It might seem surprising but almost 10 years after the first bitcoins have been minted, the question of bitcoin's value is still not settled.

Does bitcoin (BTC) have value?

Franck Miltgen, Candy Gradient V & VII, picture taken by myself

In the short term, the answer is unambiguously "yes", as anyone can easily verify: try to get a bitcoin and you'll be hard pressed to succeed without paying a price (about 3650€ at the time of this article).

However, whether BTC has value in the long term, and what that value might be, is still hotly debated. Famous economists such as Nouriel Roubini and Joseph Stieglitz seem convinced that BTC's long-term value is zero.

In this article, I'll look into some of the purported sources of value for BTC, among which some I consider substantial, and some less so.

1. Bitcoin as a new God (or a new ideology)

More than a year ago, not long after discovering Steemit, I wrote a post called "The Church of Bitcoin", in which I was saying:

Bitcoin is something of value because people think it has value – and the more people agree, the higher its value.

But what pushes some people in the first place to believe BTC has value and then look out to connect with other people sharing the same belief?

source

Ideological value: people want to make a statement, to send a message, to protest against a system - the current financial system - seen as deeply flawed, unfair and exploitative.

In a sense, it has been said that bitcoin embodies yet another aspect of the "revolt against the global (financial) elites" - the one which led to the "Brexit" outcome and the election of Donald Trump as POTUS, among others.

As such, bitcoin provides a useful "safety valve" for a part of the discontent. The "defensive" narrative of "Bitcoin as the 'knight in shining armor', defending the victims of the 'banksters' from their oppressors" is quite strong and people believing in it justify a significant part of BTC's worth.

2. Gateway to the cryptoverse

At the other end of the spectrum, the whole "crypto phenomenon" - the ICOs and dApps and projects - comes with a positive, optimistic outlook. Some people (disclosure: I'm one of them) believe blockchain is a radical vector of desirable change for our societies.

Which projects will succeed though, it's hard to say. Therefore, "diversification" seems a reasonable strategy.

But if one wants to contribute to these projects by acquiring their "cryptocurrencies" or "tokens", chances are it won't be easy to buy them with classical money ("fiat currency", i.e. dollars or euros). One first needs to exchange the euros or dollars in a "pivot" cryptocurrency, before then trading this "pivot" into other cryptos and tokens.

The question of the "pivot" is the classical "Schelling point" problem from Game Theory

If I have no idea what "pivot" currency I should choose, I'll choose BTC (i.e. the red square)

Pierre Rochard, a "Top Writer in Bitcoin" according to Medium, and many others, mention bitcoin's value as the "Schelling point" of the cryptoverse (when in doubt, choose BTC), which value, somewhat paradoxically, increases as the size (and complexity and induced confusion) of the cryptoverse increase.

In practical terms, alongside Ethereum (ETH) for "tokens", the "BTC - crypto X" pair is often the most liquid and hence cheaper pair for almost every "crypto X" out there on the exchanges.

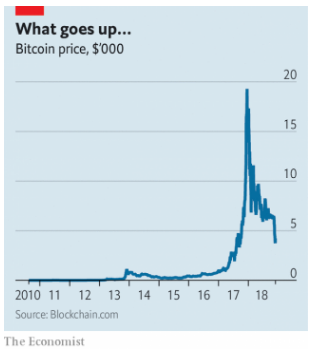

3. Speculative, uncorrelated asset, used for trading and hedging

Finally, BTC's extreme volatility make it desirable to another category of people: those looking for a liquid, uncorrelated asset, which they can trade speculatively and use for hedging.

source

Moreover, as knowledge about it increases and more people seek to acquire some (even if only out of curiosity), demand for BTC is expected to increase overall. Limited supply in turn means that long term, one can reasonably count with a bullish trend.

Being (up to now at least) uncorrelated with other classes of financial assets, bitcoin can indeed play a hedging role for large portfolios. I have mentioned in the past a tendency of large asset managers to "get off zero" and investigate an objective of 0.1% of total assets.

I believe the above three features account for most of bitcoin's intrinsic desirability and value.

However, we have heard a number of other arguments which, while not completely without merit, I consider somewhat overblown and not as important as their proponents think.

I'll discuss three of them here.

4. Ultimate store of value

From these events (rather marginal for the time being), some people have started contemplating bitcoin as the ultimate store of value in case of a systemic crash. They believe that the true value of bitcoin will become apparent in the next crash, when the classical financial system will again teeter on the brink of collapse. Money will then seek refuge and a significant amount of them will chase BTC.

I believe that, as long as we are talking about the next financial crisis (which most people reckon is less than a decade ahead), that idea is fanciful.

During financial crises, money takes shelter in assets which inspire trust to the people controlling the movements of money. Most money movements are controlled by rather old people with a background in finance. In the past, they have shown trust toward government bonds and gold. Bitcoin is an abstract and complex mathematical and computer construct entirely reliant on a good quality internet infrastructure.

In a rather mild crisis, it is a stretch to imagine rather old people, not particularly computer literate, ever preferring bitcoin over good old cash and Treasuries.

In a more severe crisis, it is just as unlikely they will prefer BTC over gold.

Getty Images via The Economist

And in a catastrophic crisis, there is a risk the internet infrastructure, on which bitcoin relies to be of any use, will become unreliable. Indeed, if a systemic crash is sufficiently deep to threaten the credibility of cash and gold, it is quite unlikely that the internet will continue chugging along and allowing bitcoin node synchronization.

5. Digital collectible

Michel Rausch, a young and bright researcher leading the Cambridge University Centre for Alternative Finance and avid Twitter user has suggested that the ultimate floor for the BTC's price is its value as a "digital collectible".

I believe bitcoin's value as a collectible is almost nil. Collectible value is ineffably linked with emotions - many of which go through the senses - humans collect mostly things they can see and especially touch. As bitcoin cannot be seen nor touched (nor heard, smelled or tasted), it's hard to imagine a significant number of people getting emotionally attached to it.

Moreover, one critical feature of a "candidate collectible" is its scarcity. Indeed, few people collect grains of sand. True, the number of "bitcoins" is limited, but to about 21 000 000, in itself a rather large number for a true collectible, for which the ideal quantity is 1.

In addition, it is hard to imagine someone collecting bitcoin while being ignorant about its true nature. As it happens, "bitcoin" is just an imaginary contraption, a "marketing name", a "brand" - the digital reality is a rather less glamorous UTXO (unspent transaction output) whose value can be almost arbitrary (hence the extreme divisibility of BTC, down to 10-8, a satoshi

In practice, "collecting bitcoin" can only be imagined as being able to show your grand-grand-grand kids ... possibly a flash memory (USB stick perhaps) with ... maybe an executable for a bitcoin node and a private key granting control over an UTXO ... but that balance need not be of 1 BTC and can be arbitrary, including 0, which would cost nothing and won't hold monetary value.

6. Sound money

Back in early 2017, some articles were explaining that "bitcoin is better money ... as it simplifies the exchange of goods and services"

Yet the reality is stubborn. There is hardly any evidence that more goods and services (excluding those related to the expansion of the cryptoverse) are paid for with bitcoin in 2018 than in 2011.

Despite failing to make any significant progress in its intended quality of "electronic cash" for the past 7 years, some people still insist that bitcoin is the future of money.

Many reasons have been quoted as an explanation for this failing, but the cognitive dissonance is stronger with the true believers. Their preferred explanation is that bitcoin is little used as "means of payment" because of the 10' confirmation time and the transaction fees.

To address that, a group of bitcoin believers have set out to build the Lightning Network, where confirmation times are much faster and transaction fees are negligible. The Lightning Network is still brittle, buggy and complicated. In addition, it introduces some troubling trade-offs, in terms of trust and control, that have yet to be sorted out.

Another group of followers of the "bitcoin as electronic cash" vision have on the other side decided to fork the blockchain and created "bitcoin cash" (BCH) which has recently split further into BCH and BSV.

But more to the point, the Lightning Network as well as the BCH and BSV forks address secondary problems while completely ignoring the primary problems preventing bitcoin (whether BTC, BCH, or BSV) from fulfilling the "Satoshi vision" of a "peer to peer electronic cash system".

The first of these major issues is that, in order for people to be ready to spend bitcoin, they need a convenient way to earn bitcoin.

"Earning bitcoin" was seemingly easy in the eyes of its inventor, the pseudonymous Satoshi Nakamoto. All one had to do was to download the bitcoin software and start mining on his computer. Little seems he to have imagined that the competitive spirit of humans was soon to transform bitcoin mining into an arms race which led to extreme specialization and concentration.

Today, no one but the most efficient industrial mining operations can mine bitcoin profitably. This has not escaped the followers of Satoshi's vision. Yet they retort that people could simply "buy bitcoin with fiat" (in order to then spend it as "electronic cash"). But if people have to earn fiat currency first, then buy bitcoin in order to spend it, why not spend the fiat currency straight away?

Especially when the authorities who control the fiat currency make spending it rather convenient while doing nothing to facilitate acquiring or spending bitcoin (or even actively hampering bitcoin transactions)?

Under these conditions, bitcoin remains an interesting alternative for international money transfers, but this use case is rather marginal and the competition in this area (with later and more sophisticated cryptocurrencies) is high.

A second powerful brake on bitcoin's suitability as "electronic cash" is precisely one of the reasons of its value, its limited supply (of about 21 000 000). Indeed, as more people start using it (for the thrills of being transgressive, for entering the cryptoverse, and for trading and hedging), demand for bitcoin is expected to outstrip supply.

As such, whoever acquires bitcoin would be rather well advised to hold it (or "hodl" it, in jargon), rather than spend it.

Conclusion

I have presented 6 possible reasons for ascribing value to bitcoin.

I believe the first 3 contribute substantially to give bitcoin value:

1. Ideological (quasi-religious) symbol

2. Gateway to the cryptoverse

3. Speculative, uncorrelated, volatile trading and hedging instrument.

I am somewhat skeptical with respect to the the next 3's contribution to bitcoin's value:

4. Ultimate store of value

5. Digital collectible

6. Electronic cash (its original intended purpose)

If you know what witnesses are and agree that people commited to keeping this blockchain ticking play an important role ...

(by simply clicking on the picture - thanks to SteemConnect)

Other posts you might enjoy:

Blockchain and Europe

- Europe, I love you! - Europe, je t'aime!

- The Blockchain Competence Center (BLKCC)

- European Financial Transparency Gateway

- Toward a pan-EU blockchain infrastructure

- Blockchain and Data Virtualisation

- Blockchain, Credentials and Connected Learning Conference

- Decentralized Learning: The Future of Student Mobility in Europe

- The "war for [steem] blockchain talent" has been engaged - Fujitsu allies with EC

- Blockchain4EU

- Poker Champion Tony G turns MEP Blockchain Champion!

- Virtual Currencies - an EP report July 2018 - Part 1

- Central Bank Digital Currencies - Part 2 of the "Virtual Currencies" EP report of July 2018

- Blockchain taming the Dragon of Corruption

- Sovereign identity on blockchain

- Blockchain and GDPR - a Call to Arms!

Steem ecosystem

- The Steemit adventure [2]

- Help Yourself! (steemit for dummies)

- Steem crypto-economics

- Best way to Grow on Steemit

- Turn up the Heat! Steem Luxembourg

- Spammers gonna spam - focus on original content!

- The best time to publish is now

- Historic evening: first beer paid with SBD in Luxembourg (+ Fr)

- Steem $10Bln!

- Setting up a new Witness Node!

- Why would anyone burn a bear? - SteemFest 3

- Steemit and the Fractal Society

- Crypto-contradictions

- Game Theory 101 - Schelling point or 'Why Steemit.com is important'

- Converting SBD to maintain the $1 peg

Blockchain, Crypto and Society

- Why Blockchain Is a Revolution

- A New Hope

- Hack Your Life in 3 Easy Steps!

- The Holy Blockchain

- Blockchain revolution: Money and Credit

- Small worlds

- The Press needs to be Freed from the Tyranny of Money

- Immigrate to Romania!

- Blockchain in large organizations

- Blockchain revolution: the CIOs' dilemma

- The Heist: How Big Blue stole Blockchain!

- Blockchain Explored - why the industry loves IBM

- Blockchain and the End of the Western Civilization

- The Church of Bitcoin

- The Ressolid Project

You might also want to check out - my “lighthearted” account, @sorin.lite, perhaps you’ll like what you’ll see.

- the Ressolid account

- the Witness account, @lux-witness (and even approve it, perhaps)

Very interesting article!

What do you think is STEEM's value? :)

I believe Steem's aggregate value is much greater than what the market has ever priced it. And I also think that it's a more powerful system than bitcoin (bitcoin is a wildly successful "proof of concept" IMO)

I think it will be a temporary crisis situation for crypto to vanish. But it can come back, since internet is not going down permanently.

Number 4 has already been tested in Venezuela. In those circumstances it has been tested.

I say this as I have had some dealings with gold and silver coins with buying and selling.... The downfall of gold and silver in economic crisis is that its hard to hide in modern times. In the 1930's you could hide your silver coins sewn into your coat (which was very useful for Jewish persons emigrating/escaping from Germany post 1936).

HOWEVER, they didn't have metal detectors. I am often reluctant to travel with Silver Morgan's on the airplane anyways... Although perfectly legal, if you travel with a roll, it does raise a few eyebrows with the TSA. I'm sure in a Venezuelan airport, it is against local law and most likely would get confiscated (most likely not even handed over to the real government and pocketed).

So for families who want to send value back home, BTC is the most secure and most viable as if gold or silver became popular, thieves or corrupt police would just use a wand metal detector on you or through you house.

Its easier to hide a 30 wallet passphrase in a note or letter in a book etc.

Also... This stuff is heavy. I've never been lucky enough to own a bar of gold, but rolls of silver eagles are a bit hefty.

You are one of the excellent writers on the Steem blockchain @sorin.cristescu and I wouldn't be suprised if writing is in line with your work - You write like a professional.

Well done 😊

P.S. I found you through a recommendation on @steeveapp.

Posted using Steeve, an AI-powered Steem interface

Very insightful post, thank you for sharing it. I believe the value of bitcoin is in the eyes of the investors. Those who hold it, and the marketplace of individuals willing to buy or sell is really what sets the price. If Bitcoin became usable, there's no reason the price can't rise to 100,000$ per coin, at the least.

There's a difference between "spot price" (whatever the buyers are ready to pay), short term value and long term value. In this article I was looking at "inner sources" of long term value. I also think bitcoin IS usable for certain things (trading, international value transfer) but a lot less for other things (buying goods and services)

Man brilliant article so you are saying the internet infrastructure becoming unreliable will push bitcoin and all cryptos to 0 ?

So this is a big question. Crypto’s make a good case against gold BUT require internet infrastructure to be intact. In the event of an EMP or horrible solar flare- crypto would be 0. Because even if I have stuff stored on my Trezor there isn’t a working connection anywhere to make a transaction.

I’d reckon to say internet infrastructure SHOULD if anything IMPROVE as years go on. Might’ve been rumor but I saw something about a node being set up in space.

To answer your question yes, internet infrastructure dying = crypto dying (it is technically internet money)

Posted using Partiko iOS

To be clear, I do not expect that to happen anytime soon, but yes, if we are in a real deep crisis and the internet becomes unreliable then I think BTC and cryptos will become worthless (at least temporarily, until Internet is re-established).

Hey man, good to see you on the trending page!

Posted using Partiko Android

That wasn't difficult, with these STEEM prices and low activity, a little help from the bots was all that was needed. Hope you enjoyed the post (stayed late to finish it too :-)

Got it! Looks like your Partiko Point is low. Might be a good idea to comment using Partiko to gain more points!

Posted using Partiko Android

On Partiko I'm logged in with my "lite" account - while my main account is saved in eSteem :-)

Posted using Partiko Android

Haha got it! You main account has 3035 Partiko Points!

Posted using Partiko Android

Hey I have noticed you have a lot of great articles linked in your post.

Have you seen steem-forever?

https://steem-bounty.com/services/forever

It is a service we have built for authors like you so articles can be upvoted forever in a way that authors earn rewards.

I would be curious to know what you think about it and if you would want to change your links accordingly.

If not let me know why as well.

A great idea indeed, I had long thought that something like that is needed as my style is to write articles that tend to keep their value. I recall reading about such an initiative from @holger80, don't know if this steem-bounty is the same or not, I'll try it out.

I'll update a couple of links in the post to see how it works

Ok, first attempt is not convincing - I allowed "posting authority" to steem-bounty who commented under my original post and put an upvote from me on the comment.

The way I imagined it working would have been for the comment to have the "beneficiaries" set as myself and percentage at 100% (or at least 95%). But I don't see that in the "comment options" so I wonder how it is supposed to function "under the hood"

You can find out the percentage of cryptocurrency rise or fall, price refresh rate according to your settings: daily or each hour.

Mammon allows to calculate the total sum of your earnings per each cryptocurrency or all of them together. This platform differs from the others, as here you can set a target price for cryptocurrencies you want and get the notification if any of them reaches the threshold.

You can download Mammon at the official site - https://mammon.app/

If your chosen cryptocurrency exchange does not have a mobile trading application (like Bittrex or Poloniex), Ztrader allows Windows and Mac users to connect via the API and execute transactions.

Delta is a great application for serious cryptocurrency trading. It creates a pie chart of a cryptocurrency portfolio and provides the calculation of such parameters as realized and unrealized profits, as well as reports on tax returns. You pay taxes, right? Of course yes. To use all the features of Delta you need a subscription. The service is provided by a great app for Windows and Mac.

You can download Delta at the official site https://getdelta.pro/

When a user upvotes a post thru our website that is older than 7 days, we do in deed create a comment and upvote that and we share the upvotes with the author of the post. We keep 15% at the moment as described in our FAQs.

We have explained this on the landing page and one can see the upvotes in our UI. Was this confusing?

So it works exactly as you envision, except we keep a little more...

Steemit does not show the beneficiary, but you can see this on steemd and other explorers.

Still this is a way users can upvote you indefinetly

You can use @rewarding for 100% beneficiaries....

Posted using Partiko Android

For me bitcoin has value because .

Is easy to manage if .....you know a little

If secure and it will not be affected by inflation or taxation

Is limited in supply and it will serve as cash when ready.

Bitcoin is a good because is simple and fair and the power cannot be contested by nobody ever bitcoin is powerfull and this is just the first page in the life of fair money.

Sorine foarte bine punctat o sa recitesc cand ies de la munca .

dont forget. the purpose of money is as medium of trade, whatever the value is, the value is use to determine the value of the good we ultimately trade, money itself basically no value, same goes to bitcoin.

Great read. I've always said...

Cheers

Waiting for the rise again like

"I wonder when will the chair stop spinning"~ cat

It is really difficult to value, given there is not consensus on what it actually is amongst market participants. As years go by it will be more clear and a more agreed upon value metric will be established.

Great point do you think the infrastructure of internet will push crypto currencies to 0

Most of them, yes! However there will be some survivors that will probably increase substantially. Those that offer genuine utility will survive and prosper in my opinion.

Hello Sorin,

congrats to this trending article! In respect to your quotes:

6. Electronic cash (its original intended purpose)

In a more severe crisis, it is just as unlikely they will prefer BTC over gold.

In Venezuela electricity and internet is still available even though country is hit by hyperinflation.

Check out my interview with the Head of DASH Venezuela to see, how this cryptocurrency paves its way through the county.

I will, but DASH is not bitcoin. My point is that the usefulness of Bitcoin as cash is seriously hindered by the difficulty to earn it. Steem for instance has much more potential because it is easier to earn. Everybody has a brain but not everybody can fork out $1000+ for a S9 to start mining bitcoin.

Posted using Partiko Android

I understand your point. Interesting perspective.

But in fact DASH is easy to earn. You can also "Mine them with Stake" through Masternode Shares.

www.crowdnode.io

You can Deposit DASH and get interest in DASH (between 5-7%). Unfortunately DASH didnt perform well towards BTC.

Good post...smh...BTC is the opposite of everything God...and Jesus, as it will never save souls...It will cost a few people their very souls; but...that's another story.

I listen to a lot of the big investors who say crypto in general is a hoax/scam; and then I observe people like the Twinklevoss twins go all in; and, I know that BTC is somewhere in the middle; putting me in the column of HODL for BTC in particular.

It shall be very interesting to say the least.

Peace.

What the buyer is willing to pay for it

Posted using Partiko Android

The question is: there are people willing to pay for it today, but will there be tomorrow too ? What if today people are willing to pay because of some kind of passing common folly that will disappear tomorrow ?

What?

Posted using Partiko Android

Think "church indulgences" - they used to be very expensive in the XVI-th century but became worthless a few decades later. Closer to use, think "fidget spinners"

They used to be something like $5 or more for one, now they are basically worthless. Turns out, they were just a childish fad with no intrinsic value (bar the very low entertainement value)

Ok thanks I think I see your point.

Posted using Partiko Android

Very interesting article!

What's Bitcoin's Value?

What do you think is STEEM's value? :)

Answered that for jaky already :-)

It will have value in a near future. has power to replace money as we know it and change internet social media and value exchange

Crypto, yes. Bitcoin, not very sure, for reasons discussed above

I'm ready for the next bull run!!

nice

Wow

very good

Congratulations @sorin.cristescu! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Hi @sorin.cristescu!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 5.822 which ranks you at #386 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 201 contributions, your post is ranked at #7.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Congratulations @sorin.cristescu!

Your post was mentioned in the Steemit Hit Parade in the following category:

limitless purpose of crypto.

Great post. Hope you could feature about Cryptocurrencies.Ai on your next article. With the platform, you can do technical charting, market research, manage your portfolio from one platform. You guys can also use our platform to identify new opportunities via our portfolio optimization model and back-test different coins.

Try our free beta platform now: https://beta.cryptocurrencies.ai

Also, join the discussion on our telegram group: https://t.me/CryptocurrenciesAi

Thanks for the tip. I'll give it a look

me waiting. maybe bubble

Interesting investigation. Thanks for sharing your thoughts.

Nice blog 🙂

Posted using Partiko Android

Congratulations @sorin.cristescu!

You raised your level and are now an Orca!

Do not miss the last post from @steemitboard:

You got a 100.00% upvote from @upmewhale courtesy of @sorin.cristescu!

Earn 100% earning payout by delegating SP to @upmewhale. Visit http://www.upmewhale.com for details!