As the momentum of this weeks madness in the cryptocurrency market slows, the insane gains and unsustainable price growth is coming to an end. Like a rocket that has run out of fuel, the upward movement of the entire market has peaked and is pausing mid air. Before the market falls back to Earth and sheds some of the speculative hype from the actual worth of the crypto techs.

We are in a 'slow roll over' period and I predict the red lights will begin lighting up across the board. And in a few short hours from now, pundits on the interwebs will be calling a 'crash'.

But it isn't really a crash. It's really a return to financial sanity.

The real 'crash' happened when the crypto markets left reality behind, blasted into the stratosphere of hype and crashed past the barrier of actual use-case evaluations. The only crash that is happening is the crash to your ego if you firmly believe that the current spot price of your coin horde is actually worth that price in real life.

Blockchain technology, the thing powering your coin assets, is largely yet-to-be-adopted technology so the current prices don't reflect actual industrial use. They reflect enthusiasm for their use.

There is a big difference between speculative value... and real value. The last week was insanity run rampant. Now, and in the next few days, reality gets a turn to run rampant and apply a smack-down price correction.

In my own portfolio, I am already positioned for the move. I have liquified certain positions and am ready for a buy in of several coins once the 'penny drops' to a price point well below what they are right now. And they will because if you look at the last week of high percentage, compounding gains on a daily basis, that means there is quite a few hundred percent to shed before prices return to actual worth.

I am a patient man and quite frankly, I realize that you I could put my money into just about any #JunkCoin and make huge gains. So if my favourite coins don't come at the discount I want, then I don't really care. There are others to ride on.

So let's talk about buying in...

The trick right now is to avoid buying in too early. The energy and downward momentum of the entire market hasn't picked up steam yet and is still in transition from upward propulsion to downward velocity.

Meaning, the real gains may come in a few days to a week. Of course, this is a rough guide to the entire market and you have to watch your coins closely.

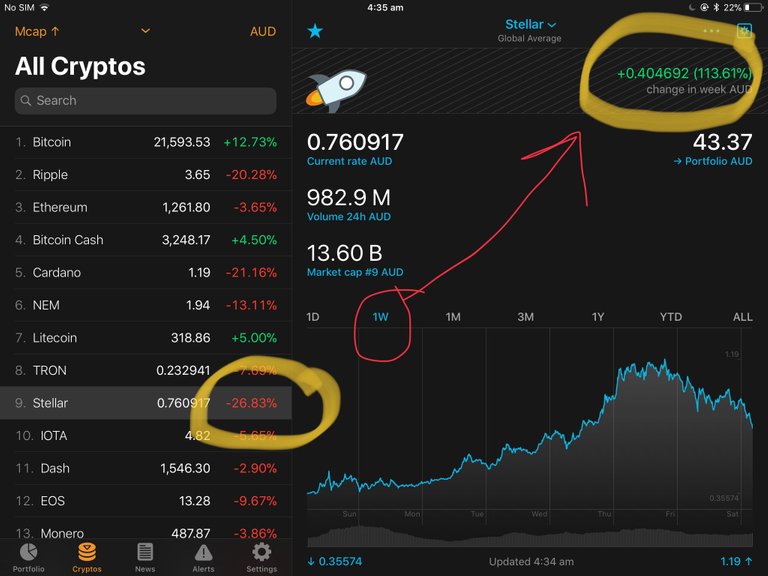

The point is that you have to factor for the compounded percentage rises that took place over the last weeks before buying. Just because the coin you are emotionally attached to flashes a giant red "50% off sign" today, doesn't mean it's a bargain price. As the picture above shows a 26.83% discount on a coin that is still 113.61% higher than it was a week ago may not actually be a bargain. If a coin rose higher and higher over the last weeks, then it is probably still expensive.

And possibly priced well above it's actual market and use value. So be careful.

Newbies entering the market during a 'crash' will be fooled by the 'massive discounts' and buy into coins that are still falling in price. And not really discounted at all.

The tendency to 'buy in' to a coin you're emotionally attached to... too early... is a trap that depletes your financial reserves. Should the price continue to drop, that coin becomes a liability as you will have locked up your finances, with an 'asset' that you won't sell. And therefore, can't manoeuvre financially until the price rises again. I.e. No one ever sells off a coin they just bought for less than they brought it.

So with your money locked up in a coin that is falling in price stops you from buying into another coin that is actually a real bargain. So just be mindful of the 'opportunity trap' when buying in a falling market.

Anyway, like always I am not your father and this is not investment advice. But here are my tips to prepare you for the current change in the market.

- Clean out some of your junk coins if the price is high. Burn some and reclaim some liquidity for better, more solid investments.

- Spend a little time ( because you have it ) looking into coins that have a real world, long term use. I.e. The tech is designed for key infrastructure.

- When looking at the graphs for discounted bargains, compare the current value to the weekly and monthly values. Those perspectives will tell you whether the "50% off sale" is really 50% off the current, daily price. Or it's still more than the price it was 1 week ago before the hype and insanity hit the markets.

- Don't get emotionally attached to your coins. Get emotionally attached to the better lifestyle you are buying your and your family when you sell off your cryptos for real world gains. You do have an exit strategy, yes?

- Be patient. Let the charts fall. Ride the wave down to the bottom and maybe let it bounce a couple of time before you buy in. You don't have to time the bottom perfectly. So be prepared to wait a few days before you pull the trigger on your trades.

Thanks for watching,

Brendan Rohan - Indie developer of 'next gen' natural medicine from Melbourne, Australia

Www.Skyflowers.co ( see "botany" tab for the plant research )

Www.ClinicalFlowerTherapy.com

Social @iSkyflowers

YouTube Skyflowers.Tv

If you support natural medicine and an independent research project that began in 1997, then steem me. The creds I get will help me provide a solid body of information that future generations can build upon.

DISCLAIMER: This article is written by an amateur investor and is offered purely for information purposes. This is not financial advice and you should always seek the advice of a finance professional.