WEBSITE | ANN THREAD | WHITEPAPER | TOKENSALE | TWITTER | FACEBOOK | TELEGRAM | YOUTUBE | REDDIT | WHATSAPP

On July the 03rd at 7:30 AM CAT, Tawanda Kembo, the CEO and founder of GOLIX hosted an AMA session on Reddit. Golix is an African cryptocurrency exchange based in Zimbabwe but with tentacles spreading to other African ecosystems such as Cameroon, Kenya, Nigeria, Rwanda, South Africa, Tanzania and Uganda. Through its unique platform that makes it easy to buy and sell cryptocurrency assets, Golix aims to arm every African out there with financial autonomy. Currently The company is holding its token sale for the GLX token, a standard ERC20 token based on the Ethereum blockchain.

N.B.I have rephrased the Q&A in my own words. I’ve also reordered and grouped questions into common themes to make it coherent for reading.

Tawanda Kembo - CEO & Founder of Golix

Q1: Where do you see Golix in the next two years?

A : In 2 years you’ll be able to use Golix in every African country using the local fiat and payment options that you have access to. In the crypto space, 2 years is a lifetime, so this goal is not a huge leap of the imagination.

Q2: How widespread do you think the GLX token will be? How do you plan on making it more understandable and accessible to rural communities for example?

A: If we do our job well, and our job is to give every person in Africa financial autonomy, the GLX will be used all over Africa. If we only achieve a small percentage of what we intend to, the Golix Token will still be pretty widespread. Many people will use it without even knowing it’s in the background of the app they are using. Even in rural communities — even in Africa’s rural areas, 3G is getting more widespread so internet connectivity is increasing and Android phones are getting cheaper each year.

Q3: What is your appreciation of bitcoin usage in Zimbabwe and in Africa in general?

A: I’m sure, if you do a study, you’ll find out that there are now more people using cryptocurrency in Zimbabwe than there are people with access to clean water. I know too that’s it’s definitely the case in the capital city, Harare.

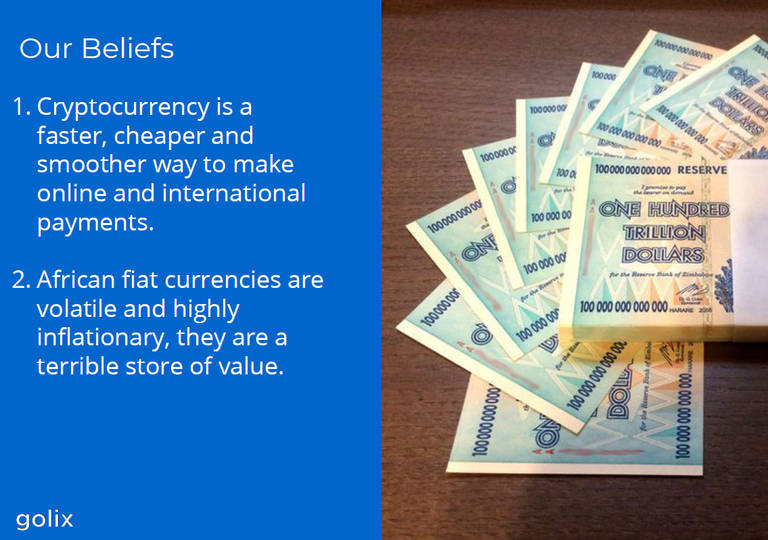

Digital Currencies are getting more mainstream in Africa every day mainly because African fiat currencies are generally more volatile than bitcoin and they are very inflationary. To add more insult to injury, there are more capital controls and forex shortages that make it impossible for most Africans to send money across their own border.

What makes digital currencies more popular is that they are providing an alternative store of value and they are a much better cross border payment rails. I do think that adoption can be accelerated and another good question is how we can accelerate adoption. But that’s not the question you asked.

Q4: What percentage of Africans even have computers?

A: It doesn’t matter. The same way Africa leapfrogged landlines with cell phones, and then leapfrogged bank accounts with mobile money, we’re leapfrogging computers with Android phones. Because most of us don’t have computers, we’re not held back by old behaviours we have to unlearn.

Here’s another analogy: e-commerce usage in Japan today is much lower than it is in China. A few decades ago, Japan was more developed than China and they had better retail stores. When e-commerce came along, it was only a marginally better experience for someone in Japan but it was a significantly better experience for someone in China. China, therefore, leapfrogged the retail stores and went straight to e-commerce.

Being an innovator in an underdeveloped market is a huge opportunity because you will not have to teach your market to unlearn old behaviours. Most Africans are leapfrogging desktop computers and savings accounts.

Q5: The majority of the unbanked population rely on USSD platforms such as Ecotel, Ecocash, M-Pesa and a network of agents who act as the fiat on/off ramps. Are there any plans to integrate their offerings into this?

A: My grandmother lives in the village and she’s on WhatsApp. I call her regularly from the city via ‘WhatsApp Call’ and I can assure you the call quality is very good.

MNOs are solving the internet connectivity problem. And we know that they are going to continue to solve this problem because voice revenues are falling for every MNO globally. 3G, 4G and LTE coverages are growing all over the world. China is also solving the device problem — Android phones continue to get cheaper.

WhatsApp is also pushing everyone from dumb phones to smart ones. Every person in Africa wants to be in WhatsApp (even my grandmother).

At Golix we’re not worried about connectivity or trying to solve that problem. We’re just focused on building for the future. And the only problem we’re thinking about is how to give every person in Africa financial autonomy.

Q6: Without having to name a particular coin, what characteristics should a currency have in order to be practicable in the everyday life of an average African?

A: That’s not a very fair question. I say this because every African country is different (you may have heard the mantra: “Africa is not a country”). Every country has unique problems and even in each country, the ‘average person’ will have unique use cases for cryptocurrency. We’re now operating in multiple African countries and we’re also learning a lot about how ‘Africa is not a country’. When you start to look at it this way, you will start to see that the future of Africa will not have ‘one currency to rule them all’ but will have lots of different types of cryptocurrencies talking different types of problems.

Q7: What are your thoughts on Binance Uganda?

A: First of all let me say I love Binance. Golix is my favorite exchange and Binance is my second favorite. I also like that they are now expanding into Africa and that we’ll both be operating in the same environment and investing in growing the market for cryptocurrencies. The market for cryptocurrency in Uganda is still small and a lot of work and investment will need to be put into educating and growing this market. It’s good to have another company sharing the load.

Q8: What are your thoughts on Humaniq?

A: I get the problem they are solving and I think they will have some impact, but I don’t think they would have as big an impact in Africa as they would have had if they were tackling the problem as a local team that has first hand understanding of the local market and the local market. I don’t know what their implementation strategy in Africa is but if it doesn’t involve partnering with locals, they are not likely to succeed as well as they would have had they partnered with locals.

The RBZ ban on Cryptocurrencies was lifted by the high court in Zimbabwe

Q9: How is crypto regulated in different African countries?

A: There’s no regulation in almost all of Africa yet. Zimbabwe is really one of the first where one of the regulators (the Central Bank) came out to ban it out-rightly (but the ban was reversed by the High Court). The second case in point is South Africa, where another regulator (the Tax Authority) issued guidelines on how crypto will be taxed.

The rest of Africa (52 countries) has no regulation and my theory is that there is no regulation yet, because we generally don’t have any cryptocurrency companies in most African countries. By providing a local exchange in each country, we’re providing the basic infrastructure that makes it easy for people to start building cryptocurrency companies. As we start to grow, we’re going to start seeing more interest from regulators.

Q10: If you had it your way, how would you deal with the issues of crypto regulation?

A: Regulation is a touchy subject but here is how I think about regulation; there is good regulation and there is bad regulation. Good regulation prevents things such as fraud and theft while bad regulation, though done in the spirit of preventing fraud and theft, has the unintended consequence of preventing a county’s citizens from benefit from a revolutionary technology.

Good regulation takes time, patience and a willingness from both regulators and innovators to work together to understand the nuances of the technology being regulated and to work together to build good regulation. If I had it my way, we would have good regulation.

Crypto could be the answer to hyper-inflationary countries such as Zimbabwe

Q11: Your customers in Zimbabwe are failing to get access to their money from your exchange and you have been silent about it. It is understandable that you don’t have access to your bank accounts but how about crypto?

A: You’re right that we have been very silent on most of the questions you raised and because of the ongoing court case, we couldn’t comment on most of these questions publicly. However, we have been very open with every affected customer and we have disclosed as much information as we could with every affected customer.

Fiat Balances on Golix:

I won’t comment publicly on fiat transactions and the court case but I will say that if you’re one of the affected customers (meaning if you have a fiat balance or pending fiat withdrawal) on Golix, we have recently reached out to you to give you an update. We will continue to reach out to you to give you regular updates and if you want to reach out with any question regarding your balance on Golix, I’m sharing our contact information below in case you’re wondering how best to reach us.

Cryptocurrency Balances on Golix:

If you made a cryptocurrency withdrawal on Golix before we halted USD trading, that withdrawal went through successfully. Almost all the withdrawals that were made between that time and today were processed successfully, however, we know what that:

There were some transactions that got delayed because in internal procedures for replenishing hot wallets from cold wallets. These transactions went through nonetheless. There we some transactions that outright failed because there were made during a system of downtime/upgrade. Failed transactions are credited back to your wallet and you have to initiate them again.

If you are having trouble initiating a cryptocurrency withdrawal, please contact us to let us know (I am sharing the best way to reach us regarding these issues at the bottom of this email. We know that we still have a few customers who are having trouble accessing their accounts because of a security upgrade we made on April 6th, 2018. If you are one of these people, please follow the instructions in this blog post to regain access to your account: http://blog.golix.com/updated-security-features-on-golix-how-to-log-in-to-your-account

Updates Regarding the Tokensale:

We’re sharing exclusive updates regarding our Tokensale in our Telegram group every day. I urge you to join the group to stay up to date, here is the URL you can use to join our group: https://t.me/golixcommunity

Contacting Us if you have issues regarding your account:

Although we have a huge Support Ticket backlog, we’re prioritising any tickets that have to do with withdrawals or people that cannot access their accounts so if you contact us about this, we’ll be able to get back to you pretty quickly. There are 4 ways to contact us:

1. You can physically visit our office on the 1st Floor, Batanai Mall, Corner Jason Moyo Avenue / First Street, Harare. We’re normally there during week days from 9am to 5pm.

2. You can open a support ticket by sending an email to support@golix.com.

3. You can call us at +2634761158. If you call during working hours, we’ll pick up.

4. You can send us a WhatsApp message. Our WhatsApp number is the same as our landline: +2634761158.

The GLX token sale is currently underway

The GLX token sale is currently underway

Q12: You guys have done an amazing job to get to where you are, however, you could have offered your Zimbabwean clients the option to convert their crypto to the GLX token so that they do not lose out

A: We’ve had a lot of customers call in and ask us to convert their fiat balances to GLX Tokens. In every case, we agreed and we even gave each customer a good balance. If you would like to do so yourself, you can directly email my colleague Dennis at dennis@golix.com (he’s the one who runs our OTC desk). We’re also going to be doing an airdrop on every person who has made at least one transaction on Golix — it’s one of the few announcements we’re making tomorrow. We’re making some big announcements tomorrow too so you may want to keep checking our twitter account for more updates.

Q13: What do you think will be your greatest challenge?

A: It’s always hard to predict the future but I think the challenges we face right now will give some insights into what challenges we’ll likely face in the future. Here are some of our challenges right now:

Talent — we have very people that understand Digital Currencies in any field. We don’t have a lot of Accountants that can account for this, we don’t have a lot of software engineers that can develop blockchain applications and we don’t have enough marketing professionals that can explain how this technology works in words that our grandmothers can understand. The obvious solution is education; at Golix we continue to invest in education.

Regulatory uncertainty — it’s very hard to predict where regulation is going to go in each country. What we know now is that regulation is coming but we don’t know whether it’s going to be good regulation or bad regulation. The best we can do for now is to educate regulators as much as we can. We’ll continue to invest in education.

Digital Currencies are changing rapidly — a lot of these cryptocurrency projects are open source and we have some of the best engineers contributing to them — it’s going to be hard to keep up.

These, I think, are the biggest challenges we’ll see. And of course, we’ll have all the challenges every tech startup faces. Those you get for free.

The #GLXToken is now listed on zilla

The #GLXToken is now listed on zilla

Q14: What are some of the use cases for cryptocurrencies in Africa

A: Here are some use cases that people are using cryptocurrency in some countries we are operating in today:

1. Because of forex shortages in Zimbabwe, it’s now impossible to make international transfers via the banks so many cross-border business people are driving hundreds of miles carrying cash in duffel bags to cross the border and pay suppliers in different countries or make international transfers from neighbouring countries. When you consider the hustle and the security risks, this is a very last decade way to make international payments so cryptocurrency is a very easy sell for these people. There’s a cool startup in Zimbabwe called Study263 that is using cryptocurrency to help people make international payments so that they don’t have to drive across the border with cash.

2. South Africa has a lot of migrant workers who cannot send money back home using money transfer services such as Western Union because they don’t have papers. These people end up putting this money on a bus that is traveling to the country they want to send money to and trust that the driver will take it there. These bus drivers who carry money are called Malaicha. There is a cool startup in South Africa called CentBee that is helping immigrant workers send cross-border payments using cryptocurrency so that they no longer have to put money on a bus.

3. If you live in Kenya, you don’t really need a bank account. Almost everyone there uses mobile money (a money service that’s tied to your mobile number and that is provided by a mobile network operator). Most of these ‘banked’ people don’t have credit ratings and can’t get loans from the MNOs. Or the banks because they don’t have accounts. They end up relying on building small communities (called Chamas). In Chamas they save money as a group and lend money to members of the community. All these transactions are done in cash on top of a table (something they call ‘table banking’). There is a cool startup in Kenya called ChamaPesa that has digitised all these so instead of putting cash on a table, Chamas are now using cryptocurrency to disburse loans to members.

4. Over 5% of Nigeria’s GDP is made up of remittances — migrant workers sending small money back home to support families. One problem with sending people money is that you can’t guarantee that the money will be used for what you’re sending it for. I’ve heard stories of people who thought they were building houses, only to travel back and see that they were being sent pictures of the house next door. There is a cool startup in Nigeria called SureRemit that is solving this problem by allowing people in the diaspora to use their cryptocurrency token to buy the actual things they want to send. So if a migrant worker wants to pay for school fees, SureRemit can make sure that the money actually goes to school fees.

This is just the beginning. We’re going to continue to see more projects on the continent. The future of Africa doesn’t have many types of currencies. It has many types of cryptocurrencies.

To all those who took part in the AMA, thanks for your contributions, we appreciate all the feedback and involvement. If you have any further questions, ask away in our Telegram channel anytime!

For More Information on Golix

WEBSITE | ANN THREAD | WHITEPAPER | TOKENSALE | TWITTER | FACEBOOK | TELEGRAM | YOUTUBE | REDDIT | WHATSAPP

About the Author

You can reach me on twitter @tendy263

Email me theicoracle@gmail.com