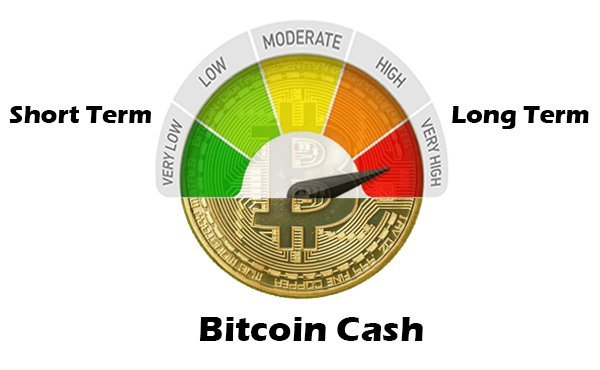

Jameson Lopp, the lead engineer at BitGo, a prominent Bitcoin and Blockchain security firm, explained Bitcoin Cash would likely do well in the short-term, but struggle in the long run.

Emphasizing the shallow development community of Bitcoin Cash, Lopp wrote:

“I suspect BCH will do alright for the short term: there's plenty of demand from users to externalize their cost of transacting into node operators. But crypto asset engineering is a marathon, not a sprint.”

On November 12, Blockstream CEO and HashCash inventor Adam Back, one of the few figures cited by the original Bitcoin whitepaper released by Satoshi Nakamoto, explained that Bitcoin has an edge over Bitcoin Cash in terms of long-term scaling because Bitcoin Cash does not have the infrastructure to support second-layer scaling.

In the short-term, as Lopp stated, Bitcoin Cash would likely do significantly better than Bitcoin in accepting new users and settling more transactions. However, the block size of any Blockchain network or cryptocurrency cannot be increased to infinity. There is a limit to which a block size increase could lead to the centralization of a Blockchain network.

For instance, if the block size of Bitcoin Cash is increased to 100 MB in the long-term, given that the block size limit of the Bitcoin Cash network moves proportional to the growth rate of its user base, only a limited group of node operators will be able to approve and verify transactions. The exclusion of individual node operators will lead to the centralization of nodes and ultimately, the centralization of the Blockchain network.

“SegWit is a bug fix to enable massive scaling on layer 2 and lightning. Bitcoin Cash intentionally removed the bug fix, think about that carefully. Bitcoin will be fine, and scale further than Bitcoin Cash, because Bitcoin Cash lacks SegWit and can't do Lightning. this is short-term pump. just hold and wait,” added Back.

If any Blockchain network such as Bitcoin, Ethereum, and Bitcoin Cash become massively successful in the long run and acquire billions of new users, on-chain scaling of any sort will not be able to handle such capacity. Even the Ethereum network, which settles twice as much transactions as the Bitcoin network, will have to implement changes to its consensus protocol, and migrate to the proof-of-stake consensus protocol.

As such, for long-term scaling, second-layer infrastructure is key in serving hundreds of millions, potentially billions of new users, while maintaining the decentralization and security measures of the main Blockchain network. In the case of Bitcoin, the original Bitcoin Blockchain network will serve as the basis for second-layer infrastructure, while payment channels operate as large capacity settlement networks to handle millions of transactions on a daily basis.

Currently, several second-layer solutions are being implemented, including Lightning. In the near future, the adoption of SegWit by leading businesses, wallet platforms, and exchanges is expected to occur, which would naturally lead to the integration of payment channels for effective scaling.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

flagged for Plagiarism @steemflagrewards source

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse, @iamstan categorized as plagiarism. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/bitcoin/@lunetteee/bitgo-engineer-bitcoin-cash-will-do-well-in-short-term-but-not-in-the-long-run