From time to time, I write extended essays on blockchain and crypto products that caught my attention. I was always interested in crypto-ATMs sector, and recently I hooked up with founders of the company, called Intellogate. They support a full cycle solution for this market, from crypto exchange to production of E-tickets and ATMs per se.

Illustration: Crypto-ATM launched in Frisco, Texas

Here is some basics one should know before launching his/her own crypto-ATM network.

Where the profit comes from? Fees. Crypto-ATMs network charges transaction fees. These fees can be substantially higher than those charged by cryptocurrency exchanges and even peer-to-peer exchange services. The reason is simple: you provide clients with quick, easy and transparent access to crypto, there is no need to search for matching bitcoin offers and customize wiring or paying methods. Simplicity and availability of supply on the spot pays off.

Operational basics. In order to facilitate your network operations, you will trade on the exchange that suits you best (and all your ATMs will be integrated with it). But the client can stay with the exchange, wallet or other service he or she is comfortable with, i.e. no registration at the exchange that you work is necessary.

To start operations, the client needs to enter his or her wallet number/address or simply scan a QR-code, then choose the cryptocurrency to buy or sell. And this is it, the transaction starts.

Cashing in. Once the user’s wallet address is identified, he or she loads the money into the kiosk. Cash acceptor verifies banknotes, ATM displays the amount inserted, conversion rates and fees to be charged. The only thing left is choosing the amount to buy.

And what if I’m a newbie and don’t have a wallet? Will the machine help me and register one on the spot? Alexander Makhinich, Intellogate CTO, says it depends on the client. The company can add this option on demand.

Here is Here a video from The German Blockchain Week in Frankfurt which got popular on Reddit, have a glance.

Cashing out. Selling bitcoin and getting cash looks quite similar to cash in option. However, it takes some time to proceed crypto transaction. To avoid queues for standing and waiting for cash, the ATMs issues a plastic card. If transaction is successful, money is credited to the customer’s card.

For example, I want to cash out bitcoins from my account on Bittrex. I know my deposit/withdrawal address for this exchange. Once all details are in the system, a QR code that needs to be scanned appears on my smartphone screen. The exchanges are connected to the ATM system via API protocols.

Integration of Crypto ATMs with an exchange. To trade cryptocurrencies crypto-ATM network should be integrated with an exchange through which transactions are made. Some operators connect ATMs to banking systems to accept plastic cards.

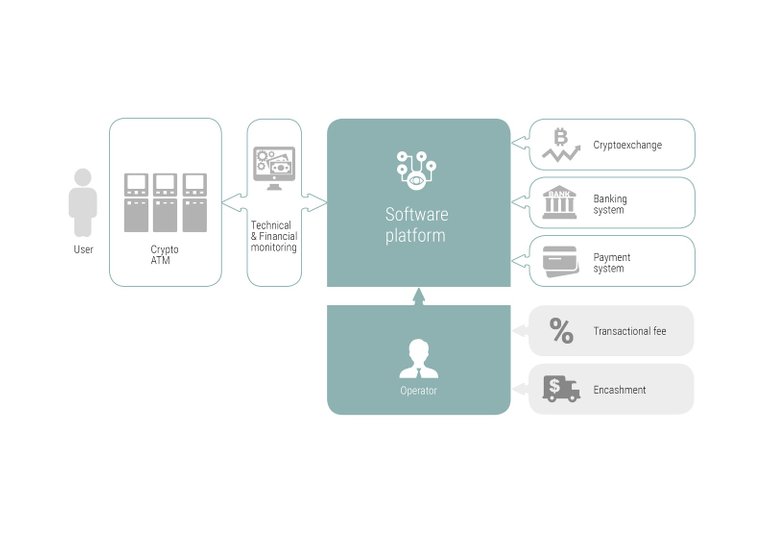

The infographics below briefly shows how typical integration scheme looks like.

Software. Obviously, a software platform is needed to merge all crypto-ATMs into one network. Software integrates with crypto exchange through API and provides an operator with remote access to his network.

Now operator can change rates, fees as well as order encashment. He can also see current operation status of all terminals connected to the network. In case any needs a repair, tech support is notified in one click.

Intellogate supplies crypto-ATMs with a pre-installed software platform of its own design called Intellosuite. It is tailored to the company’s crypto-ATMs and can be integrated with any exchange or payment system. Thus, operator gets a complex solution that is ready to use.

Adoption is on full steam. Crypto ATMs become popular in many countries these days with regulators already granting licenses to some operators. For example, just recently New York has issued a bitlicense to Coinsource which runs 40+ machines through the US. Instead of ATMs, they call these machines BTMs (Bitcoin Teller Machines). Some nice humor here. I wonder what CTMs will look like...

You can contact me via