For me bubbles are usually; one part soap to nine parts water. Those with kids can probably relate to the fun of creating an extremely delicate, but enchantingly beautiful sphere of liquid, encapsulating a part of your breath; and the following satisfaction of watching it 'pop'. Pretty fun right? Well how fun's a bubble if you're an economist, or a speculator? Let's explore.

We're all probably familiar with the story of how currency came after barter; how money evolved from shells, seeds, stones into coined metals. And how these all were, at one point, the basis for a means of exchange.And as long as something is universally coveted by the majority, then it could and would be used as a means of exchange.

An economist would define a bubble as two parts; 'a rapid and significant inflation of the price (not value) of an asset, that is soon followed by an equally dramatic, collapse in price'. and that 'Bubbles typically arise from speculation or enthusiasm, rather than an intrinsic increase in value of that asset.'

So is Bitcoin a bubble?

Well yes; of course. Just not the delicate kind (but we'll get to why later on in this article). A rise in price from $4600 to nearly $20000 in 8 weeks, followed by a drop to $5800 in the 8 weeks directly following is pretty damn dramatic. So the definition of a bubble: 'a rapid and significant inflation of the price (not value) of an asset, that is soon followed by an equally dramatic, collapse in price' is completely satisfied in this respect; there's no doubt about it.

Hype around Bitcoin was at record levels in December. I personally remember conversations I was having in Jan-June, just before the huge rise, where I stated my highest price prediction for Bitcoin 2017 was at best $5000. Boy did I get that wrong.

But what about the intrinsic value of Bitcoin? Is Bitcoin more valuable than tulip bulbs? Well if you've read my previous article; I've made the case that Bitcoin is the most secure, transparent, immutable and global currency that has ever existed in human history, so if you want to learn why check out that article by clicking the link > (link to that article). So whilst I was shocked by the veracity of the price increase in Nov-Dec 2017; I still believed that $20,000 is probably still undervalued for ' the most secure, transparent, immutable and global currency that has ever existed in human history'.

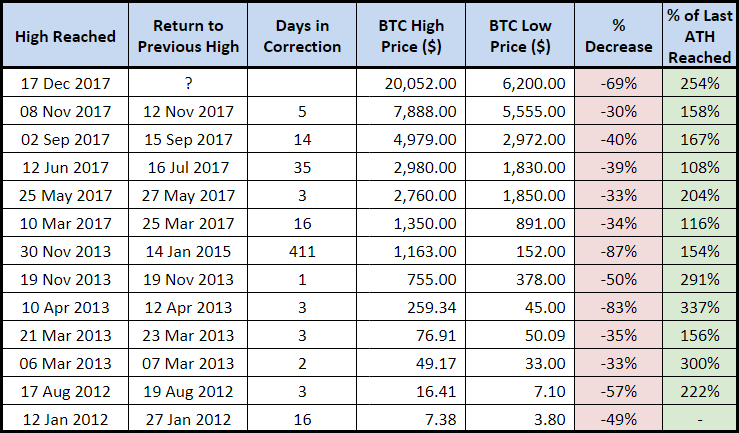

But one thing is certain; there was definitely a bubble cycle of rapid appreciation followed by a huge depreciation in value. And in Bitcoin's short 10 year lifespan; these things aren't new. Actually, they're pretty common, moreover this wasn't even the worst one in terms of % loss.

The table above shows Bitcoin's last 13 bubbles over the last 6 years. There are more. By bubble I mean any drop in price of over 30% following a gain of at least 100%.

The biggest drop was November to January 2013-14; where the price of Bitcoin dropped 87%. As of writing Bitcoin is currently 66% down from its December high.

Personally, this 'bubble' is one I will remember. Why? Because it was THE 'bubble' that I thought was economic end for Bitcoin. I thought to myself; no asset in human history as far as I'm aware has been able to come back from 87% drop in value. And at this point I eagerly anticipated a drop all the way down to 0. And it took me 18 months to realise, it wasn't happening.

However, I did learn a few valuable lessons I'll share with you. Firstly, Bitcoin is a record breaker if you class it as a commodity; it's broken loads of financial records, over and over again. Secondly, a 'bubble' doesn't mean the death of an asset; think housing, DotCom, ect. Thirdly, a bubble could be a sign of an immature and emerging market; think solar panels, computer chips and medicine. Boom and bust cycles have reared their heads in all of these markets just before a technological or operational breakthrough; whether it be 10nm computer chips, hybrid cars or medicinal marijuana; hype, stigma and uncertainty cycles with direct regard to volatile price and value are evident in all.

Money is the oldest form of communication; bartering, the oldest form of money. It existed before we could linguistically communicate with one another.

The first writings were not poems, stories or letters; the first writings were ledgers, showing who owned what, and who owed what.

From this almost intrinsic way of communicating value, we derived the gold standard, which evolved into fiat currency, that then evolved the Breton Woods agreement, where now your national currency is issued by a central bank pegged to the US dollar. And these systems of exchanges aren't fit for intended purpose, they’re excellent in some ways. It’s a great system for producing value for certain industry sectors, it’s great at generating innovation like the internet, cars, radio, Tor, etc. But there is a lot to be desired. It isn’t that easy to send it all around the world (try and take more than 10k in cash to an airport with the view to travelling with it, what happens?), it isn’t easy to control, it’s really easy to counterfeit, and it’s near impossible to track. Yet, we rely on our monetary policy to track and dictate the entire health of the economy. These same systems rely on software and networks that were developed in the 70’s, that is pretty dated (if not technologically ancient) to say the least.

Bubbles exist and are pretty much everywhere you look, more recently, they’ve come to shape markets that are either highly coveted (like housing) or extremely disruptive (like the dot.com bubble).

More importantly bubbles exist due to our monetary system; you’d be hard pressed to convince me that no less than 90% of all of the money in the global economy is currently used for financial speculation. The economy of the planet/wealth of a nation is measured by how effective we are at speculating, producing bubbles and knowing when to cash out.

What happened last year with the cryptocurrency market is that we finally got one of the most documented & mathematically accurate depictions of a real life bubble market psychology.

And after studying this technology in depth for the last 3 years, (and having an interest for 8); there is no doubt in my mind that this technology has groundbreaking capabilities; capabilities that we have barely scratched the surface of.