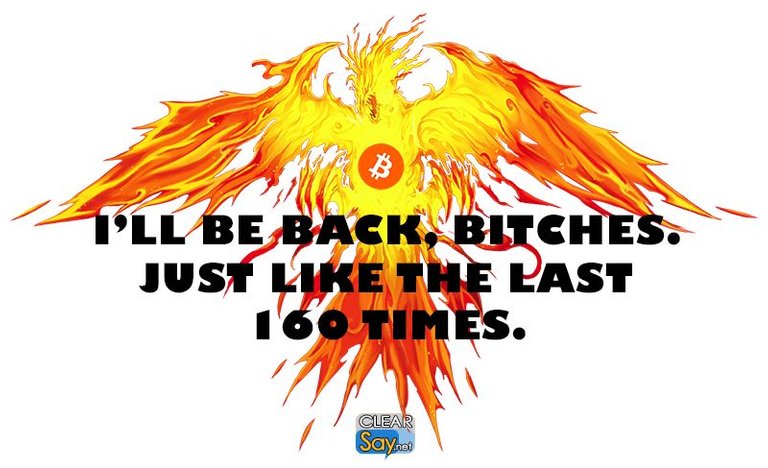

Yep, our "poor" phoenix has been killed yet again. This time by the combined forces of Jamie Dimon - JP Morgan's CEO - and to a greater extent, China's regulation of ICOs and threats of more regulation to come.

And yet, like the mythical phoenix, each time crypto rises from the ashes, and each time flies higher than before. What's up with that? Could it be something to do with values such as efficiency, security, and integrity? Could decentralization be a good thing? Could a currency with no need for trust be a good thing? Could - somehow - more and more people be hearing about it and wanting in on the action?

Why would big players like China and JP Morgan do such a thing? It wouldn't be a leap to guess that big banks and China are afraid of a revolution in currency and want to crush it. The last thing big banks want is for the populace to stop using fiat currency! Same for China.

Another potential reason: What if the Empires and Elites understand the inevitability of cryptocurrencies and want to bring the price down where it will be easy for them to buy a huge amount while simultaneously putting a dent in the collective wealth of the rebel alliance?

What do you think?

A small sample of the 160 bitcoin death predictions from https://99bitcoins.com/bitcoinobituaries:

- Jun 20, 2011 - "So That's the End of Bitcoin Then" - Forbes - $15.15

- Aug 09, 2011 - "The Bitcoin is Dying. Whatever" - Gizmodo - $10.95

- Nov 23, 2011 - "The Rise and Fall of Bitcoin" - Wired - $2.37

- Dec 24, 2012 - "Wired, Tired, Expired for 2012: EXPIRED - Bitcoin" - Wired - $13.30

- May 20, 2013 - "Beward of This Insidious New Currency Scam" - Salon - $117.06

- Jun 20, 2013 - "Bitcoin Sees the Grim Reaper" - NY Mag - $105.70

- Aug 08, 2013 - "The SEC Shows Why Bitcoin is Doomed" - Bloomberg - $93.57

- Oct 16, 2013 - "Bitcoin is a Remarkable Innovation, ... Why It Will Fail" - Salon - $145.16

- Mar 07, 2014 - "Sorry, libertarians: Your dream BTC paradise is ... dead..." - Salon - $637.77

- Dec 16, 2014 - "Bitcoin's financial network is doomed" - Washington Post - $325.10

- Jan 19, 2016 - "R.I.P. Bitcoin. It's time to move on." - Washington Post - $382.00

- Sep 16, 2016 - "Cryptocurrencies are Dead" - Medium - $606.43

- May 05, 2017 - "The Death of Bitcoin" - Daily Reckoning - $1,570.25

- Jun 06, 2017 - "Mark Cuban calls bitcoin a bubble, price falls" - CNBC - $2,741.29

- Jul 12, 2017 - "BTC acceptance is virtually zero and shrinking" - Yahoo Finance - $2,410.55

- Sep 05, 2017 - "Bitcoin’s price hit $5,000... still dumb investment" - LA Times - $4,363.02

- Sep 09, 2017 - "Why China Crushed Bitcoin" - Forbes - $4,450.15

My personal recommendations for crypto right now:

- Bitcoin duh.

- ARK is for bridging capabilities of cryptos to each other (BTC, Lisk, Ethereum right now). ARK transactions are super fast and scales well. Uses JavaScript (which is super ubiquitous) and allows use of other languages.

- Monero is a privacy coin. Who doesn't want privacy? There are others, but Monero has momentum.

- Steem part of https://Steemit.com, a fast-growing decentralized social network with no censorship. With censorship rearing it's ugly head at Facebook, Google, and YouTube, Steemit has huge potential. I also love that upvotes mean I get paid for my writing! If you create any kind of digitally shareable content and you don't hate money, try Steemit!

- Ripple is what many banks are looking at very seriously. It's fast and scales well.

- 0x is for decentralized crypto exchanges, which could be "the next level".

- EOS is the brain child of Dan Larimer, creator of Steem. "The operating system of cryptos." Super smart concept. High risk but low price.

- Dash has a smart plan and mucho marketing.

Disclaimer: No guarantees. Be careful. Only "bet" what you can afford to lose. I'm not responsible for your losses.

Lol :D. Bitcoin is like a phoenix, indeed.

Great post, I like your recommendations too.

Nice post, my friend

Well, to be fair, some of those articles are pointing out that crypto currency is definitely going to rise but "bitcoin" in the "long term" might not be the leader. I especially liked Yanis Varoufakis' argument that Bitcoin only rewards hoarders (don't forget that he's an economy professor and #1 enemy of the banks in EU):

"If bitcoin succeeds in penetrating the marketplace, an increasing quantity of new goods and services will be traded in bitcoin. By definition, the rate of increase in that quantity will outpace the rate of increase in the supply of bitcoins. In short, a restricted supply of bitcoins will be chasing after an increasing number of goods and services. Thus, the available quantity of bitcoins per each unit of goods and services will be falling causing deflation"

To prevent that would need regulation; which is directly against the idea of decentralisation.

This is why Bitcoin is "eventually" doomed to fail; but we don't know when. For all that we know, perhaps 1BTC might reach 1 million dollars before that happens.

Brilliant! I saw this on Google Plus.