Member preview

Go to the profile of Jared

Jared

Here to share my thoughts & ideas concerning cryptocurrencies. Hoping to learn & digest meaningful content that will expand my knowledge and thought process.

Jul 21

Bitcoin to Surpass $100k by 2021?

For nearly the entirety of 2018, the cryptocurrency space has experienced the doldrums of a bear market and Bitcoin has failed to sustain a price above $10,000 (as of writing this, Bitcoin is stuck in the $6k/$7k range). Numerous investors, especially newer entrants, are starting to capitulate and lose interest in the market. Detractors are louder than ever, notably including Warren Buffet who called Bitcoin “rat poison squared”.

“I made the wrong decisions on Amazon and Google” — Warren Buffet (He’s well-respected and deservedly so, but could he be wrong about Bitcoin?)

For many, the onslaught seems like it has no end and shortsightedness has become apparent. Even with diminishing public sentiment and a large contingency that thinks Bitcoin’s future is bleak, I believe Bitcoin will hit $100,000 by 2021:

Countdown to Bitcoin Halving in 2020

Source: Insider Pro

The next Bitcoin halving (or halvening) will occur in May 2020, which will reduce the current mining block rewards by half. This event is significant since the amount of Bitcoin mined after each ten minute block will drop from 12.5 Bitcoins to 6.25 Bitcoins. After the halvings of 2012 and 2016, a considerable appreciation in Bitcoin’s price was reflected within the year. It’s also likely that speculators may temporarily provide a spike in anticipation of the next halving as it is approached. With less Bitcoin being distributed into the circulating supply and increased demand, the halving may serve as a distinguished price catalyst.

Comparison of Current and Historical Markets

Source: Internet History Podcast

At the height of the dotcom bubble, the NASDAQ was worth nearly $7 trillion. I must emphasize, the dotcom bubble was only confined to the United States! In contrast, the cryptocurrency market is global, so it has the potential to far eclipse the trillions witnessed during the dotcom boom. Currently, the entire crypto market is less than $300 billion, with Bitcoin accounting for about 45% of this sum. Bitcoin’s size pales in comparison to other markets, which may help to put it’s growth potential into perspective:

January 2018 U.S. Stock Market Peak = $30 Trillion

Implied Market Cap of Gold = $7.8 Trillion

Value of Dotcom Bubble Peak = $6.71 Trillion

Daily Volume in Forex Market = $5.1 Trillion

Bitcoin’s Market Cap = $125 Billion

Furthermore, each of the top 10 companies in the US stock market, on their own, have greater market caps than all of crypto. The likes of Apple and Amazon are on the cusp of reaching $1 trillion valuations. Will anybody want to buy Bitcoin at $100k? Admittedly, Bitcoin has less stable growth, but Berkshire Hathaway’s class A shares have had prices above $300k, so the price alone shouldn’t be a deterrent.

By the end of 2021, the supply of Bitcoin will be around 18.7 million, meaning that the market cap of Bitcoin would need to be approximately $1.87 trillion to achieve $100k. Taking the aforementioned numbers into consideration, it’s conceivable that such a price point can be reached by 2021.

Lost Bitcoin and Hodl’ers

Source: Fortune Magazine

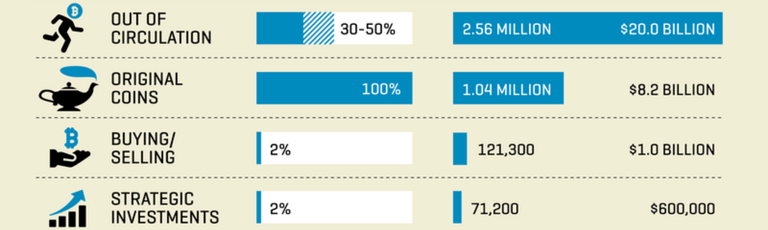

It’s estimated that nearly 4 million Bitcoins are lost forever, many during the early days of Bitcoin’s history. This is a sizable figure considering that the current circulating supply is just north of 17 million and the final supply of Bitcoin will be 21 million.

Another aspect that is highly underestimated is the conviction of Bitcoin’s holders. Typically referred to as Hodl’ers, they are likely to hold their Bitcoin through the dramatic and often chaotic swings of the market. Bitcoin is not just mere speculation, it’s a movement. There’s a growing number of individuals favoring the principles embodied by Bitcoin’s decentralized network instead of the established banking systems. Hodl’ers, in conjunction with Bitcoin’s missing coins, may serve as compounding effect on supply and demand, which may ultimately contribute to positive price action.

Crypto Advancements Provide Added Momentum

Source: Robinhood

“It resonates with us when a client says, ‘I want to hold Bitcoin or Bitcoin futures because I think it is an alternate store of value.” — Rana Yared, Goldman Sachs Executive

Despite the often negative headlines and incomplete information that is proliferated in mainstream media, behind the scenes, a cryptocurrency arms race is transpiring:

There’s been of migration of Wall Street’s top talent to the crypto space

Binance, the world’s largest crypto exchange, will be adding its first fiat trading pairs this year

Nasdaq has expressed interest in trading cryptocurrencies and is supporting the launch of the DX crypto exchange overseas

Circle, backed by Goldman Sachs, purchased the crypto exchange Poloniex and Goldman is entertaining the possibility of trading Bitcoin

Coinbase is continuously active and has made a number of strategic acquisitions including Earn.com

Mobile applications supporting crypto, like Robinhood and Abra, are now making it more convenient and easy to purchase Bitcoin

The demand for blockchain and crypto-related jobs has also skyrocketed

As you may have noticed, the number of gateways into Bitcoin has increased greatly and the infrastructure behind crypto is strengthening. While immense progress is being made, there may be a future application(s) that will usher in greater levels of adoption and the complexities once presented to user’s may be essentially eliminated.

Other product offerings will act as mechanisms for growth. Coinbase will be adding Ethereum Classic and other potential cryptos, which I think will benefit Bitcoin’s liquidity.

Interestingly, the currently purposed CBOE ETF, if accepted, will cost around 25 Bitcoins per share. This is significant since the under lying asset, Bitcoin, will be purchased in the process. If such options become more widely available, then Bitcoin’s exposure may extend to new vehicles like brokerage accounts and your 401k. Once the first ETF is approved, then other variants of ETFs are likely to be constructed.

Economic Downturn: Bitcoin Provides Safe Haven

Since Bitcoin’s inception, the US stock market has generally been in a steady uptrend. If a cataclysmic event similar to the 2008 crash occurs, then we’ll truly learn what Bitcoin’s correlation is to traditional assets. It’s an often expressed belief, within the crypto space, that investors might flock to Bitcoin if a stock market crash happens.

Source: Economist.com

In other countries, such as Venezuela, Bitcoin has proven to be a safe haven as the local currency (the bolivar) is incurring a precipitous decline. Global occurrences are often overlooked by first world countries, but in Venezuela, the importance of Bitcoin is pronounced. The Venezuelan bolivar is suffering from hyperinflation at the current rate of 16,428% a year, basically making it worthless. In such a crisis, many residents are resorting to Bitcoin as a way to preserve their capital. Unfortunately, I believe that such scenarios could play out in other countries, which will contribute to Bitcoin’s value.

Millennials: Their Buying Power Increases

For a set of millennials, cryptocurrencies are the preferred investment vehicle over the stock market. Since many millennials have mostly known a society integrated with the internet, they may be more receptive and gravitate towards cryptos in their investment journeys. As each year progresses, more millennials will accept new job offers and substantial pay increases may add to their disposable incomes. This development may encourage the purchase of more Bitcoin.

Moreover, many millennials are becoming disillusioned and feel like they live in a system that cares little about their financial well-being. A prominent example of this is the increasing student loan debt epidemic that has stifled many in their financial growth. As a result, Bitcoin may become an attractive option, since it’s not tied to a system that hasn’t necessarily served their best interests.

Final Words

I’ve been told by naysayers that Bitcoin “will never hit $100k” and such a proposition is absurd. With a combination of the factors above, I believe that Bitcoin will usurp the $100k barrier within the next 3 years, but the path won’t be seamless. There will be cycles of boom and bust. Also, it’s possible that Bitcoin fails to reach such valuations or is halted by a massive setback like a black swan event. However, my bet is clearly on Bitcoin. In fact, I envision that someday we’ll look back and realize that the greater risk was not investing in Bitcoin at all.

Disclaimer: The content above represents my opinion, therefore this is not intended to be investment advice.

My Past Articles:

Cryptocurrencies: The Greatest Opportunity of Our Generation?

In 2018, Cryptocurrencies May Surge to New Heights: Here’s Why

2017 Crypto Year in Review: As Told by Twitter!