If you have been busying opening new accounts at crypto exchanges to sell your newly minted ICO tokens or just learning how to trade crypto, you may not be aware that unlike stock exchanges, there are currently over 211 crypto exchanges (listed on coinmarketcap.com) and more are opening every other day.

I have over 10 exchange accounts some of which are barely active as they were opened just to trade some new tokens. Like most of us who started trading crypto last year, Poloniex and Bittrex were the go-to exchanges for newly listed tokens. Unlike stock exchanges which are only open during business hours and after hours trading, crypto exchanges are always open for business, 24 hours a day, 365 days a year.

In a study made by HowMuch, we can see how much are cryptocurrency exchanges generating on a daily basis:

As you can observe from the above chart, trading volumes on Bittrex and Poloniex have been usurped by new competitors and their current standing has fallen to 23 and 33 respectively.

Most of us probably paid no attention to exchange volumes and profits until a new crypto exchange became the No.1 in trading volume in 3 months or so. I am of course referring to BINANCE. Less than a year after their launch, Binance claims to have made more profits in their 2nd quarter than Deutsche Bank. It took Binance only 143 days to become Top 3 crypto exchange by daily volumes and their recent 2nd quarter profit was over US$200 million.

With such exponential growth, it is no wonder, copy cat exchanges and competitors are literally

sprouting with the dawn of each new day.

While BINANCE is not the first exchange to use their own token to fund their business model, the heady rise of Binance Coin (BNB) from ICO of US$1.00 to almost US$15 at last trade represents an ROI of 15X vs 3X for Bitcoin during the same period.

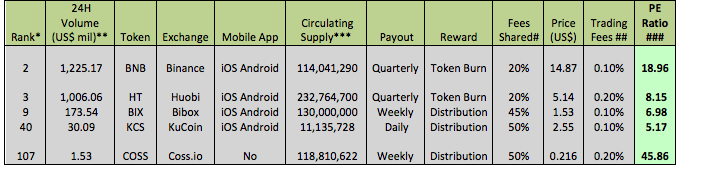

Since not all crypto exchanges issue tokens to fund their business model, I decided to search and do a comparison of crypto exchange tokens that could be attractive for a long term hold. After all, as long as tokens continue to be issued and traded, larger exchanges are likely to invest more to keep their share of the trading volumes.

Notes:

-* Rank based on 24 hour trading volume ins US$ or Bitcoin equivalent in US$

-** 24 hour trading volume based on data from coinmarketcap.com as at 10th June 2018

-*** Total circulating supply, information from exchange website or coinmarketcap.com

-# Percentage share of trading fees distributed to token holders

-## Published trading fees quoted by exchange

-### Ratio calculated as follows:-

Price / (24 hour trading volume X 365 days X Trading fees earned X Fees shared to token holders / circulating supply)

It clearly shows that while BNB has a higher PE ratio of almost 19, it remains an attractive crypto asset to own given the many initiatives by Binance to expand their business model. My picks are HT and BIX which are attractively priced based on their volumes.

Another area where these exchanges have in common compared to older exchanges is the timely launch of mobile apps (iOS and Android) for trading. Nowadays, I only trade using these mobile apps. Compared to the early days of heavy volumes and DDOS attacks on many exchanges, these apps make life much easier and could be the single biggest factor why they have done well.

The annual trading volume being priced in with their potential future earnings if current volumes are maintained. This does not take into account potential rise in prices of Bitcoin and alt coins which will of course drive the prices of the tokens higher.

In fact, during these last 4 weeks, exchange tokens have remained quite resilient despite the dip in Bitcoin and alt coin markets.

Disclaimer: Crypto investments are highly risky and as with any investments never "All In" or invest your life savings.

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Coins mentioned in post: