(picture source- www.pixels.com)

There’s one high-quality feature of cryptocurrencies that nearly all people looks to have missed, together with Satoshi himself.

But it’s there, hidden away, progressively gathering electricity like a typhoon far out to sea that’s sweeping in the direction of the shore.

It’s a stealth feature, one that hasn’t activated yet.

But when it does it will ripple across the entire world, remaking every aspect of society.

To apprehend why, you just have to recognize a little about the history of money.

The Ascent of Money

Money is power.

Nobody knew this better than the kings of the historic world. That’s why they gave themselves an absolute monopoly on minting moolah.

They became shiny metal into coins, paid their soldiers and their troopers offered matters at nearby stores. The king then despatched their troopers to the merchants with a simple message:

“Pay your taxes in this coin or we’ll kill you.”

That’s nearly the whole history of cash in one paragraph. Coercion and manipulate of the furnish with violence, aka the “violence hack.” The one hack to rule them all.

When electricity passed from monarchs to nation-states, distributing strength from one strongman to a small crew of strongmen, the strength to print money surpassed to the state. Anyone who tried to create their personal money bought crushed.

The purpose is simple:

Centralized enemies are effortless to spoil with a “decapitation attack.” Cut off the head of the snake and that’s the quit of anybody who would dare task the power of the nation and its divine right to create coins.

That’s what happened to e-gold in 2008, one of the first tries to create an choice currency. Launched in 1996, by using 2004 it had over a million money owed and at its peak in 2008 it used to be processing over $2 billion greenbacks worth of transactions.

The US government attacked the four leaders of the system, bringing prices in opposition to them for money laundering and walking an “unlicensed cash transmitting” business in the case “UNITED STATES of America v. E-GOLD, LTD, et al.” It destroyed the corporation through bankrupting the founders. Even with mild sentences for the ring leaders, it was once recreation over. Although the authorities didn’t technically shut down e-gold, virtually it was once finished. “Unlicensed” is the key phrase in their attack.

The power to grant a license is monopoly power.

E-gold used to be free to apply for interstate money transmitting licenses.

It’s just they have been in no way going to get them.

And of course that put them out of business. It’s a living, respiration Catch-22. And it works every time.

Kings and kingdom states know the actual golden rule:

Control the cash and you manage the world.

And so it’s long gone for thousands and hundreds of years. The very first emperor of China, Qin Shi Huang (260–210 BC), abolished all other forms of local currency and added a uniform copper coin. That’s been the blueprint ever since. Eradicate choice coins, create one coin to rule them all and use brutality and blood to keep that electricity at all costs.

In the end, every device is prone to violence.

Well, nearly every one.

The Hydra

In decentralized systems, there is no head of the snake. Decentralized systems are a hydra. Cut off one head and two greater pop-in to take its place.

In 2008, an anonymous programmer, working in secret, figured out the solution to the violence hack as soon as and for all when he wrote: “Governments are good at reducing off the heads of centrally managed networks like Napster, however pure P2P networks like Gnutella and Tor seem to be conserving their own.”

And the first decentralized device of cash was once born:

Bitcoin.

It was once explicitly designed to resist coercion and manage by means of centralized powers.

Satoshi accurately remained anonymous for that very reason. He knew they would come after him due to the fact he used to be the symbolic head of Bitcoin.

That’s what’s occurred each time someone has come ahead claiming to be Satoshi or when any one has been “outed” by the information media as Bitcoin’s mysterious creator. When faux Satoshi Craig Wright came out, Australian authorities right now raided his house. The reliable cause is constantly spurious. The real reason is to cut off the head of the snake.

As Bitcoin rises in value, the hunt for Satoshi will only intensify. He controls at least a million coins that have never moved from his unique wallets. If VC Chris Dixon is proper and Bitcoin rocket to $100,000 a coin, those million cash will shoot up to $100 billion. If it goes even higher, say a $1 million a coin, that would make him the world’s first trillionaire. And that will only bring the hammer down more difficult and faster on him. You can be 100% positive that black ops units would be gunning for him around the clock.

Wherever he is, my recommendation to Satoshi is this:

Stay nameless till your loss of life bed.

But resistance to censorship and violence are solely one of a quantity of gorgeous features of Bitcoin. Many of those key elements are already at work in a wide variety of other cryptocurrencies and decentralized app projects, most notably blockchains.

Blockchains are dispensed ledgers, the third entry in the world’s first triple-entry accounting system. And breakthroughs in accounting have usually presaged a huge uptick in human complexity and monetary growth, as I laid out in my article Why Everyone Missed the Most Important Invention in the Last 500 Years.

But even triple-entry accounting, decentralization and resistance to the violence hack are no longer the real energy of cryptocurrencies. Those are purely the mechanisms of the system, the way it survives and thrives, bringing new capabilities to the human race.

The remaining characteristic is one that Bitcoin and modern-day cryptocurrencies have only hinted at so far, a latent feature.

The actual strength of cryptocurrencies is the energy to print and distribute cash besides a central power.

Maybe that looks obvious, but I assure you, it’s not. Especially the 2d part.

That strength has continually rested with the divine right of kings and nation-states.

Until now.

Now that proper returns to its rightful owners: The people.

And that will blow open the doors of world commerce, sowing the seeds for Star Trek like abundance economics, leaving the Old World Order of pure shortage economics in the pages of records books.

There’s simply one problem.

Nobody has created the cryptocurrency we virtually need simply yet.

You see, Satoshi understood the first phase of the maxim, the strength to print money. What he neglected was once the strength to distribute that money.

The 2d part is without a doubt the most integral part of the puzzle. Missing it created a imperative flaw in the Bitcoin ecosystem. Instead of distributing the cash a long way and wide, it traded central bankers for an un-elected group of miners.

These miners play havoc with the system, holding lower back a whole lot needed software improvements like SegWit for years and threatening pointless difficult forks in order to power down the fee with FUD and scoop up extra cash at a depressed price.

But what if there used to be a unique way?

What if you ought to diagram a device that would absolutely alter the monetary panorama of the world forever?

The key is how you distribute the cash at the second of creation.

And the first group to recognize this possibility and put it into motion will alternate the world.

To recognize why you have to seem to be at how money is created and pushed out into the device today.

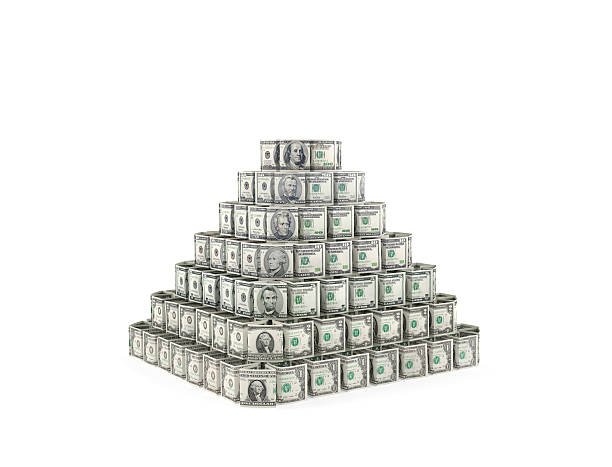

The Great Pyramid

Today, cash begins at the top and flows down to every body else. Think of it as a pyramid.

In fact, we have a famous pyramid, with a 0.33 eye, on the dollar itself.

One of the most cliched arguments towards Bitcoin is that it’s a Ponzi or “pyramid” scheme. A pyramid scheme rests on the original creators of the system roping in as many suckers as possible, paying them for enrolling people in the device alternatively than by providing items and services. Eventually you run out of people to convey in and the entire things collapses like a house of cards. A Ponzi scheme is basically the same, in that you dupe the authentic investors with fake returns on their initial investment, a la Bernie Madoff, and then get them to rope in greater suckers because they’re so elated by the huge returns.

The irony of course is that fiat currency, i.e. authorities printed cash like the Yen or US dollar, is closer to a pyramid scheme than Bitcoin. Why? Because fiat money is minted at the pinnacle of the pyramid via central banks and then “trickled down” to anybody else.

The only problem is, it doesn’t trickle down all that well.

It strikes out to a few big banks, who both lend it to humans or provide it to human beings for their labor. In fact, having a job or getting a mortgage are the foremost techniques that humans at the bottom of the pyramid get any of the money. In different words, they trade their current time (with a job) or their future time (with a loan) for that money. It’s simply that their time is a constrained resource and they can solely exchange so an awful lot of it before it runs out.

Think of economics as a game. Everyone in the device is a player, searching to maximize their gain and the gain of their team (a company, their household and friends, etc.) to get extra of the money. But to start the sport you need to in the beginning distribute the money or no one can play. Distributing cash units the enjoying field.

Now if you have been in cost of the money, how would you distribute it to the network? You’d want to preserve as a whole lot of it for yourself as possible, so you’d set the policies to maximize your personal private advantage. Of course you would! That’s what each person in their right thought would do, maximize their personal electricity to keep it for as lengthy as possible.

That’s exactly what the kings and queens of the historical world did, and that’s what state states do today. As Naval Ravikant stated in his epic sequence of tweets on blockchain, today’s networks are run by using “kings, corporations, aristocracies, and mobs.” “And the Rulers of these networks [are] the most effective humans in society.”

That’s why each and every single system in the history of the world has dispensed the money in one way:

From the top down.

Because it maximizes the gain of the kings and mobs at the top.

Unfortunately, that means most of the cash never really leaves the top. It stays right there, as wasted and frozen potential that’s by no means realized. There is little to no incentive for the money to move. Since money is power, hoarding it is actually hoarding extra electricity and no person would willingly provide up that power.

In other words, the recreation is rigged.

What we want is a way to reset the game.

Up till now, our potentialities looked very dim.

For example, we ought to pass a law, like a Universal Basic Income (UBI). That would provide anybody a stream of money, pushing it out throughout the complete enjoying field and giving more people a risk to participate in the system. If more humans can participate, we liberate all kinds of hidden and untapped value.

How many wonderful inventors by no means managed to create their subsequent leap forward because they were stuck riding a bus seven days a week to feed their family, with no hope of free time or any clear course to digging themselves out of debt? How many splendid writers went to their graves by no means having written their incredible novel? How many budding scientists never discovered the therapy to cancer or coronary heart disease?

The hassle with all of the plans before now, from UBI to socialism (high taxes on the rich to unfold the wealth across the game) is that to redistribute the cash after it’s already been allotted is nearly impossible. The people with that money rightfully resist its redistribution. And as Margret Thatcher said “The trouble with Socialism is that sooner or later you run out of other people’s money.”

But what if the money is NOT already distributed?

What if we don’t have to take it from everybody at all?

The inevitable consequence of all fractional reserve lending booms is bust.

That’s the missed chance of all of today’s cryptocurrencies. Cryptocurrencies are developing new money. And not like savings markets, which solely faux to increase the money supply, by way of lending it out 10x with fractional reserve lending, cryptocurrencies are actually printing money. And they aren’t loaning it to people, they’re giving it to them for their service to the network.

It’s like microloans, except the loans.

As Naval said: “Society gives you money for giving society what it wants, blockchains provide you cash for giving the network what it wants.”

So alternatively of giving all the money to a small crew of miners, what if we could do better? A lot better?

We can.

I outlined one way in the an article about the Cicada project, How We Deliver a Universal Basic Income Right Now and Save Ourselves from the Robots. The Cicada sketch flips the concept of mining on its head. Everyone on the community is a miner and no person can have greater than one miner.

Miners are drafted randomly to keep the community going for walks smoothly. You might be on foot along, getting espresso and your phone gets referred to as on to invulnerable the community for a few minutes. After that it goes right again to sleep. As a reward, you may win new cash for doing nothing however having the application on your phone. Simple right?

Because everyone is in the end drafted, all people gets paid, in essence creating a UBI right now.

And that’s just one way.

If you think about it you can come up with dozens. Oh and don’t get caught up with wondering the only way to do this is with an ID. Lots of methods to randomly draft miners barring that too. The key is to free your mind of the “Satoshi box” and assume different.

What we certainly want is to completely gamify the shipping of money, distributing it a ways and huge at the second of creation.

Money is a Game. Embrace it.

Give it out as rewards for the usage of apps, or as disbursed mining fees, or as shared cuts of the mining fees to organizations that furnish fee to the network are just a few more methods to do it right. Those are just the tip of the iceberg. There are hundreds of approaches however we just haven’t been thinking about the problem the right way.

In other words, we overlooked the real electricity of Satoshi’s creation: the distribution of money.

The first machine that simply gamifies the transport of cash will rocket to exponential growth, upending the contemporary machine for good. That will set the preliminary playing subject dynamically and enable gamers who in no way would have gotten into the recreation to compete. The extra human beings who can participate, the more efficient and precious the network becomes.

“Networks have “network effects.” Adding a new participant increases the value of the community for all current participants.”

Right now, we’re no longer adding new contributors quickly sufficient to the cryptonets of tomorrow. The device is still inclined to the violence hack. Gamified cash is the reply to exponential growth.

If the machine can grow massive enough, speedy enough, it will emerge as an unstoppable juggernaut, and the rest of the financial universe will need to come over to the new playing field.

Once the Amazons and Google’s of the world be part of the playing field, their self-preservation instinct will kick in and they’ll choose to protect and enlarge it. And this new community will behave differently. Instead of beneficial just the humans at the top, who’ve been rigging the regulations in their prefer on the grounds that the commencing of time, the game will definitely reset with a new set of rules.

What’s high-quality for the whole network, now not just the few gamers at the top, is best.

“Blockchains are a new invention that allows meritorious members in an open community to govern besides a ruler and without money. They are merit-based, tamper-proof, open, balloting systems. The meritorious are these who work to increase the network. Blockchains’ open and advantage based totally markets can change networks until now run by using kings, corporations, aristocracies, and mobs.”

Those that be part of the community and help it grow will thrive and flourish with it. It will amplify their very own value, making it develop faster than at any point in history. Every ounce they supply to the system will enlarge their very own rewards.

By contrast, economies that stand towards the network, attempting to cripple it with arbitrary rules, will pay a heavy price. The device will stretch throughout the globe and solely the most indispensable policies will take root, because in order to improve a allotted system, you want giant consensus throughout the network. Since people can commonly only agree on big, imperative solutions, no self-defeating, narrow-minded policies will be allowed.

Let’s say that a u . s . decides to hinder ICOs to their citizens altogether or make cryptocurrencies illegal. Instead of killing the network, the policies will blow returned on their creators. Only their very own humans will suffer, as they won’t be in a position to participate in the explosion of new attainable that ICOs bring to the table, draining money out of the financial system into rival economies. Even worse, if they make cryptos illegal, they’ll without a doubt power that money underground, which will keep them from getting tax from their citizens, which will starve them of revenue.

As the system spreads it will put human beings back in manipulate of their very own economic power. No one will be able to take your cash from you. And that is a right thing.

Of course, no longer each person thinks so. Some people usually worry that humans will do terrible things with this power, like commit crimes. But human beings will continually do awful things. They do these things now and they continually have. Crippling the device for each person just to get those people is the top of insanity. It has never worked and it by no means will.

Still, some human beings will by no means agree with that.

They believe their central powers unquestioningly. All you have to do is wrap up your argument in “protecting the children” or “fighting terrorism” and you can normally idiot 1/2 of the human beings half of the time about any terrible coverage you want.

Yet I’ve observed that humans who see central structures as the answer to everything have generally lived in a secure central gadget for their total lives.

A few days in an unstable machine would alternate their minds very quickly.

Don’t accept as true with me?

Imagine you lived in Syria proper now.

Your central infrastructure is destroyed, as is your money. You don’t desire the war, however there’s nothing you can do about it. Now your house is gone, your pals and household are dead, your banks are bombed out and you’re cast out, adrift, homeless and penniless. Even worse, no one desires you. The world has shifted from open borders to constructing partitions everywhere. You’re no longer welcome anywhere, you can’t remain the place you are and you’re broke.

But what if your cash was still there, recorded on the blockchain, ready for you to download and fix a deterministic pockets and give it the right passphrase to repair it?

How an awful lot less complicated would it be to begin your lifestyles over?

Cryptocurrencies eventually offer a way for us to manage our very own destiny. For the very first time in the records of the world, we have a way to generate and distribute cash barring a central power. People will have manipulate over the cash they rightfully earned.

And even better, rather of placing the taking part in subject so the game is constantly rigged, we can set the recreation up the way it was usually supposed to be played, with open competition and flexible regulations in a dynamic system that approves all people to compete.

But we want to assume big. We need to locate a way to distribute the cash far and huge besides taking it from all people else. Do that and we alternate the sport forever.

Hope you all like my blog, and if anyone any question regarding this than feel free to ask in the comment box.

Rahul Pareek

Thank you to tapash bhai for first person to upvote me on this post...

No Mention you post is awesome that is why I upvoted you

thank you brother for your appreciation

Yes you are right, decentralization power is same as like HYDRA......

That's why i believe more on decentralized than centralization.

That's why i believe

More on decentralized than

Centralization.

- rahul-pareek

I'm a bot. I detect haiku.

How you get idea to write this mindblowing article

Hehehehe its top secret....

oooo come on rahul, i know you are enough intelligent................that's y i ask you share idea also with me

Sure sure dear ....i will share with you every idea next time

Mr. rahul pareek, your great pyramid is awesome.

heheheh thank you Mr. ramawat

yes bro. even i plan to make the same with my friends

sure sure aakansha

Hii bro awesome blog as to info. for decentralisation power..

thank you ragav, even the system of decentralization have more potential than centralization

The way of presentation is too good, but rahul

Is really decentralization better than centralized system

Yes bro. Even the future market is totally based on decentralization

yes you are right........may be in the future cyptomarket beat each and every other security market

yes wait till 2020.....you will get great return