Woobull lists some interesting Bitcoin charts.

Given the lack of clear direction of the BTC/USD market, I looked closer at some of these charts to see whether they can reveal what we can expect from the market, compared to the past.

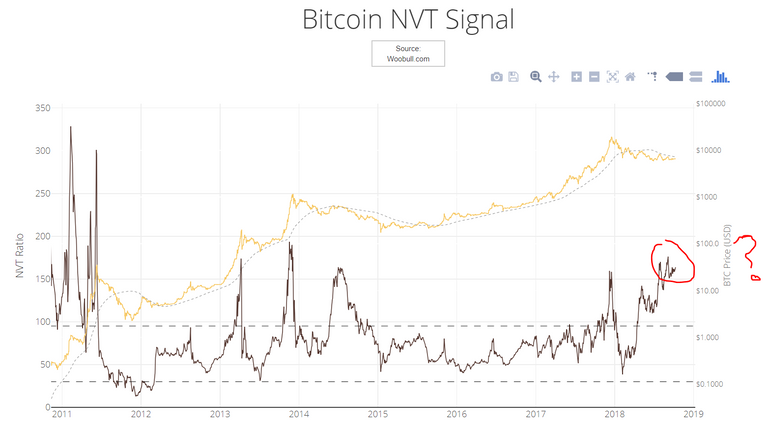

1. NVT Signal

The so-called NVT Signal is the most interesting chart.

source: Woobull charts

It is my understanding that this indicator is a reworked calculation of network activity/value (i.e., the use of Bitcoin as a payment medium) versus the BTC/USD price.

As you can see, it neatly fits the prior bubbles and busts giving - on a larger time scale - pretty good signals on when the bull is ageing and when to start loading up again during market bottoms.

But for the current situation something is off. Very off.

- either Bitcoin is extremely overvalued right now, even more than the recent USD19k top

- or something fundamentally changed rendering the NVT Signal worthless

A plausible explanation may be transaction batching: putting more transactions in an input and/or output part (see link for a better explanation). I have no information (or knowledge) to verify whether this could clarify the apparent anomaly. I understand Willy Woo confirms that batch transactions do not have an impact on the NVT ratio.

Assuming linear relationships, price may have to go to $2,2xx (with everything else staying equal) for this indicator hitting about 50 for a clear 'buy' signal.

I am curious (but undecided).

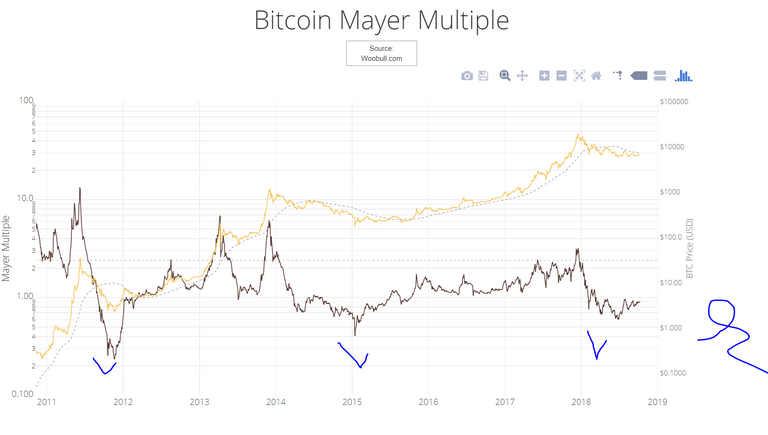

2. Bitcoin Mayer Multiple

source: Woobull charts

The Bitcoin Mayer Multiple is closer to our gut feeling that a bottom has been set or is close to being finalised in the $6,xxx zone. There is some room to hit the lows seen in the 2015 period but the 2018 period at least shows a nice bottom in the indicator followed by upward action.

A point for the bullish case I would say.

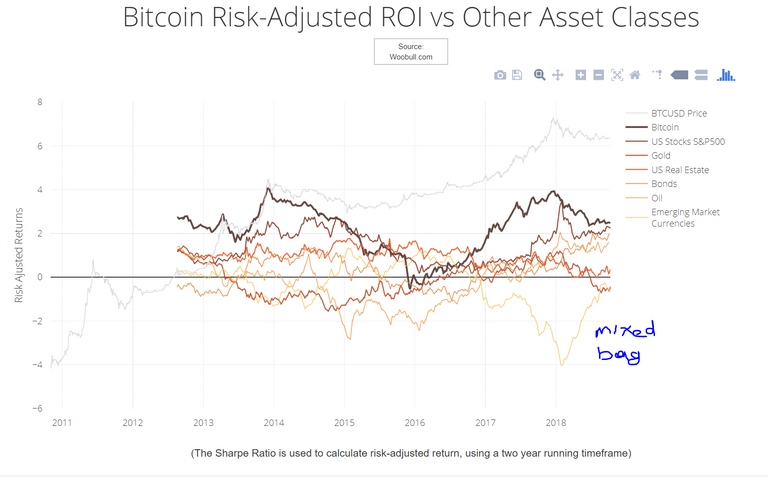

3. Bitcoin ROI vs Other Asset Classes

source: Woobull charts

This chart does not give conclusive signals. We could see confirmation of a bottom forming/having formed, but the bottom is not very deep compared to the 2014/2015 bear market. The chart lacks some history with data for the 2011/2012 bear market missing.

Inconclusive.

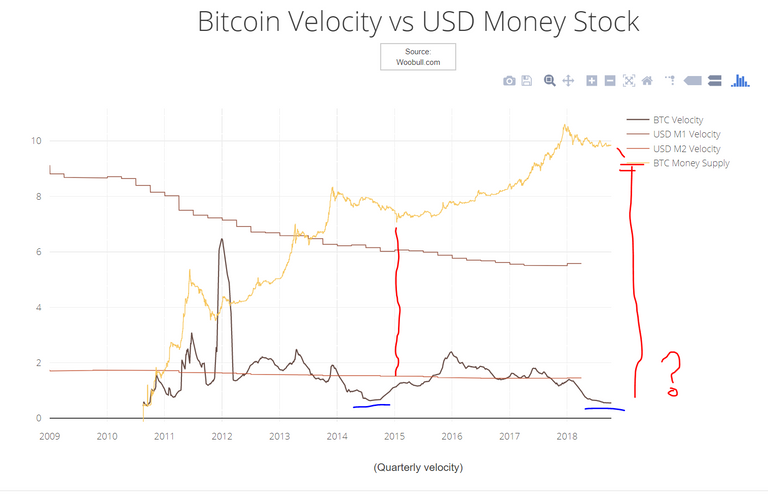

4. Bitcoin Velocity vs USD Money Stock

source: Woobull charts

The problem with this chart is that it is - from my perspective - highly subject to interpretation. My best guess in finding a repeating pattern is that we reached a moment of low volatility after which one final volatility surge can be expected - the move to capitulation. But there is no clear indication that this happened more in the past other than in the long 2014/2015 bear market. Peaks of highs and lows aren't that clear/pronounced either.

I take it as a sign of bottoming, while having no clue whether this means that $6,xxx is it for the lows or that we could still expect to see much lower prices.

5. Conclusion

I hope you enjoyed looking at these charts and look forward hearing your thoughts.

Congratulations @wekkel! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @wekkel! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!