If you follow me on Twitter then you will see that I don't make many trades, and there's a reason for that. My aim is for longevity and I have spent time in the past where I would hit anything for the sake of trading or because I was happy to gamble - I would lose a lot.

I try to remove as much subjectivity as possible in my trades as I know "feelings" and "emotions" about how things are playing out cloud judgement. Not FOMOing can be a constant learning exercise.

I've written about MPL before, but there are some very valid reasons why to take it.

I'm writing this post because I had slipped recently and this will serve as a stark reminder. You can also learn from my mistake :-)

One of the key things about trading at MPL is that if you miss the trade, you miss the trade and move on. That's where I messed up, by emotionally hitting the market buy button after price missed my limit order by $1 on BTCUSD. I then ended up losing ~15%.

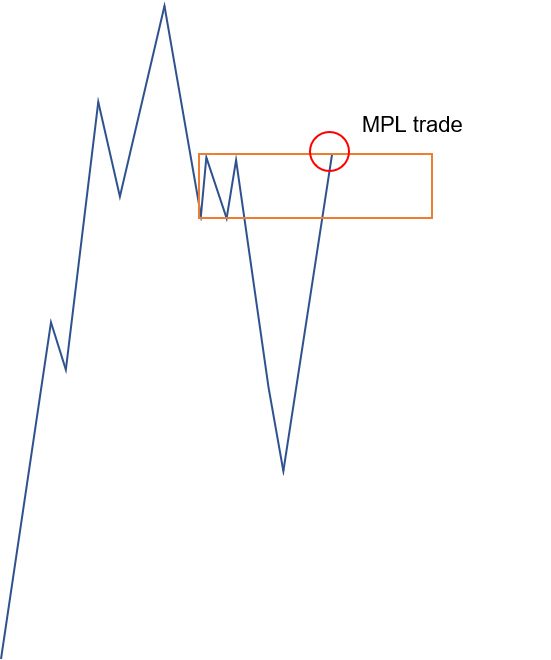

Let's look at MPL in its simplest form again.

On this short, we look to take the trade as close to the very limit of the zone we've marked as possible. Essentially, MPL means "the last key orders as close to the edge as possible". This could be a support/resistance line, a QM, or many other things.

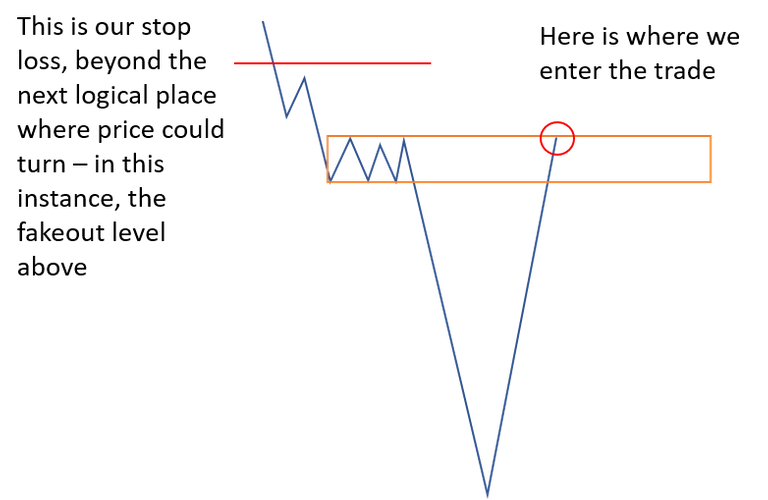

This is for several reasons:

1 - more favourable R:R

2 - the likeliest place for a bigger reaction due to unfilled orders from a big sell off/rally - MPL of key levels is the place where it is 95% likely that something has to happen

3 - we give ourselves more chance to stay in the trade because we are looking to enter as low/high as possible meaning we can have a better stop

We can expect a few things at MPL:

1 - a valid reaction (i.e. a bounce that we profit from immediately)

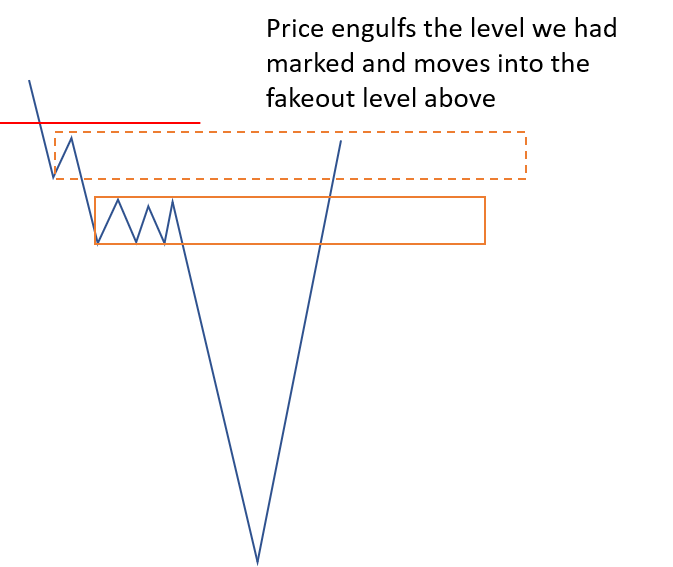

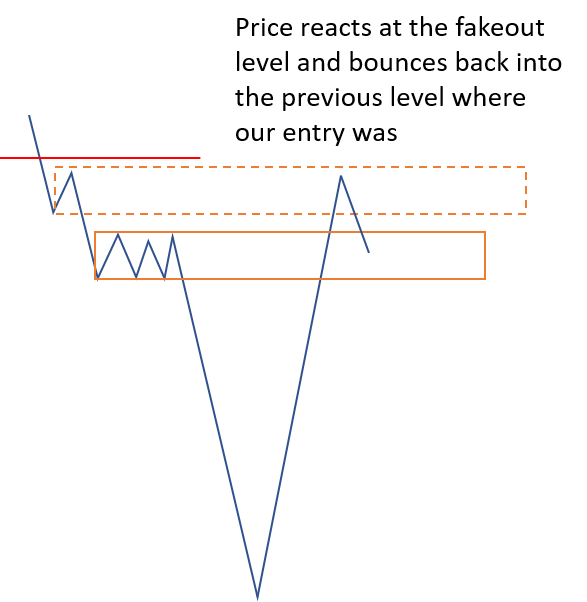

2 - a fake out to a level above/below, and then a good reaction (i.e. a bounce from just a bit higher/lower than where we entered before continuing in the direction of our trade. This is usually a tactic for stop hunting for liquidity. Entering at MPL means we can risk less on our trade for a stop that doesn't need to be as wide)

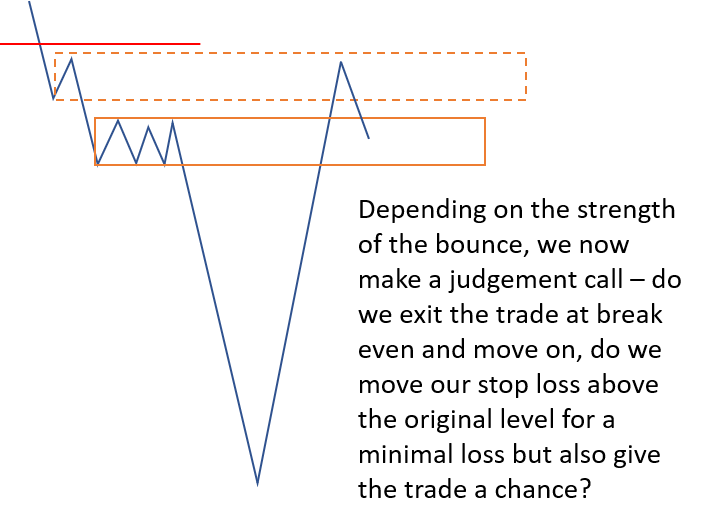

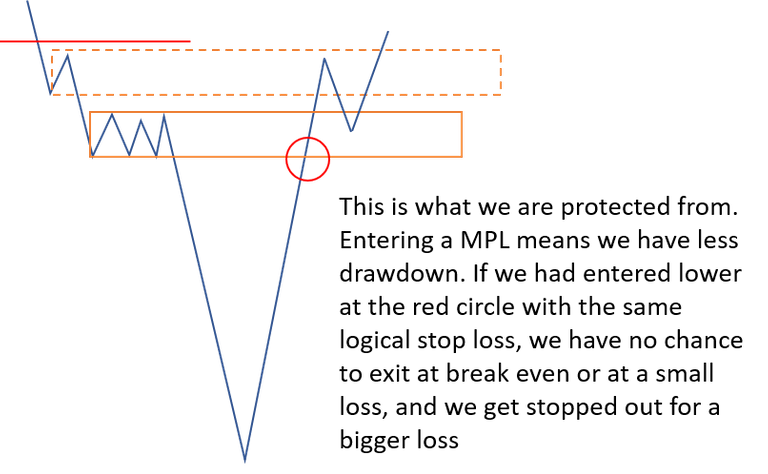

3 - an engulf of the zone, but then price almost always retraces back to the MPL (or deeper) before continuing against us

Number 3 is the most important reason.

It's the most important reason because it gives us the chance to get out at break even or at a minimal loss.

I'll visualise this scenario with hand drawn pictures and then a real life example.

Of course, price can turn at that red circle in the last picture and we can miss the trade by looking at MPL, and this is where a stronger mind is required to not get greedy and to not FOMO into the trade, as I did in the next example. Price most of the time will revisit the level. It could be minutes, hours, days or weeks, but that level can remain valid at MPL and we can look at it in the future. In most cases where there is a strong move in the direction of the level, it will get there quicker than we think after the initial reaction.

Onto the real life example on BTCUSD:

As you can see, price engulfed to the level below and bounced back into the zone I was looking at.

My original buy order was $1 below that red spike, and once price had shot up - making me miss out on about a 15% gain - I FOMO'd into the trade instead of being patient and looking lower. I thought I'd missed the trade.

Price didn't return to where I bought and I had to cut the trade at a 15% loss. Had I entered at MPL, I could have made a small 5% gain getting out of the trade.

Thus endeth the lesson.

Nice, thanks for sharing! Appreciated.

Virtually all my trades now are limit orders. So many times I've made bad decisions and bought at market because of FOMO. Now if the orders get hit, they get hit, or not, it doesn't matter. It just means a lot less stupid mistakes on my part.

Thanks for the post, always look forward to them.

Thanks missy. I much prefer market orders but you're right, if limit orders get hit they get hit, or not.