I dabble in trading equities, I follow fundamentals to make my stock picks and use technical analysis to determine my entries and exits.

I want to start show people that technical analysis does indeed work on trading cryptocurrencies. The charts below were generated using tradingview. This is not about how awesome i traded, just sharing the tools that I have found to be accurate and useful so far.

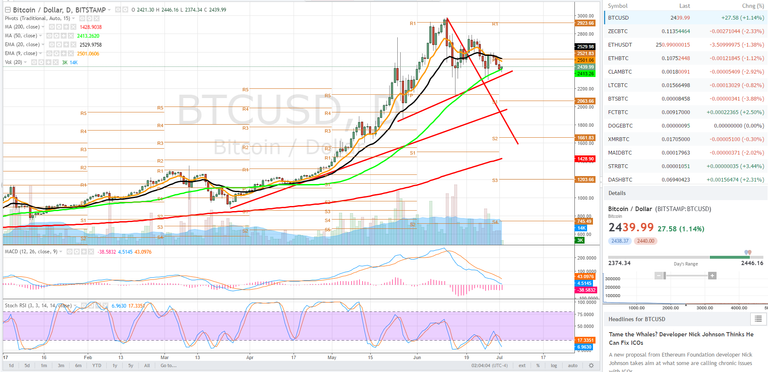

Moving averages, the average price over a set number of days - this measure acts as a support or resistance, a magnet if you will. Aside from moving averages I use pivots, historical areas where the price has hung around. The 50dma and 200dma are critical.

I also use what is called a stochastic RSI and MACD - these are momentum indicators and tell me if a ticker is about to enter an uptrend or down trend and how strong that move is. More information on these technical analysis tools can be found at http://www.investopedia.com/

Another part of technical analysis is visual. We are looking for candle stick patterns, repetition and trend lines. Trendlines often form into obvious patterns such as channels, wedges, pennants, etc. (more info on chart and candle stick patterns can be found at investing.com) . The above chart is bitcoin and a decent demonstration of how the trend lines converge to form a pattern.

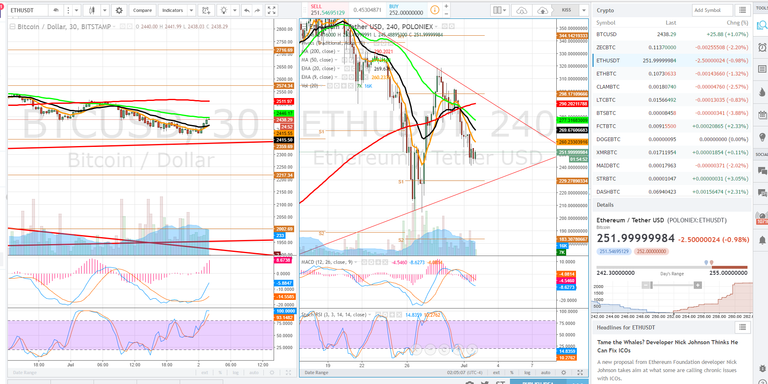

Timeframes are also very important - they represent the above mentioned tools in a different manner as a function of time. 15min/30min and 1hr time frames are most important to day traders. Long holders should be looking to daily and weekly time frames -- yep it is shorter term outlook vs long term.

And with that, this mornings trade was in NXCBTC - the parabolic move had already occured but i still managed to sneak in for the last 10 % -- how you ask? the above tools, studied, learned and practiced.

#STUDY up on the moving averages tools, momentum indicators, pivots and trendlines, as i intend to share some of my knowledge and insight about how cryptocurrencies are trading! http://www.investopedia.com/

<3 Follow me @satchmo

Technical analysis is one of those areas that no matter where you apply it (stocks, crypto, etc) there will always be people that say it doesnt work. Of course I side with that it does work, and your post supports that.

Hope to see more from you, crypto needs more TA based traders that are willing to share information!

Thanks! I will do what I can -- its not just TA I want to share but the mechanics of the market -- such as market makers and most importantly manipulation. I def want to show people the light! I will post about stocks and indexes also!

What are your ideas about Bitcoin price action in view of the 1 August 2017 deadline? Love to hear your thoughts from a technical perspective.

I wouldn't worry about the August 1st deadline too much. Any attempt at a UASF (essentially a Sybill attack on the Bitcoin network) without miner support is utter lunacy and doomed to fail. If the UASF goes forward, all that will happen on August 1st is a bunch of nodes will fork themselves off the network onto a chain that will probably never have a single block mined on it. Anyone can spin up many full nodes for next to no cost, so the count of full nodes is in no way representative of the "economic majority." The real economic majority will never follow a fork without majority support from the miners, as such a fork would be trivial to 51% attack.

I do not worry so much about a fork. The most popular one will win and that is how Bitcoin was designed. Any fork is a good opportunity to buy cheap coins.

Honestly, its all noise. Crypto is here to stay, it will weather storm after storm.

I don't deny that TA is an elegant mathematical interpretation of human psychology, but I am wondering, what are your thoughts on the notion that TA sometimes creates a self fulfilling prophecy?

Its the individual who makes charting a self fulfilling prophecy. Technical analysis is just a tool of course. It is up to the chartist to be dilligent and follow their own rules, such as buying or selling supports and resistance, using stop losses etc.

I've personally seen and been duped by false signals etc, so its not perfect and cannot always predict unknowns - like say a company will be releasing big news -- unless there is volume suggesting the transactions in the equity are increasing, its impossible to predict something impending.

But chart is as you put it, elegant, math, psychology - it tells the story of a particular equity - it is predictive but not always perfect.

Does it also work when you are trading crypto against crypto (say ETH or BTC as a base)? Or does it work better against fiat (USD)? I am asking this because of the volatility of ETH and BTC as a base, so will the indicators work in the same way?