I think there are many reasons for why bitcoin may increase in value, but I am too troubled by the current trends to recommend getting into bitcoin at this point.

Many are saying that the bottom may be in, since the outrageous run ups November have vanished, and it looks like at price is again increasing. But these claims downplay the overwhelming moves up which happened before November, and which are considerably less clear from most charts. Lets be clear, Bitcoin made exponential moves in 2017. But that wasn't the only time that it made exponential moves.

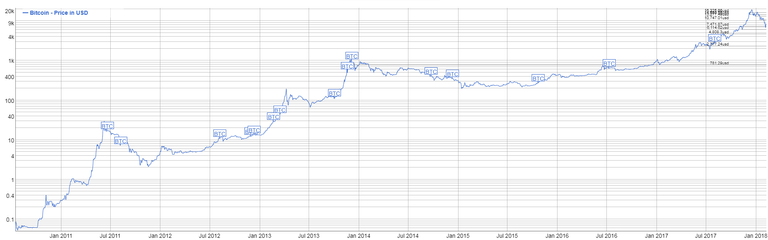

Above is a longer term chart that demonstrates this.

Two things are clear while looking over this diagram:

Gains were most exponential until 2013, after this it backed off.

We can distinguish two noteworthy declines of Bitcoin previously: the end of 2013 and the late spring of 2011. At the two times the value drop kept going quite a long while until the point when it recouped.

The only other plunge which was as large as the present one and didn't wind up in a multi-year slump: was the one occurring from April 2013 until July 2013.

The crash in April 2013 resulted in a price run up to $237 per coin. After a tremendous run up, it crashed rapidly and severely, likewise irritated by a long blackout of MtGox.

One could contend that the conditions of April 2013 are similar to the present condition: colossal press coverage and many retail investors who didn't catch wind of digital currency before are putting resources into it.

Obviously, Bitcoin also has problems with enormous electricity costs, regulation, tether, exchange costs, trade platform shutdowns, and many more.

These sorts of issues have not kept the value of Bitcoin from surging before (and I don't know they will keep this later on) but, these issues may be more pertinent today than two or three years back: The market capitalization of Bitcoin and cryptos are substantially higher now than before, and media coverage is greater than ever.

We also need to keep in mind that the relative market cap of Bitcoin is rapidly declining. In July 2017 it appeared that Ethereum was going to surpass Bitcoin as the world's biggest crypto, an occasion which was nicknamed 'the flippening'. (the flippening hasn't happened and Bitcoin held its position as the biggest digital currency, yet it is down from just about 100% out of 2013 to around 35% today). A decreasing dominance does not have to be a problem if market capitalization of cryptocurrency keeps on increasing indefinitely. But on the long term, this is just does not seem like it is going to happen, or at least not at the degree to which it has in the past couple of years. Add to this the way that Bitcoin is mechanically second rate compared to numerous different digital coins, and it looks like bitcoin might not make any real gains over the next few months, regardless of whether other crypto's would flourish.

Main point: the recent crash in cryptos can end up lasting longer than many would like. Meaning that buying the dip, at least in bitcoin, might not be such a smart move.

Disclaimer: I am not a financial advisor, these are my opinions, do your own research.

Dear red-lotus,

Nice post my friend but I only have to say what I mention below many other posts right now. Do not worry too much. At the latest of March nearly every coin should be bullish again. The third elliott wave is coming, and this wave is big. Btc will at least reach 30k$ this year. Maybe even 50k or 100k$.

We will see.

Nevertheless, btc could drop again but I am more on the upwards side.

Yours truly,

Gandalf The White

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!