I hear opinions and stories and articles all day, but really I care about is this community's outlook on things. Opinions and predictions that are real and not skewed for interviewers or media.

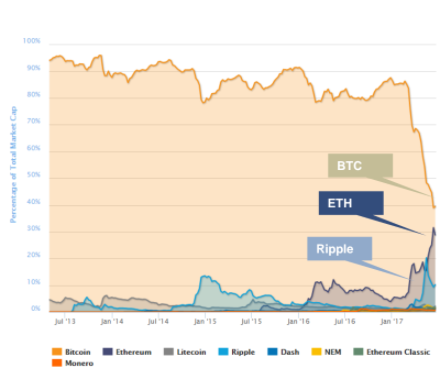

Ethereum's share of the cryptocurrency market has exploded

Ethereum is gobbling up share in the cryptocurrency market.

"Ethereum is not only cheaper than bitcoin, it is also more robust and has more applications outside of simply financial transactions,"

Read more in the article : http://www.businessinsider.com/ethereum-price-sends-marketcap-sky-high-vs-bitcoin-price-marketcap-2017-7

Not pleased about the current price but I suppose its a buying opportunity so if I had any unvested capital I would be very pleased. Steemit is the best thing going since pancakes man! We are going to see big improvements in the coming weeks, months years. Ground floor here going up!

The main thing to keep in mind though when looking at that data is that currently BTC is undervalued, while currently ETH is overvalued. Re-look at this data in mid/late August and I think you will see a much clearer picture at that time.

Just my 2 cents...

I don't feel good about either but I feel better about ETH.

Preach brother haha, feel the best about LTC honestly

I feel the same! Most of my holdings in crypto are in Litecoin!

I think they both have their strengths honestly. The future of currency I feel will be Bitcoin or some derivation thereof. Especially when people get fed up with central banking and/or the the banks themselves fail to catch up with the technology. I think the reason so many investment firms "feel good" about Ethereum is the fact that smart contracts are a potential major cost saver for both internal and external transactions for these firms. With ETH in its infancy and and not yet widely accepted, most of the uses for this feature are speculative until mass adoption, but the MBAs and CFAs at these firms got there for a reason - they see the potential for cost cutting, for circumventing risk, for faster movement from deal close to final liquidity, etc.