A year ago this week, the price of the sweetener peaked at around $ 20,000. Since then, everything has been trending downward. The market value of all digital currency assets increased from $ 800 billion at the beginning of the year to $ 100 billion. That sounds bad, but if you look at the fundamentals of the market, the 2018 will get a B + score.

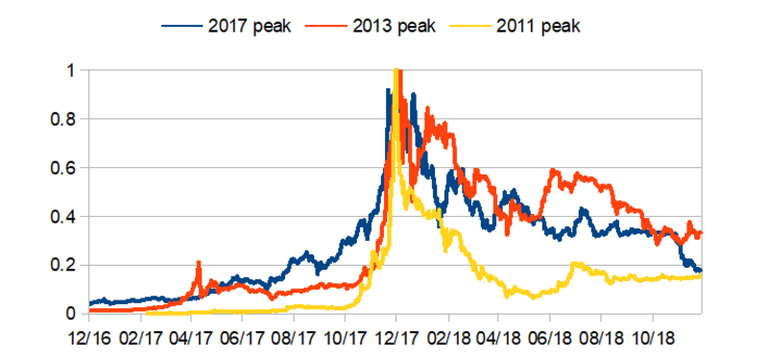

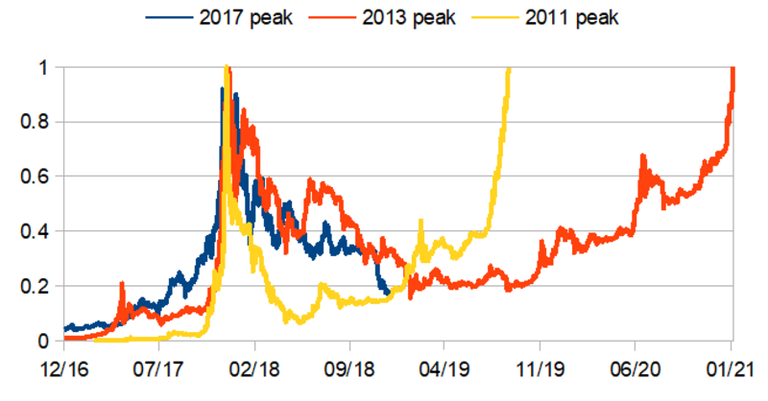

To understand the price, go to the table below, which shows the reference prices for the 2017 and 2018 blue chips, as well as the prices corresponding to the price peaks achieved for the 2011 and 2013 peaks, which are changing. all to the same peak and the same time. The high start-up prices in 2017 were lower and consistent than in previous operations. The decline occurred between the 2011 fast and the slowest of 2013.

What happened next?

In 2011, bottlenecks reached a bottom in one year and increased in less than two years. Nothing happened in 2013 for almost two years and it took four years to organize a new summit.

Compare digital currencies with actions

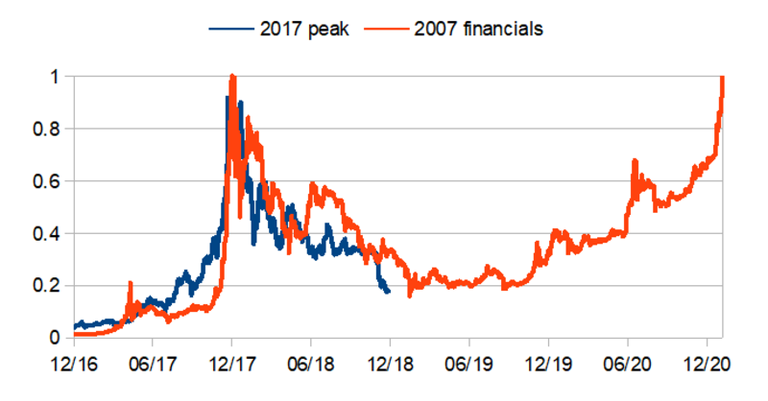

Or compare the collapse of the digital currencies in 2018 and the Dow Jones US index in 2007. The charts look similar from a year before the peak to a year after the peak, but if the market for digital currencies follows the same way, it may take more than three years.

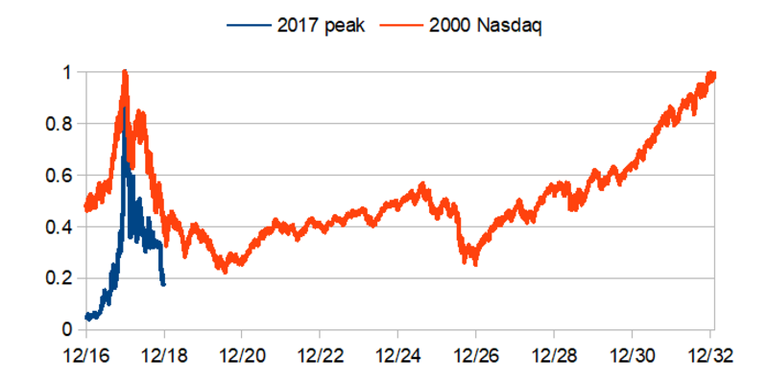

The Nasdaq composite rally in 2000 was slower and took 15 years to recover. Events and currency fluctuations may remain weak for a very long time, or go to zero and stay there forever, but recovery from an avalanche is commonplace.

Examples of collapses in global markets

People tend to ignore what happens after an accident. When the bubble of the South Sea collapsed and exploded in London in 1720, stocks went from £ 100 to $ 1,000 and fell, but the company prospered for 133 years.

In 1627, the Netherlands experienced a significant decline in the prices of the most famous plants by 20% in a week, but they quickly recovered and the cultivation of flowers has become the most profitable agricultural activity in Europe since.

In other famous bubbles, such as the John Lo project in Mississippi, the land boom in Florida in 1925, precious metals in the 1970s, biotechnology stocks in the 1980s, Internet stocks in the years 1990 and real estate stocks in the first decade of the 21st century, Where a lot of money, but the underlying assets have finally overtaken the price of the bubble.

In 2018, the number of individual customers increased from 17 million to 35 million, almost the number of Internet users in 1995 and 1996.

The number of people working in digital currencies has grown faster, nearly 2.6 times. Despite some setbacks, stable currency successes, decentralized platforms and second-tier networks exceeded expectations.

Digital currency and regulation

A number of major technical issues have been resolved and the regulatory framework has been significantly clarified, with considerable uncertainty. Operational services - including warehousing, incubation and integration with traditional financial markets - have also increased significantly.

Missing businesses are classified into three categories. First, a lot of money has been given to fraudsters and hypothetical optimists of companies that did not exist. Second, some valid technical ideas implied that there was a conflict with regulation or technology, they were safely shut down and returned money to their investors. The third group consists of companies that have raised enough money to reach the launch stage, but have invested in digital currencies (sometimes tradable) and thus lost money.

There is also bad news. Piracy (in reality mainly deception or gross negligence) remains a serious problem. Only about 40% of verified individual users use digital currency for the purposes for which they are intended. Most of them are long-term investors or short-term traders. Includes a lot of activity and profit in the assets associated with digital currencies, trading and investments. Actual applications of technology are often very small and are limited to cross-border payments and services for vulnerable economies.

I am convinced that digital currency as a technical solution has come to stay and that the economic sector that is developing and supporting will prosper. This does not mean that existing digital assets will have value in the future and that digital currencies as an asset class will offer higher risk or return rates for other potential investments. We may find a stream of economic benefits for large technology companies, startups, developers, or users rather than digital assets. Either way, the real rule and the real users are a better indicator of price volatility, and 2018 will fall into the history of digital currencies as a positive year.