The market is living a disturbing calm, is like resting on the eye of the storm.

Crypto market seems to have focused on the approval or not of the bitcoin ETF by the SEC.

Recent history shows the rejection of different funds, but the appointment of Elad Roisman may have changed the bets in favor.

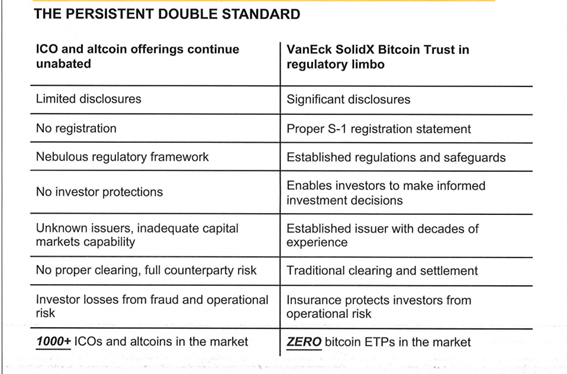

Now the market follows very closely the decision on the fund that is driven by the investment company VanEck and the financial services company SolidX, which is expected to be listed on the Chicago Board of Exchange (CBOE) BZX Equities Exchange.

The decision on this fund has been delayed since June 2018 and now as a deadline it has on February 27, 2019.

1. Two parties involved

Members of proposal

Van Eck is an established issuer that manages over 70 funds with approximately $46 billion in assets under management.

CBOE is the largest options market in the United States.

SolidX is a provider of blockchain software development and financial services. SolidX began working on a bitcoin ETF in 2015, partnered with VanEck in 2017. SolidX founders come from traditional financial and legal backgrounds and have been involved in the bitcoin ecosystem since 2011.

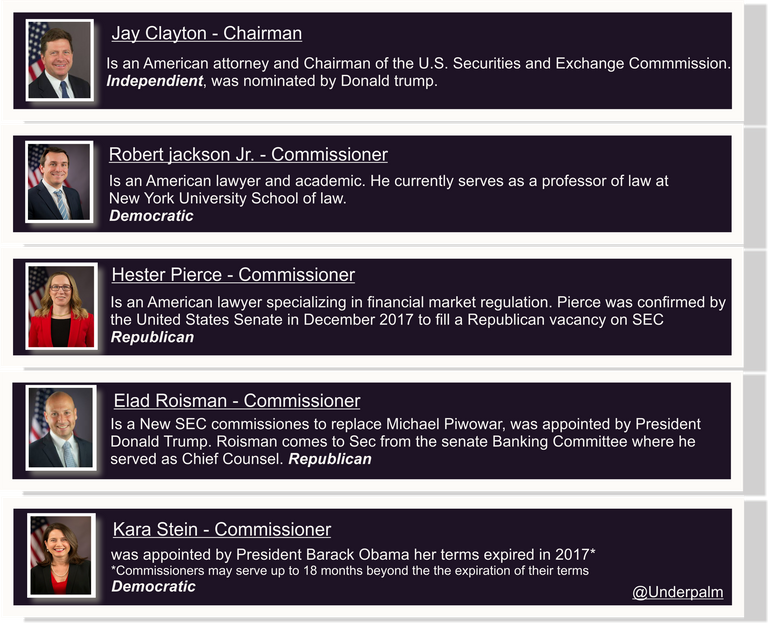

Commission Members (SEC)

2. Result of previous vote - Winklevoss brothers Proposal

The Winklevoss review was voted on by Chairman Clayton, two Democrats and a Republican, the decision was to deny. Kata stein could not participate in that decision, his position had expired.

He SEC’s decision to block the ETF was voted for 3-1 by its sitting commissioners, with Peirce voting against. She argued that by rejecting the proposal, the agency was overstepping its intended role to regulate the securities markets.

"The Commission's mission historically has been, and should continue to be, to ensure that investors have the information they need to make intelligent investment decisions and that the rules of the exchange are designed to provide transparency and prevent manipulation as market participants interact with each other"

3. New Events - Meeting October 9, 2018

The U.S. Securities and Exchange Commission (SEC) has published a memorandum, from a meeting regarding the Bitcoin (BTC) exchange-traded-fund (ETF) proposal from VanEck and SolidX.

According to the document, Commissioner Elad Roisman and his counsels, Matthew Estabrook, Dean Conwayand Christina Thomas met with representatives from VanEck, SolidX, and the Chicago Board Options Exchange (CBOE).

• Dan Gallancy, SolidX

• Dimitri Nemirovsky, SolidX

• Laura Morrison, CBOE

• Kyle Murray, CBOE

• Adam Phillips, VanEck

SEC arguments focuses on “prevent fraudulent and manipulative acts.”

The following agurments are detailed in the document.

"Issues identified in disapproval order have been resolved

• There now exists a significant regulated derivatives market for bitcoin

• Relevant markets - Cboe, bitcoin futures, OTC desks - are regulated

• Concerns around price manipulation have been mitigated, consistent with approval of prior commodity-based ETPs

• Cboe's rules are designed to surveil for potential manipulation of Trust shares

• Promotes investor protection".

The memorandum accompanies the following summary.

4. The commission has changed

The analysis of possible decisions may have changed with the new incorporation of Elad Roisman, now we would have two republican and 1 democratic. So Of the 4 known members, we would be facing this possible result:

Elad Roisman Approve

Hester Peirse Approve

Robert Jackson Jr. Refuse

This leaves the decision of paralysis or approval in the hands of the president, Jay Clayton, who must decide whether to run for the Republican side or generate a complicated situation of tie.

That is the unknown, but remember Jay Clayton was nominated by Donald trump...

IIf you want to know more about the opinion of Jay Clayton, I recommend this article, Statement on Cryptocurrencies and Initial Coin Offerings.

https://www.sec.gov/news/public-statement/statement-clayton-2017-12-11

5. Impact approval ETF Bitcoin

A Bitcoin Exchange-Traded Fund (ETF) would be hugely optimistic for the price of bitcoin.

- Legitimize bitcoin

- A new class of investment assets would be created.

- It would attract institutional investment, that is, huge amounts of money towards bitcoin.

Mike Novogratz, founder of Galaxy Digital, said: "We believe that institutional investors will drive an exponential growth in the cryptocurrency market."

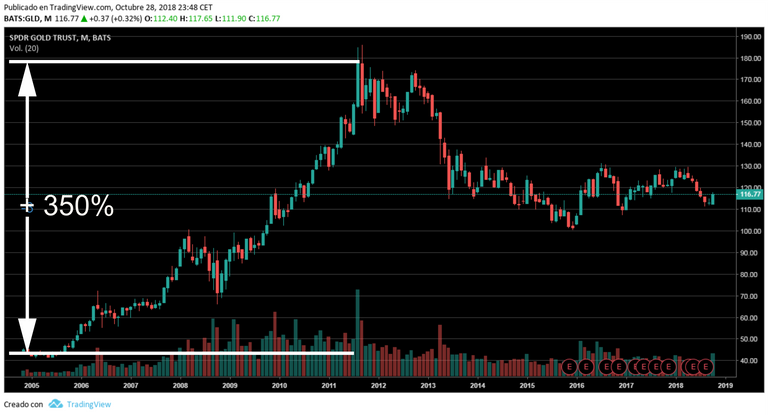

It is difficult to predict how much it may affect, but let's look at what happened with the approval of the first gold ETF in 2004 on the price of gold.

The first gold-backed ETF in the United States, the SPDR Gold Trust GLD, launched on Nov. 18, 2004.

In this case in 4 years the price grew by 350%.

As I said, it is difficult to know what will happen in the crypto market, what I do believe is that the money will enter the market but its effect will be an incognita.

Some articles talk that the effect of money entering the crypto market in mass has a multiplying effect.

Cheesman and Burniske, in "Cryptoassets: Flow & Reflexivity", called that relationship the fiat multiplier, and they estimated a multiple in the range of x2 - x25. Ref: https://medium.com/@cburniske/cryptoassets-flow-amplification-reflexivity-7e306815dd8c

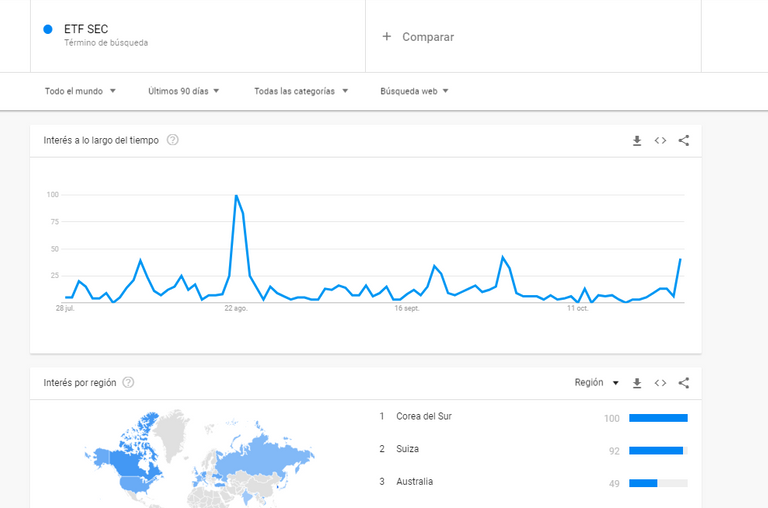

Finally a curiosity, if you explore google trends with words "ETF SEC"

South Korea is the region with more interest ;)

I dont know what will happen in that vote on the ETF .... but this time it's time to vote for @underpalm

;) Thank you

Disclaimer:

@underpalm does not offer any sort of investment advice. This is a opinion article.

@underpalm is not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think and entertain. Consult your advisers before making any decision. I am not responsible in any case for your investments