If you're looking at supply and demand zones, then there's a particular way of trading them successfully. It also brings a bit more logic into your trading, as well as reducing your risk and increasing your potential reward.

By now, you should have read some of my other posts on the blog on how to identify and mark supply and demand zones. If not, I'd recommend doing so.

Let's get straight to it.

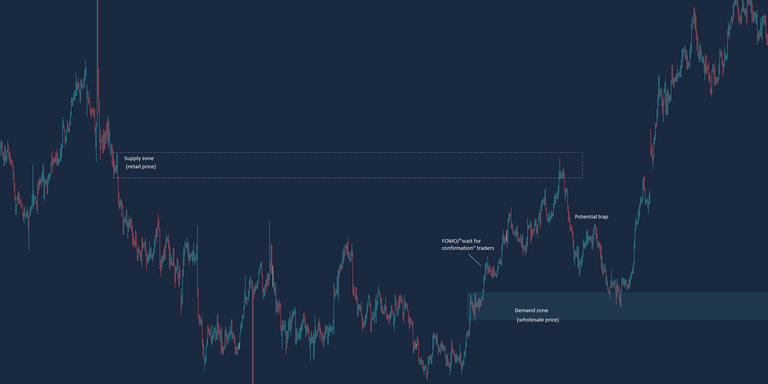

A - This is the price support (demand level) where we have the indecision of what price is going to do. WE DO NOT TRADE HERE. This is gambling on what price is going to do and that is very risky.

B - We have a rally in price which tells us that at this level, there are more buyers than sellers (i.e. demand exceeds supply). There is no other explanation for it. Therefore when price returns to this level, it offers an opportunity of a lower risk and higher reward trading opportunity.

C - Price revisits the demand level and this is where we take our trade, knowing that at this level there is a high probability of unfilled orders to rally price again, that we can jump on. Our risk/reward is much more favourable.

A very simple concept, which looks a lot easier than it is.

We need certain other factors in our favour, as this is only one piece of the puzzle. For example, if we are in an overall uptrend (we can tell this by checking the higher timeframes, remember), then a pullback to a level like this offers a higher probability of success.

The higher timeframe that you find these levels, the better. I personally don't look for supply or demand zones on anything less than 4H, and aim to have 8H as a minimum if it can be helped.

Far too many traders place too much significance on time frames lower than 4H, and this is an ideal way to get REKT.

So yes, it looks easy in principle, but when price is approaching the level you've marked from the opposite direction and potentially very fast, you can very easily submit to your conditioning and emotions to not hit the buy button.

Let's take another look at that chart, but zoomed out.

(Sorry it's not the best quality on here)

One of the things you will see in almost every "cheat sheet" regarding trading is to "wait for a confirmation" before placing a trade, and unfortunately, this is a retail trader mindset.

Sometimes it can work, sure, but if you're waiting for confirmation, what happens to your risk/reward? Your risk goes up and your reward potential goes down.

Your biggest risk is buying close to a supply zone, as in the example above. If you wait for confirmation of a breakout or to get above even the 2 obvious resistance spikes that you can see to the left, you are further decreasing your chances of a successful and profitable trade.

We want to be thinking like institutional traders and not retail traders, and that is buying at wholesale prices (demand), and not at retail prices (supply). One of the biggest mistakes you can make is buying after a rally in price, and you wouldn't do that in any other part of your life would you? If not, why would you do it in trading?

From my experience, more often than not, price revisits a demand level and it requires patience. Again, this makes this method a bit more difficult than the concept seems.

Having unfilled orders at a level is key to the success of this trading concept. How do we know that there are unfilled orders at a level? Well, if all of the orders were filled, price would have stayed there!

To wrap up, it's absolutely possible to trade between demand and supply as price will travel between them. That's just what it does. But taking a trade in midair and not a logical zone puts the odds less in our favour, and on the longer term, we highly decrease our chances of success.

You can follow me on Twitter: https://twitter.com/technical_anal

followed

good solid advice, we need more people writing stuff like this, to counter all the voodoo multi indicator TA garbage

Thanks. This is just my understanding and experience of it. I didn't come up with the concept!

@technicalanal, for me this is a good post as far as it goes, as it is just really explaining the sup/dem method that can be found anywhere on the internet or in books. So nothing new here.

If you really want to make an impression here on Steemit, you could post your sup/dem levels in advance, as then people here would know you can walk the talk, and you would gain a lot of traction. No offense intended. Just saying :).

Absolutely none taken mate.

Yeah, I'm not saying I'm re-inventing the wheel or anything but it's been a profitable method for me and has produced some very consistent performance results over a number of years. I've been trying to offer a more seasoned approach to what I see around certain spaces (i.e crypto), where all I see is an over-reliance on indicators that don't actually explain anything.

I'm not sure I can be bothered chasing after huge amounts of followers on here. As much I'd like to have more people see my posts and find benefit in them, it also helps me writing everything down.

On my Twitter though, I'm finding it easier and more engaging to post strategies on there.

Thanks for the reply 😀