The next step out of poverty begins with the blockchain, folks. From Trusted Lending Circles to the unbanked in peer to peer lending agreements, this seems to be the place to be. A lot of activity. Here is the latest:

"WeTrust next steps on the road to Financial Inclusion

Dear supporters,

Since our last update on May 10, the team has been busy improving the Trusted Lending Circle dApp and working on potential product next steps:

Partnership with Mexico based startup AhorroLibre to build an electronic Mexican Peso token

ERC20 collateral backed peer-to-peer lending product

We are currently deliberating between these two high potential options, which we describe in more detail below. We would like to hear your opinion and incorporate your feedback into our decision making process regarding our next product.

We believe our community makes our project stronger, more meaningful, and we’ve taken to heart your requests for more sharing and information on our progress. We are trying to strike the right balance regarding frequency of communication, and in the future you can expect to hear regular updates as we progress on the Trusted Lending Circle dApp revamp and our next product.

Trusted Lending Circle dApp

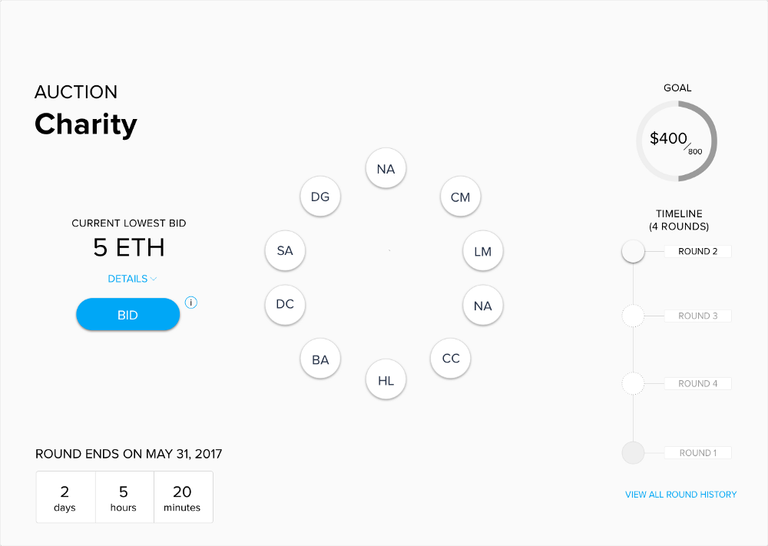

We built the Trusted Lending Circle MVP as a proof of concept prior to and during the crowdsale. Thanks to the valuable suggestions from our trusted community, we received tons of great feedback on how to make it better. For example, while our MVP has basic functionality, we plan on giving the interface some love and attention and making it easier to use. We’ve brought on Nisa Andrews, an amazing UI/UX professional to support this effort. Here is a wireframed concept of the ROSCA dashboard that she is working on right now:

We plan to have the designs complete by the end of May, after which we will be implementing the changes. Our goal is to make the Trusted Lending Circle DApp much more attractive and easier for the average person to use, and we expect to complete the revamp by the end of June. We’ll be simplifying the process of creating and participating in a Trusted Lending Circle, so that new users will be excited to use the WeTrust app with their friends and family, and won’t be deterred by previously-dense, spreadsheet-style pages filled with numbers.

On a related note, we’ve received feedback from community members asking for the option of creating Circles with a “pre-determined” payout sequence (predominant in Tandas in Latin America and Chit Funds in India) and Circles with random selection of the winner. We will be rolling out these new features with the design revamp and here is the userflow that is currently being designed.

Our vision is to build much fairer and more accessible financial products for everyone. As such, we believe that in order for the Trusted Lending Circle product to reach our target audience, the complex aspects of blockchain technology need to be abstracted. To enable that, three fundamental building blocks are essential:

Seamless on/off ramping between crypto and fiat

Stablecoins

A fully-functional mobile browser

These dependencies are critical for widespread adoption of Trusted Lending Circles, and we think the uncertainty in their development timelines should lead us to focus on endeavors that allow for iterative product releases and user feedback. We believe our immediate next product should allow us to progress toward our long term goals, have minimal dependencies on other projects, and allow us to add value independently to the Ethereum community while gaining valuable field-tested experience.

Here are some details behind the two products we are considering between:

- Solidify a partnership with Mexico based AhorroLibre and build an electronic Mexican Peso token

Last week, we held in-depth discussions in San Jose, California with Rafa Jimenez, Founder and CEO of AhorroLibre, Latin America’s only digital Tanda (Trusted Lending Circle in Spanish) service. They are backed by Plug and Play and have served thousands of customers. We’re exploring a partnership with AhorroLibre and their partner bank, in order to jointly build an electronic-Peso token that has a 1–1 ratio with the Mexican Peso currency. This would enable access to banking accounts directly via a smartphone wallet, reduce the friction of transactions, and enable other financial innovation on the blockchain. Rafa has significant experience with emerging markets globally through his experience at McKinsey, and has spent 4 years in Mexico building AhorroLibre and cultivating the banking relationships necessary to facilitate a crypto Peso stablecoin.

As a next step, the WeTrust team plans to meet with the AhorroLibre team, users of the AhorroLibre app, and representatives of Mexican banks.

- Building an ERC20 collateral backed peer-to-peer lending product

In parallel, we have been evaluating and designing a trustless peer-to-peer lending product which enables borrowers to use ERC20 digital tokens as collateral for an ETH or USD denominated loan (the latter paid out via ETH, and in the future via stablecoins).

Today, many people hold various ERC20 tokens because they believe these will either be useful in the future, or they will appreciate in value. However, huge amounts of tokens just “lie there” in wallets providing no value, even though they could serve as a basis for credit. This would be analogous to Securities Based Lending in the traditional financial system.

ERC20 tokens (and other forms of tokenized assets, in the future) can become a new form of secure, low friction lending. The use of collateral serves as a safety net against default and eliminates the need to interact with a globally fragmented credit rating system. Borrowers can range from long term cryptocurrency holders, to startup founders who are “token rich”, but need access to funds for expenses. This service would appeal to a wide range of general debt investors and crypto investors who want to diversify their gains, due to the reduced default risk enabled by collateral held via smart contract. We’ve been working on the detailed mechanics and business use-cases of the product these past few weeks, and will have more to share regarding the detailed mechanics, in our next update.

If we go the peer-to-peer lending route, we plan to open source the project in its entirety. Regardless of the path we take for our next product, we will consider a “buy & burn” mechanism of TRST tokens using any fees charged by the platform as a method to reduce token supply and benefit the entire WeTrust community.

Our vision to bring fairer, cheaper and trustful financial opportunities to those who do not have access or want more from traditional financial systems underscores the importance of building a product that empowers people. Our proof of concept has demonstrated the viability of Trusted Lending Circles. However as we discussed previously, there are 3 dependencies that need to be addressed before this product can reach the unbanked and underbanked across the world. In the meantime, we believe we can deliver value to users while creating building blocks which we can leverage for future products.

Which of the two products do you think we should pursue — and more importantly, why? Leave us comments here or on our slack channel!

Thank you!

George, on behalf of the WeTrust Team"

Creating partnerships and working to eliminate poverty. Sounds like a dual purpose coin to me! Join our blog:

https://medium.com/m/signin?redirect=https%3A%2F%2Fmedium.com%2F_%2Fsubscribe%2Fcollection%2Fwetrust-blog%3Ftoken%3DI3byOKlZgotdqy7t%26redirectUrl%3Dhttps%253A%252F%252Fmedium.com%252Fwetrust-blog&referrer=https%3A%2F%2Fblog.wetrust.io%2Fwetrust-next-steps-on-the-road-to-financial-inclusion-db1f5d06ff7e&originalAction=toggle-subscribe-collection

Using held tokens as leverage for credit. Interesting idea. Watching TRST closely for a while now, seems pretty well thought out.

I'll get up to the minute news from their team as they send it to me. I am invested in this and accumulating at this price

Interesting ...

Following to 👀👍

They definitely have nice alternatives in the works to present to the unbanked for helping them get capital. Like the ROSCA lending circle.

Love wetrust! Long term hodl.

This post has been ranked within the top 80 most undervalued posts in the first half of Jun 02. We estimate that this post is undervalued by $13.11 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jun 02 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.