It could be....my apologies.....so here is a tip to catching onto trend changes. Don't use it as a bible for trend changes, but it can help you spot one. I have no idea your level of study in the technique presented here....so I'll keep this pretty baseline....

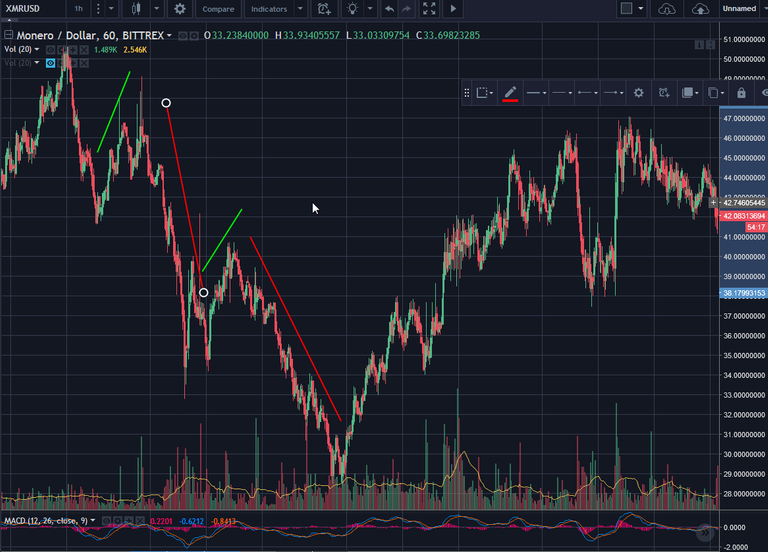

A common sign of a longer term trend change is the swapping of 5 waves up and 3 waves correcting......here's an example....

Can you recognize the difference across the spectrum of each chart.....same coin, different market movement. The key is to recognize the change of the more complex impulses moving upward in image 1 and the more complex impulses downward in image 2. Simple corrections in 1 and simple rises in 2.

All in all, it looks like the BULL market is keeping XMR floating closer to the top than previously expected. The retrace could have been up to 90 percent or so with that extended 5th, but the market is strong, and price is still rising after a smaller than expected correction. There are many ways to spot larger trend changes, but this is usually a dead giveaway. If you see the counts essentially swapped.....cycle after cycle, you can safely assume we're moving to a bear market.

I won't impede on Haejins next count of XMR, but looks like another correction is due, but we are still moving in the BULL fashion forward....take profits and ladder back in....

Actually you really only need image 2, after the terminal end, you see the wave structure change as described.....like I said, not a bible for trend change, but a good indication!

Thank you very much, this is precious studying material to me!

This is in the EW material by Prechter....but I have never heard Haejin reference this type of indicator.....so keep an eye out to see if he nixes this indicator in lieu of pattern recognition.

I would trust Haejin's experience.....especially for cryptos over Prechter's reference to stock indexes.