BTC and other cryptocurrencies, such as Ethereum and Ripple, are more like “investment vehicles” than fiat currencies that people can spend on products and services.

Bitcoin represents a “marginally more inconvenient way to pay” and there are only a handful or reasons to use the cryptocurrency instead of a credit or debit card.

Most regulators and investors view cryptocurrencies more as assets than actual currencies. Their values are too volatile and too hard to actually use for payment for most to consider them currencies.

Our conversations with some merchants indicate that, while cryptocurrencies might actually be attractive for them to operate their businesses, they find that the cryptocurrencies are far too volatile to be used.

Some general thoughts!

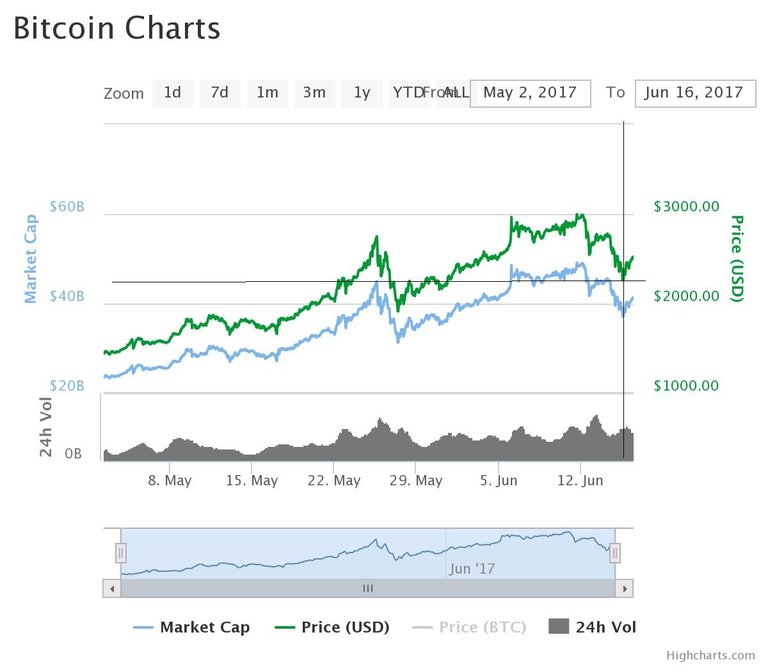

Bitcoin at the moment seems to have finished its correction at 2275$ on Thursday 15th of June. It is on the rise once again and almost the whole cryptocurrency market is following its lead.

Why does cryptocurrency market advance so fast? Some cryptocurrency experts say developments in Japan are the likely cause for this latest price growth. The Japanese have given bitcoin the green light as a currency and are looking to increase the rigour that their exchanges are subject to. Plus lots of inexperienced investors are 'rushing' into the market, and it's possible to be causing a bit of a bubble. Bitcoin and Ethereum seem to be leading the cryptocurrency market. With their growth many other cryptocurrencies have found themselves at prices they've never reached before.

Even after a big correction the cryptocurrency market is in a bullish trend.

I've recently heard an interesting opinion on the bitcoin and on the crypto-market in general.

A dude called " concerndcitizen " said: 'This is capital flight and hedge funds and individuals seeking greater returns than the Wall St casino provides. Look at China, there are at least $100's of BILLIONS of $$ trying to escape. Venezuela, the list goes on, that's probably a total of at least $500B over the next 18 months trying to escape from somewhere and crypto is their best bet. There are $3T in hedge funds that are currently dead money with a 3.5% return. Either the limiteds will do this themselves or the funds will do it and that's probably 20% of the total in hedge funds. That's a $1T tsunami of potential fresh capital into a market with a $100B total market cap. Watch how fast the price snaps back on this "correction".'

Thanks for reading feel free to follow, vote and Re-esteem if you find it useful.You can find more of my articles here:https://steemit.com/@sungazer13

source: Here and Here!

With over $100 billion in crypto's, +40 billion in just Bitcoin alone - It's clear there is a lot of money (and still lots more) to enter this space.

Whether now (or later) when volatility has settled down, I'm sure the answer to your question will be a definitive yes. It's just a question of time.

The experience up to now is that despite crashes and hypes, this crypto thing is not going away and only becomes stronger with each wave. With diverse Blockchain alternatives popping up in this hype/burn cycle, the vulnerability of cryptocurrency as a whole is is lower than ever.

Even if Bitcoin runs into an accident and cannot grow further beyond its technical limitations, many alternatives without these limitations are already available.

One thing is sure, no 'corporate version' of cryptocurrency will be able to crow out free open source versions. Together, we are strong.

Indeed!

A very good post that summarizes Steemit well.

Thank you for this work that will help many new members.

My pleasure, Thanks for reading!

I think that crypto currencies are virtual currency that we must use as they present themselves to us. We must not consider them as foreign currencies. In reality, they have values only with the currencies that we know. That is what I think. Thank you