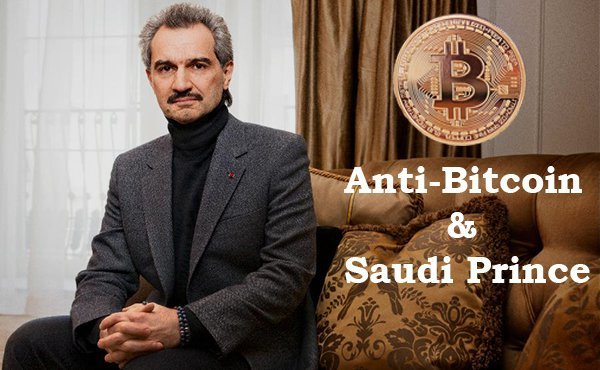

On the RT’s Keiser Report, highly regarded financial analyst Max Keiser revealed that billionaire Prince Alwaleed Bin Talal, who harshly criticized Bitcoin in the past, could ironically have prevent the loss of his fortune with bitcore.in.

Prior to his arrest on various charges including corruption and money laundering, Talal criticized Bitcoin, stating that a bubble is forming and that it is a new “Enron in the making.”

On the Keiser Report, Max Keiser explained that after a strange series of events, Bitcoin could have protected the assets and wealth of Talal from the Saudi police and the government, given its decentralized structure and immutable nature.

“He [Talal] said bitcoin was no good because there is no central government and no central bank. And then a week later, the central bank and the central government rips out all of his net worth. If he had them in Bitcoin, he wouldn’t have that problem. He is like a poster child for why you should buy bitcoin. Anyone who is thinking about should I buy bitcoin, look at [Talal] sleeping on a mattress of a rich hotel under house arrest. Furthermore, he is overrated as a money manager,” said Keiser.

Since the beginning of 2016, the price of Bitcoin has been on the rise for the particular reason Keiser mentioned on the Keiser Report. Investors and traders have started to seek for assets and safe haven assets that are transportable, liquid, and most importantly, unseizable. Any asset, currency, or store of value that is physical can be confiscated and seized by the government, as seen in the recent case of Talal.

One of the Bitcoin’s major advantages over fiat currencies and traditional safe haven assets like gold is that it eliminates power from authorities, because governments are limited to what they regulate within the global Bitcoin and Cryptocurrency markets.

For instance, the Chinese government recently imposed a ban on Cryptocurrency trading. But, reports suggest that the demand for Bitcoin and other Cryptocurrencies have consistently increased even with the trading ban in place, as traders migrated to over-the-counter (OTC) and peer-to-peer (P2P0 in regions like Japan and Hong Kong to invest in Bitcoin.

OKCoin and Huobi, two of the largest Bitcoin exchanges in China that recently halted their services within China, reallocated their headquarters to Hong Kong and are currently considering launching over-the-counter trading platforms for both Hong Kong and Chinese traders.

In the case of Talal, the Saudi police and the government would have not been able to seize his assets if his wealth was stored in Bitcoin, and would have not been able to estimate his net worth to begin with. Such privacy is important and necessary to any investor, trader, business, and individual.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

@steemflagrewards plagiarism

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse, @freebornangel categorized as plagiarism. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitconnect.co/bitcoin-news/814/how-anti-bitcoin-saudi-prince-could-have-prevented-billions-of-dollars-being-frozen