Ten years after the greatest bubble-burst in modern market history – which we can’t stop talking about – there’s a bull market in bubbles.

There are bubbly stock markets: The U.S. leads the pack, but it’s only one of many. There are bond bubbles galore: U.S. Treasuries, U.S. corporate bonds, emerging market bonds, subprime auto bonds. And then there are bubbles in art (where a Saudi Arabian prince recently paid US$450 million for a single Da Vinci), venture capital, lithium, student loans… and don’t forget real estate, in Vancouver, Auckland, Sydney, Toronto, Hong Kong, San Francisco and London, for starters.

There’s a bubble in Google searches for “Bitcoin bubble,” as my colleague Tama Churchouse pointed out. And of course, there may currently be a bubble in cryptocurrencies.

And don’t forget the “mother of all bubbles” also known as “the everything bubble,” which infers that a global debt bubble feeds all the other bubbles. It might be time for a Bubble ETF (my proposed ticker symbol: POP), composed of the many bubble markets, to buy bubbles.

What’s a bubble?

It can often be hard to tell you’re in a bubble until it pops – and it’s too late. It would help to know how to tell a bubble is forming.

Luckily, there are about four centuries’ worth of speculative bubbles to study for answers.

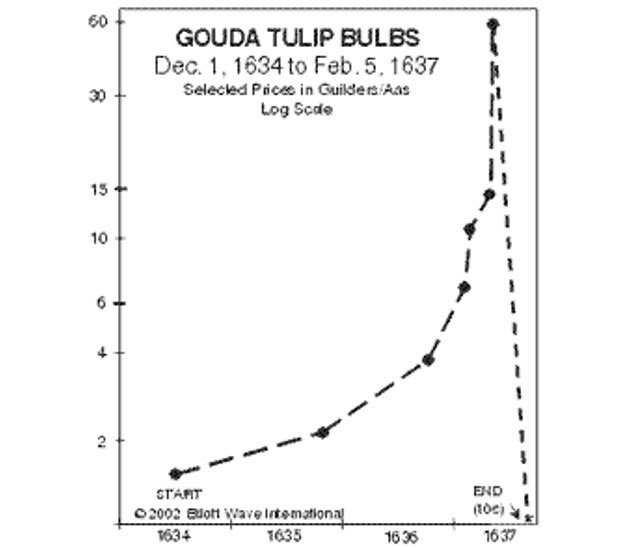

The first widely known and the most famous market bubble of all time was Tulip Mania, which occurred in Holland in the early 17th century. At that time, the Dutch became enamored with tulips that had flaming colours on their petals. They coveted the bulbs that grew into these unique tulips.

As demand for the bulbs increased, along with their value, a market in tulip bulbs developed. As word of profitable speculation spread, more people piled in. Prices moved steadily higher.

Then from December 1636 to February 1637, the price of premium tulips surged by 200 percent. At the height of the mania in 1637, the market price of a single prized bulb was sufficient to purchase one of the grandest homes on the most fashionable canal in Amsterdam – when the city’s homes were among the most expensive in the world.

Needless to say, these prices were not an accurate reflection of the true value of a tulip bulb. In February 1637, buying tipped over into selling, and a domino effect of cascading lower and lower prices took hold. Speculators saw that they had spent vast sums to buy plants that were little more than glorified onions, and liquidated their tulip bulb holdings without regard for price. As wealth evaporated, pandemonium engulfed Holland. A deep economic depression followed.

Tulip mania established a pattern that has since been repeated over and over in speculative bubbles ever since. Despite advances in economic theory and the increasing sophistication of markets, market bubbles, and human psychology, haven’t changed much since the 1630s.

The four phases of bubble-dom

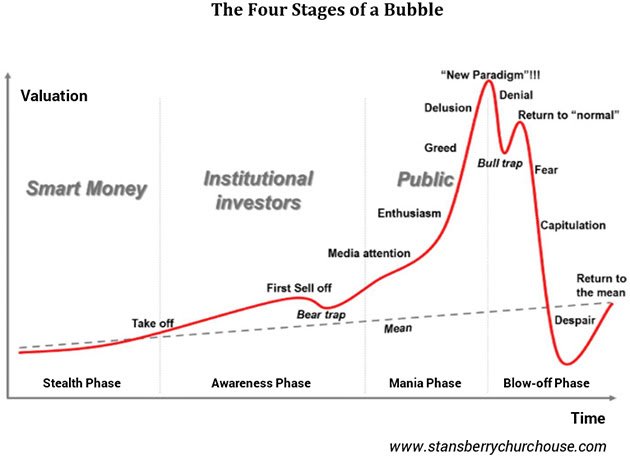

In 2008, Canadian scholar Jean-Paul Rodrigue published a model of bubble stages:

Stealth Phase. The initial bubble stage is where a new market opportunity, or paradigm, is cautiously recognised by early smart money investors.

Awareness Phase. As market prices rise, more investors are attracted to the new investment story. The media begins to cover the story, adding to the momentum, and investors become increasingly interested – and increasingly less sophisticated.

Mania Phase. Now everyone notices the rising prices. The media is touting “the investment of a lifetime.” Price becomes detached from underlying economic reality. Euphoric, irrational investors project recent price gains into the future. Enthusiasm spreads like a contagion between investors. A feedback loop ensues – rising prices amplify stories that seem to justify high valuations, which attract an ever increasing number of buyers.

Even cynical traders join the buying, expecting to sell to “greater fools.” Price gains become nearly parabolic. Paper fortunes are made. Greed rules. Meanwhile, the smart money is selling to the dumb money.

- Blow-off Phase. At some point, buying abates and a paradigm shift slowly – or sometimes quickly – unfolds, as market participants realise something has changed. Sellers now find few buyers and prices fall quickly. Leveraged speculators face margin calls and are forced to sell. The decline becomes a crash.

In this stage, prices fall faster than they rose as the bubble was inflating. Often, prices fall below pre-bubble levels. The asset in question becomes universally hated. But eventually, the smart money starts buying again, recognising the panic has created an opportunity to buy assets at cheap prices.

.jpg)

The Four Stages of a Bubble

Over 400 years of market bubbles have shown a recurring pattern: An investment idea gains a following, and prices rise. The media discovers the story, ever more investors join in, becoming increasingly excited, and prices rise even more. Valuations lose connection with any kind of economic reality. Sooner or later the bubble bursts, prices crash, and many investors suffer enormous losses.

Examples

A lifetime ago in cryptocurrency terms (that is, 2013) you could buy one bitcoin for about US$12. By the end of November of the same year, you could have sold it for US$1,100 – a 9,000 percent gain. When the bubble popped, bitcoin prices fell over 50 percent within a month.

Of course, bitcoin (flirting with US$17,000 as I write this) is arguably in the midst of a much bigger bubble right now.

Protect your portfolio from bubbles

How? Start with this…

Regularly rebalance your portfolio. Did your 35,000 percent gains in yesterday’s hot crypto make your portfolio look like a bit with a tiny sliver cut out – with the big piece all crypto? (We’ve said repeatedly that you should only risk what you can afford to lose in cryptocurrencies… so I hope not!) But if so… be sure you rebalance your portfolio – and avoid a classic rich-person mistake.

Watch those stop-loss levels. No one likes to admit defeat. But in investing, it’s important to have a disciplined approach to selling your bad positions and losing the battle. Otherwise, you risk losing the war when a few bad stocks wipe you out altogether.

The important thing is to follow through. If the stock falls to the stop loss level price, sell… no questions asked. And make sure you don’t put a standing market order in at your trailing stop level. You don’t want to tell your broker when you’re going to sell. Make sure that you make it a mental level – not one that you tell your broker.

Raise some cash. If you think a bubble is forming… sell something and hold onto the world’s best hedge. It’s the least-exciting asset known to mankind (how many cocktail party conversations have started with some variation of, “Let me tell you about this great cash I have”?). But it’s also one of the safest and one of the easiest to use. And if all other assets collapse in price, cash will be worth the same tomorrow.

Don’t bet the ranch to begin with! If you employ basic position sizing from the outset, then regardless of what happens to a particular potentially bubbly asset class that you are invested in, a severe correction isn’t going to cause you any kind of catastrophic drawdown in your portfolio.

If, for example, you allocate 2 percent of your investable asset base into cryptos, then even if the entire crypto market is worth zero tomorrow, your maximum loss is 2 percent. It’s not rocket science, it’s just prudent position sizing.

This time isn’t different. Bubbles always pop.

you always have the best content tranthienhanh keep it up!