The only constant is change when it comes to Bitcoin’s price action, and that change can be quite volatile at times.

In a recent post I delved into the correlation of the price of bitcoin in regards to the China-US trade war but today, I would like to get in a little deeper to unearth what's really driving the price of bitcoin in either direction. That's the million dollar question.

Let's look into it.

source

As traders we try to predict those times so as to capitalize on the volatility. We know it will move but the science is knowing when and in which direction. It sounds simple enough but we all get it wrong sometimes, despite being able to dissect and inspect the price charts with expert technical analysis, based on multiple strategies and formulas. We look at fundamentals or whether any new developments are coming from the team involved in the particular cryptocurrency we wish to trade.

And we also determine market sentiment, by putting our ear to social media and listening to the pulse for optimism or fear.

Despite all of this, Bitcoin and all cryptos continue to surprise us, catching us unaware with a sudden and totally illogical move from out of left field. So what is really causing the price of the cryptocurrencies to move the way they do? Sure, it’s probably a combination of technical, fundamentals and sentiment, plus one other unknown factor most descriptively described as manipulation.

Let’s face the fact that Bitcoin is still a very small asset market by global standards, with only a fraction of trading volume daily compared to say gold, or forex. Besides that, it was recently discovered and released in a Bitwise report worth reading that the real Bitcoin volume presented on coinmarketcap.com for example or on individual exchanges is 95% fake.

Exchanges are allegedly artificially inflating their daily trading volume by wash trading, or buying and selling large amounts of Bitcoin to themselves via numerous wallets. This is usually illegal but in the crypto market which is so unregulated, it goes on unchecked. And even if it is noticed and announced, there is little anyone can do except make a mental note to factor in to your trading strategy and equations.

source

And with the trading volume so extremely low, it is quite easy for a whale or someone with large amounts of Bitcoin or fiat to simply place a massive buy or sell order and thereby immediately push the price up or down, creating these occasional sudden spikes that we see popping up out of the blue to disrupt our analysis of the price action.

The reason for this lies in the fact that there are layers upon layers to trading and investing in Bitcoin and the cryptocurrencies.

We can buy or sell over the counter (OTC) and whales usually do this to avoid slippage on exchanges when putting in massive orders. This is when you put in such a large order at a certain price that only some of it can be filled at your price while the rest can only be filled at much lower or higher prices than you wished, so ultimately you end up paying more for your Bitcoin that you wanted to. There may simply not be enough Bitcoin on sale to fill your particular buy order at your price, and you lose out as a result.

By purchasing OTC the whales bypass this problem, but when even OTC trades run out or the whale has alternative motives, then we see them putting their buy or sell orders on not only one exchange, but on two or three simultaneously, causing these sudden and unexpected price spikes or plunges of hundreds of dollars within minutes. And that’s what we sometimes see occurring on the charts.

Now that’s not necessarily manipulation, you might think, as it’s simply a large order which anyone has a right to place. But sometimes there are ulterior motives, specifically when we consider the deeper layer of Bitcoin trading called the Futures market. Generally the current price of Bitcoin at any time does not represent its true value as much as it represents an investor’s expectations of what the future value may be.

We buy because we think it is going to be more valuable in the future and sell when we think it’s going to be cheaper in future.

This is also the principle of the Futures market, where special financial instruments called futures contracts are traded. You don’t actually buy or sell physical Bitcoin at all, although the concept of physical Bitcoin is a paradox in itself. Bitcoin is after all a virtual digital asset with little to show for physically other than some numbers perhaps, but – semantics aside - you get the idea.

source

When a trader buys a futures contract s/he is placing a bet on what the future price will be. Futures contracts can be renewed from month to month and you can buy or sell into the contract at any time during the month at the current price on the day and then sell at any pint too, for profit or loss. And you are then paid out in cash if your trade is profitable.

If the price went against you then obviously you lose the difference like any normal Bitcoin trade.

Now on Bitmex, a very popular international exchange, you can buy into these futures contracts with 10x or even 100x leverage, where your bet is worth that much more than you actually physically invested. Here your potential profits or losses are both multiplied by the amount of leverage you chose, making them massively beneficial but also just a risky.

With so much potential profit available to the savvy trader, you can see where a whale might use whatever tactics s/he can, to ensure that the price goes in the direction they bet on with 10x or 100x leverage on Bitmex.

For example on around 1-2 April, depending on your time zone, we had the April Fool’s day pump, which looked like a joke but wasn’t.

source

By tracing the Bitcoin trade history back on the transparent open ledger of the blockchain, we can see that a large buy order was placed on three exchanges simultaneously – Coinbase, Kraken and Bitstamp. The 21 000 BTC order valued around $100 million occurred within a mater of minutes and the price literally jumped up 20% within that hour. At the same time close to $500 million worth of short positions (sell orders) were liquidated on Bitmex.

This price spike came out of nowhere, on a price chart that had been trading flat or sideways for months until then.

A similar situation occurred on 17 May, when a sell order of 5000 Bitcoin worth $36 million, was placed on Bitstamp exchange, again causing the price to drop 26% in minutes and liquidating $260 million worth of longs (buy orders) on our futures exchange Bitmex. And to the discerning trader these moves looked exactly like manipulation. A whale could have placed a huge futures trade on the Bitmex exchange at 100x leverage, and then physically traded fiat for Bitcoin on the other exchanges with the knowledge that their massive order will push the price in the direction they require to fill their futures contract and make them 100x profit on their investment.

source

And this kind of thing may well be going on all the time in this low volume market of ours at present in Bitcoin’s history. The lower the volume traded daily in dollars on a market, the easier it is for a whale with a lot of dollars to manipulate that market. This is what manipulation looks like and there’s nothing we can do about it except factor it into our own potential trading strategy while riding out the waves made by the splashing whale in our little boats.

With Bakkt – another futures market just around the corner, about to be released in July (though constantly being delayed), we could see more of this kind of manipulation occurring. Here the difference is that traders and paid in Bitcoin and not fiat but the same opportunity will be available for whales to cause price spikes or dumps with their large orders. It’s an unfortunate part of the cryptocurrency industry for now, and we will just have to live with it.

Remember too that it was on that fateful day of 17 December 2017 that Bitcoin rose to its ATH of $19 800 or thereabout (depending on which exchange you look at), just one day before another futures market was launched, namely the CME (Chicago Mercantile Exchange).

And of course thereafter the price plummeted amidst tremendous volatility, leaving most of us at a loss. This price action could have also been a result of whales attempting to capitalize on potential 100x leverage profits by going short on the newly opened futures market.

- So the question remains, will the upcoming Bakkt futures market also cause just such a crash based on manipulation?

Ideally it will bring new added investment from larger finance firms and actually push the price up.

What do you think, is there so much manipulation in the Bitcoin market that futures and whales affect the price action, or is it potentially an attractive bonus to have Bakkt coming online soon?

Let us know in the comments below.

Related articles

- The dirty business of wash trading and how it gives crypto a tarnished name

- Bitcoin Just Doesn't Give a Fuck About FUD Anymore — Price Still Soaring — Currently Sitting At 8.2k

- Why FED's Puppet Congressman Sherman Wants to Ban Bitcoin

- Bitfinex and Tether back in the news amid a potentially devastating controversy for the crypto industry

- As bitcoin price breaks the 200 day MA could this be the sign of the bull run?

Contact me on

Discord: Runicar#1726

Telegram: @Runi

Wow...It's like watching a storm gather...

How many here think this is a HUGE upcoming bull trap?...

I think we launch to at least 9.4k in the coming weeks...

then plummet back to 4.5k area?...Lot's of money to be made either way...

I'm one of them! We have been rejected at around 8.1k three times now, implying a huge correction is imminent. 30% would be my guess.

4.5k is an overstatement imo, but in the same time I would like to see the price drop that far down!

Price manipulation is something odd to other while it's good to other. When you make profit of course this is really good. But if you broke then something went wrong to you...

I enjoy the volatility tbh. Makes the entire space much more interesting than if the price was moving in .1% increments.

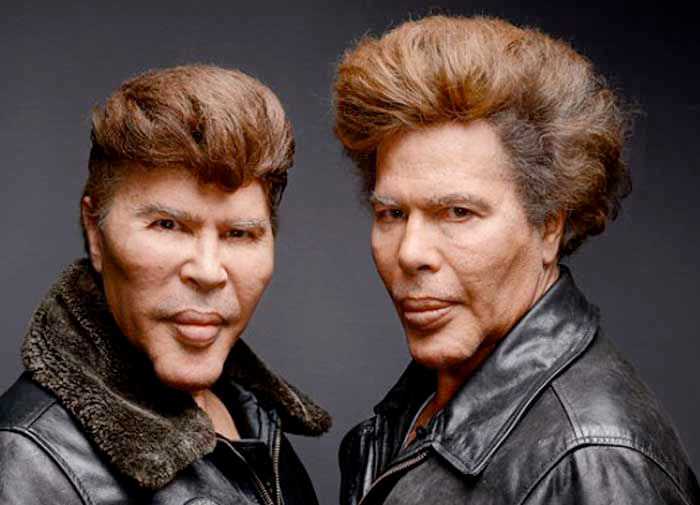

It's actually quite simple- the price is controlled by the Bogdanoffs

🤣🤣🤣🤣🤣

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

it sound easy to do but very difficult and risky to execute as it is impossible that all whale will conspire at the same time to be part of manipulation

Well, you don't really need other whales to collude in order to help move the price as seen in the example from the article just a single whale dumping 5k btc dropped its price down about 26%.

Hi @runicar!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 5.222 which ranks you at #884 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 483 contributions, your post is ranked at #17.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Mind boggling to see bitcoin price heading towards $10,000 mark