A team of researchers from Bank of America Merrill Lynch (BAML) has published a report, which States that the first cryptocurrency Bitcoin bubble, wherein the bubble is the largest in history.

The team of Bank of America Merrill Lynch, headed by chief investment strategist Michael Hartnett, went so far as to classify the current cryptocurrency market, which is now experiencing a 60-percent correction since 2017, as "a bubble that has already surfaced", Bloomberg reports.

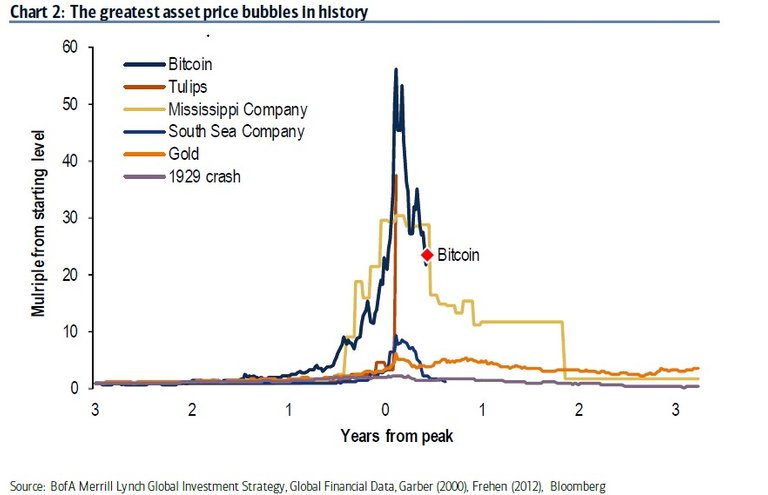

Representatives of the largest us banking holding company published a chart in which bitcoin is already traditionally compared with the well-known financial pyramids: the bubble of the Mississippi company and the company of the Southern seas in the 18th century, gold, the us stock market in 1929 and the Dutch bubble of tulips (Tulip) in 1637.

The published chart shows that the bitcoin bubble has the highest asset price with a substantial margin. At its peak, the price of bitcoin was almost 60 times higher than three years ago. According to researchers, the prices of Dutch tulips, during the so-called "Tulip", increased by about 40 times.

According to the CoinMarketCap service, on December 17, 2017, the weighted average bitcoin exchange rate reached a maximum of $ 20,089. At the time of writing, it is trading at $6,863.

BAML shows the effects of known historical bubbles, as well as their "pampas", indicating that after the collapse of prices they stabilize at new, much lower levels.

However, it is worth noting that the growth and decline of BTC after December 2017 is not the largest in the history of cryptocurrency. The bitcoin exchange rate increased 120-fold in 2010 and 2011 to about $ 11 before the crash. Its growth in 2013 and 2014 was also much steeper than the recent bullish market.

In turn, BAML analysts note that comparisons between the "bubble" of 2017 and the previous ones would be unfair, since in 2017-2018, the market was invested incomparably more funds than in 2010-2011 or 2013-2014.

материал взят с сайта CryptoPro