strategy; this is how you are going to trade and react to the market. You may wonder why this isn’t in month 1. The thing is, we all have a different appetite for risk, money to invest and available time. Believe me; Crypto can suck up your time, especially when you have a full-time job. I want you to get a feel first before developing your long term strategy.

It may be worth reading a couple of things here, firstly take a look at my strategy but also take the time to understand why it is my strategy and why it works for me. My goal is not to have a job and work as little as possible, as such my strategy is as follows:

- I buy and hold coins for the medium to long term which I feel have growth potential.

- I take small punts on small and interesting coins which have significant growth opportunity.

- I rebalance my portfolio based on tiered investments, primarily investing in Tier 1, long term stable growth coins supported by speculative investments on small/new growing coins which might see significant gains and accelerate my stable coins.

- I take money off the table, 5% for each 25% up, back into FIAT (British Pounds), to give me an income while still benefiting from compound growth

Your strategy should be about your goals, and you will understand the kind of strategy that will work for you once you have a feel for the market.

Take a read of these two articles I wrote, the two main strategies are hold and trade, and I have written about both.

For the rest of the month, just keep your records up to date, keep researching and if you REALLY want to make trades then do them based on what I have explained in this guide.

Month 3

This is where you start putting your strategy in place and start trying some new things. Depending on market conditions I would recommend investing what is left of your fund but against your investment portfolio strategy.

I would recommend this month you also find the time to do the following:

Make your first sale — find something in profit and make a sale, you don’t have to sell it all, but it is a good thing to try so you understand how you sell coins too. You then also have to decide what to do with your sale. If you are selling on Coinbase, then you may be selling back into Fiat (your local currency). If you are selling on Bitcoin based exchanges you are selling into Bitcoin (though others will allow you to trade in other currencies such as Dash and Ethereum).

When you have made the sale you need to choose then what to do with the funds, your options are:

- Keep the Bitcoin

- Sell the Bitcoin for a new coin you are interested in

- Sell the Bitcoin into fiat

Join the community, by this I mean, join a Facebook group, a subreddit and start contributing to the conversation. Don’t be afraid to give an opinion but avoid arguments. Be a valuable member of the community. The relationships you build will help you with your future investments.

By the end of month 3, you should:

- Have a solid portfolio

- Be tracking performance

- Have a feel for the market

- Be confident in buying and selling

- Be happy with exchanges and how they work

- Be happy selling coins back into fiat

From here, it is up to you, but you should be a confident and active crypto trader. I will leave you with the following warnings:

- If the market drops, suck it up and be patient, you only lose money when you sell a coin

- Don’t chase coins which are in a rally; there are always dormant coins which are always an opportunity

- Don’t get over emotional, if something is dropping then take a break and trust it will come back

- Do not panic, this could all die, but the original plan is to only invest what you can afford to lose so you should able to handle changes

- Don’t get greedy, when the market booms it is easy to be an accidental genius and start believing your own hype

- Don’t overtrade

- Don’t chase losses

I have probably missed a whole bunch out, but this should be a good start. Please shout me if you have any questions.

This is fantastic! Thank you for taking the time to write this step by step guide. Based on your experience in the Crypto Currency markets it's really good to have a plan before entering a market like this. I'm going to follow you! Looking forward to more great posts like this one!

No problem, I also post to my website www.whatbitcoindid.com

Alright! That's great. I will give it a click and see what your up to on your site. Cool URL by the way! :)

awesome guide thank you, resteemed and upvoted.

Good one, best digital currency wallet