BTCUSD - Day Traders Chart Setup

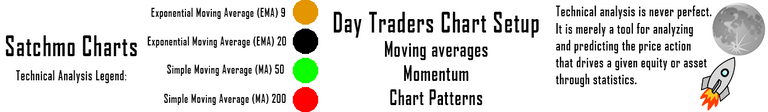

Moving averages:

Green = 50dma

Red = 200dma

Orange = 9ema

Black = 20ema

Is bitcoin on a tear or what?! Thats right bullish since the pullback to $5500 and providing trade set-ups along the way. As the action will continue to be with Bitcoin I think it's important we take another look especially for those who missed the buy opportunities as we were calling them out.

It is important to be aware the the CME (Chicago Mercantile Exchange) is predicted to have futures trading available on bitcoin by the second week of december - Has anybody ever heard the term, Santa Clause Rally!

What this means is that the billions of dollars on wall street will be able to get more, safer and sanctioned exposure to the lucrative crypto market - Billions of dollars.... the current market cap of bitcoin could easily double, and 100 billion $ is really peanuts in the grand scheme of global economics. If I recall crypto is 0.1% of total money - let's double it into January, k? Thanks!

Daily

In just a few short days traders and investors saw the price of bitcoin climax at approximately $8000 before rapidly declaining to around the $5500 range. Then swiftly shooting back up after setting a double bottom or W formation.

Looking at the daily time frame, the price caught support at exactly the 50dma, the wicking here was the buy signal of all buy signals and led to the price reclaiming the 9 and 20ema. Resistance is found at pivot r1, $7210 breaking bove this level gives way to the $7300's and beyond (All time highs)

The daily stochastic has quickly pushed back into uptrend pulling the RSI along with it. Key support is the 9 and 20ema, and tests of these moving averages is an opportunity to add or take a position setting a stop loss just below, if you aren't already in it.

4 hour

The 4 hour time frame is cause for some pause as the stochastic RSI is extended, however, a test of the 80 level will be indicative of sustained momentum, keeping the trend going. I lean towards the side of caution in providing these calls.

With resistance being found at pivot R1 on this time frame a dip back to the moving averages is not at all unlikely - This would be a back test of 7k, price verification. Key support is the 9ema here, approximately $6921.

1 hour

The 1 hour time frame is on the verge of producing a golden cross which is an extremely bullish signal, the 50dma crossing above the 200dma. The long term the time frame the more bullish the indicator!

So far price has found support at the 9ema but could continue to dip as low as the 20ema, a perfect opportunity to scale, longer and would see the stochastic RSI fully cycle. While momentum wanes make note of the uptrend in the RSI - it's holding the level, few sellers.

Long story short this could be one hell of a bull run,

Bullish Above: $7320

Bearish Below: $6707

RISK TRADE: Scale long here adding all the way the 1 hour 20ema. Set stop loss just below.

Don't forget to use stop losses!!!

Previous Articles:

ETHUSD

BTCUSD

BCHUSD

BTCUSD

ZECUSD

XRPUSD

ETHUSD

BTCUSD

BCHUSD

Follow at your own risk, Not a financial adviser, understand the risks associated with trading and investing. Manage your own Risk - in other words you could lose it all and it's your own fault.

nice post

Thanks for the tip... I'll be opening a long BTC trade on plus500

I can testify that trading on analysis by @satchmo has been profitable.

Thanks again for the time and effort you put into sharing your views with the community

I really appreciate that thank you!

Excellent brief saves me so much work,thanks.

What is the best trading platform?

For Crypto, Bittrex, polo, bitfinex, bitstamp have all the volume.

Thank you so much and good luck

The market trends looks bearish and it is getting really confusing for me... Good insights in this blog....thanks

It really depends on time frame and risk tolerance. Use stoplosses and conditional sell orders to mitigate risk. Glad it helps though! ... BTC is going to the moon in my opinion next few weeks.

Again, thanks for the concise insightful market evaluation. To the moon we go. Remember, crypto will set us free!

thanks for info. Means i have to go check something..

Next Stop 10k ,😊😊😊

I want to see Roger Ver reaction .I expect big dump very soon.

LOL!!!!!!!!!

alalım mı satalımmı :)) gercek fıkrınız ney acaba

Thanks for the info.

thanks for info