Firstly, I want to thank you, Mike Adams, for your work. I respect you and use your content, especially on health.

I would also like to make clear that in terms of financial preparedness, my personal strategy is Gold, Silver, Crypto-currency, spend fiat as soon as you get it to retain value. I am fully aware of the possibilities that lie in our economic futures. Despite residing in South Africa, we do live in a small world, I can assure you.

My post is in response to Bitcoin, and your assessment that it is not a bubble. After watching the video, I feel that you are missing some fundamentals when it comes to bitcoin. I personally have been invested in Bitcoin, and Blockchain technology for around 3 or 4 years now. I am now part of a group of people who are actively advancing the use of Bitcoin, and Blockchain Technology, as well as mining in South Africa, and the continent. Make no mistake, I am invested in the currencies, assets, and tokens across many blockchains.

Here is the video the following text will comment. Please take the time to watch it to get a better understanding of the post:

I think you miss some understanding as to what bitcoin is being used, and how it is being used. I currently acquire and spend bitcoin daily now, and often make real world transaction without converting or selling a Satoshi for fiat. I buy items online with it, I use it to trade my time. You say that it has no value until you sell it... Well, here in South Africa, I am proving that grand statement as wrong.

Ok fine. Let's decide you do need to sell them quickly in order to realize a "real" value. How about a VISA accepted plastic card that you can spend your Bitcoin with? Wirex, currently does - affiliate link | non-affiliate link. This card allows me to sell bitcoin for USD, in real-time, and proceed to swipe it at essentially any location in the world. I am sure you understand how big VISA is right?

Your thinking is that Bitcoin is going to go alongside the fiat world, use it to invest, and sell when you want to realize a profit. I challenge that Bitcoin and all the other assets that are technically better will look to replace fiat altogether. I have given you an example above of how you can use it in real-time, backed by one of the biggest giants of fiat transaction processing, and you still deny its value.

Additionally, you say that the centralized banks can buy up all the coins. Yea, that is possible. What is also possible is that we stop using central banks altogether. You see Mike, Bitcoin isn't a fad like a fidget spinner, or the latest Bieber song, no, it is the first thing we have had in our society in over 100 years that is a viable method of achieving financial control. Just like the Health Ranger is the Alternative to health, Bitcoin, what it represents, stands for, and was created for, is the Alternative to Wealth.

My understanding of anything as a store or value/transferable asset/or money will be compared to gold. The only thing that Bitcoin doesn't have that Gold does is its intrinsic value. What I mean by this is that I cannot use a physical Bitcoin for anything like melting it down and using it as a conductor of electricity that is in my laptop's motherboard. Or I can't make a wedding ring or jewelry with. I accept that. But that's it. It's scarcity and ultimately limited supply, its peer-to-peer qualities, its privacy, its decentralized (which Gold actually isn't), community-based currency.

The peer-to-peer aspect of it is also something that you are not taking into account, I don't feel. Remember Napster? Remember how the big bad corporations in the music industry threatened and scared the hell out of everyone using peer-to-peer networking sites? What ever happened to that? Did p2p sites just all stop operating? Nope. p2p is bigger now than it has ever been, despite distributing what authorities deem illegal. Bitcoin is on the same path, but instead of content, it will be financial.

Greece, Cyprus, India, and much more, and much more to come have already proven that Bitcoin will be used as the alternative when the fiat financial system collapses. This has already happened Mike, and if you don't know that then you should check your research.

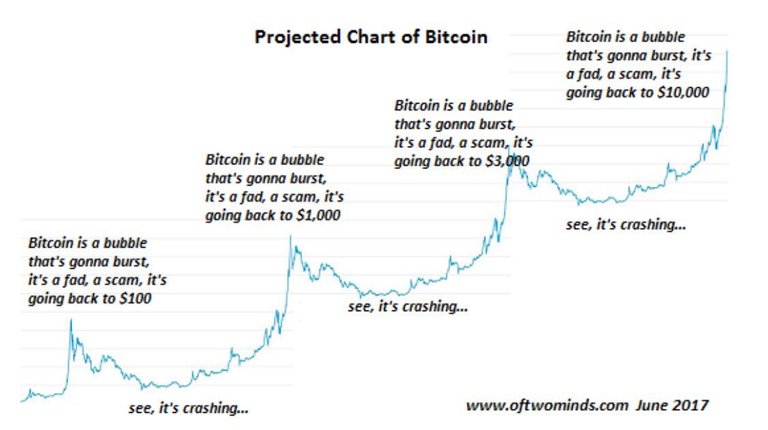

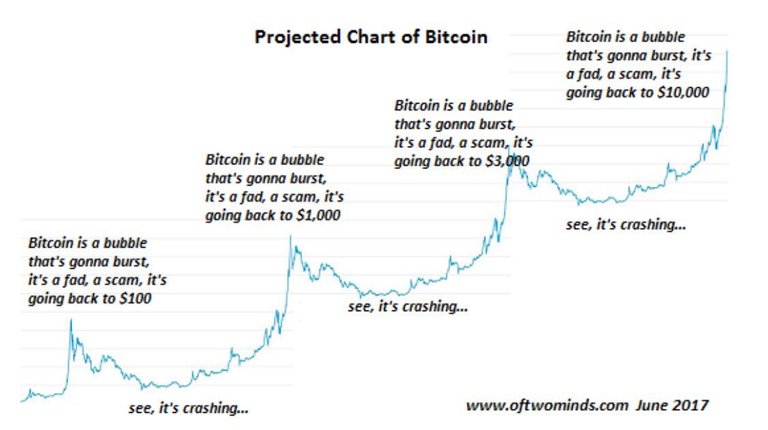

In summary, I believe that Bitcoin is not in a bubble and that its value should be in the tens of thousands of dollars, not the thousands it is now. I don't see that you understand its full potential, nor does it seem that you are aware of how it is being used and adopted globally. I can discuss this subject for days because I am living it, so please, if you would like to engage, I am more than happy to.

I also think you may be a bit reckless in your commentary on Bitcoin, especially to a wide audience. I would encourage you to get and interview or chat with Roger Ver, or anyone of the thousands of Bitcoin and Blockchain investors out there because as I mention, I feel there is a lack of understanding that you need. You don't know what you don't know.

Peace.

Interesting analysis. I don't think anyone can say for sure how it will pan out, but I do think it's really cool how Bitcoin and other cryptos are being used in developing areas as a primary transaction source.

@spartanza this is one of the best defences of bitcoin I have ever seen. You analyzed BTC as any other currency and showed its full potential.

In my opinion BTC price has gone high in last couple of months and now needs corretion (before increasing even more). And we are seeing that right now. But I do not believe that bitcoin is in the bubble.

On the other side, I do believe that some other altcoins are in the bubble and that their price will fell even more in next weeks.

What do you think?

There is certainly a bubble that will affect the bitcoin and alt-coin prices, however, that bubble is not going to be directly related to crypto. It will be as a result of when the shit hits the fan, people will be thinking that holding steem or ether or bitcoin isn't the wisest thing right now when you are going hungry. But it will be a thinning of the heard instead of a collapse. Obviously, this is a prediction, and I am not attached to that opinion either. This world changes so rapidly now, there is no telling, but this is my view.

I have a lot more defenses and use cases for bitcoin and more importantly blockchain technology, which is the real winner here.

Programmable money will go a lot further than we are currently contemplating. It will take us some time to rid ourselves of current thinking about money.

I think Hearn knows all this already. I'm very skeptical of Bitcoin also and I have heard all these arguments many times.

A couple of points:

Thank you for commenting. Great points.

Bitcoin can scale, and will. That isn't really the debate, the debate is how will it scale.

I set Gold and Crypto apart more in regulation than centralisation/decentralisation. They have also passed laws in the past that forced citizens to give up their gold, and they can physically do this by coming into your house and taking the physical gold. Bitcoin isnt so simple. You can store your coins in a cold wallet, offline from the rest of the word, write down a backup phrase and keep that safe on a piece of paper. Easier to store than Gold, harder to steal by the government.

I love gold, and gold always win most cases, but its too regulated for me. I should have said that instead of centralized.

The scalability problem has been known for years. It could have been solved before there were any problems – but it wasn't. It should have been solved when the problems became evidently clear for everybody, when the blocks became full and fees went high – but so far nothing has been done.

That's why I have very little trust in Bitcoin and I wouldn't recommend it to anybody. It has a governance problem, which is so big that it prevents all the most important development from happening.