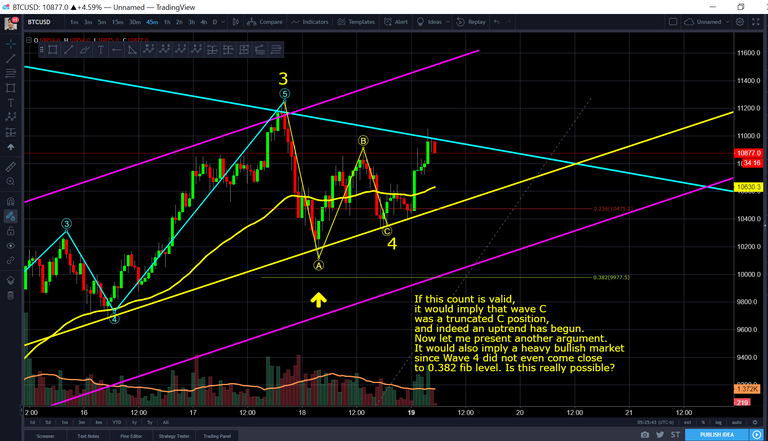

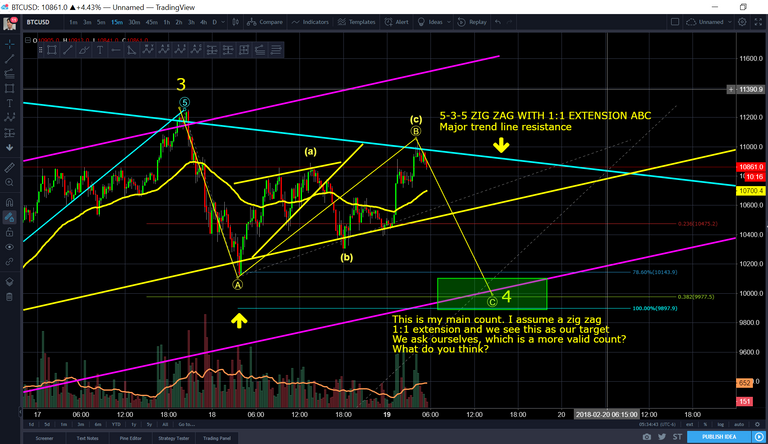

General tone. Indecisive Elliot Wave Count. I do not believe this is the end of correction

We hit a critical resistance. There are two counts of EW which of concern. We have not reached even 382 fib retracement, which would imply that if this is an uptrend, this would be an incredibly bullish market.

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Neutral

Short Term Bias (Today) - Neutral

Long Term Target Prediction - Primary Wave 3, $35,000+ by 2019

Long Term Target Prediction - Primary Wave 5, $50,000+ by 2020

I would firstly like to state the rules of alternation, which summarized implies that corrective wave 2 and 4 have a difference in expression. Simply put,

- If Wave 3 retraces little we can expect wave 4 to retrace more.

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If I've helped you, consider buying my dog, Luna, a beer in her tip jar

BTC: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

NEO: AaZu8fiiMW3vnizUaSkRj6JoobswkeCKPQ

EOS: 0x2538b728f9682fc1dc2e7db8129730f661753850

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 4110054236

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

TY for this. I'm a large Bitcoin Cash supporter on Twitter. so I know a lot about the hate and vitriol you receive when they say "your messing with my money." I've learned if it is directed towards me or is just ad hominem or name calling. I just ignore it or respond with a peace love and Scooby snacks comment. if it does question my study or knowledge, Then and only then do I respond with facts and data and only if they are NOT my regular trolls. this helped me a ton in dealing with the hate. I also realized when I stopped calling out the trolls & fighting with them. my followers increased rapidly. I've only started trading recently because until Nov 12 2016 I was a Hodling Bitcoin maximalist.

I have found quite a few trading channels and you TEACH, for free, and also admit when you don't know or are wrong. Keep up the great work and know MORE PEOPLE will end up appreciating you than hating you. Oh and FYI I have never blocked anyone(except scams & spam) when you ignore them. most get bored and g away.

Thanks for the updates Philakone <3

what if the 3rd wave is not done....?

also because of same degree in the same channe ....

makes sense. Much appreciated!

you are a flipping machine!!! forget TA charts - you gotta tell us what you eat bc I want 1/10th of your energy.

Lol! I'm not even sure he sleeps :)

He eats cornflakes thats why hes so corny

Should we read it like "wave 2"?

YES. Great puzzle we got here hehe

Just a little bit further in the guidelines ('alternations within impulses'):

"If wave two of an impulse is a sharp correction, expect wave four to be a sideways correction, and vice versa".

Looking at your previous count here :

https://steemit-production-imageproxy-thumbnail.s3.amazonaws.com/DQmSctVLkk7dKzfjkpgVgAn2CoovqDVb3acY7VtkcUgfi3h_1680x8400

That 4th seems quite sideways indeed, in indsight.

Wouldn't that imply a very bullish 5th wave ?

(Note : I still have to watch the video, sorry - I'll get to it right now)

Ok, video watched. Aaaand of course you covered it :)

I guess I'm also making a mistake by saying the 4th looks sideways. It doesn't. (Yet ?).

... That being said, that noob here still have to get through the second part of your tutorial series and yet tries and dares to count Elliot Waves ; can you freakin' believe it ??

Well, I'll shut my mouth and wait till I have a better understanding of all this ^^

Thanks again for sharing your work.

Cheers.

Amazing TA! Always great work! You've been right thus far these past few weeks.

It's the 3rd day we're flirting the 55 EMA daily trying to break it upwards. The last time it took BTC around 7 days to test 55 ema for a final break down, so I think any break up will take another few days, which should allow time for correction back to at least the .382 levels.

This will be more "healthy" as an uptrend.... as compare to that "very bullish" scenario. I rather BTC raise up slowly with more support levels than a quick spike up...

Having said that, I measured it's a 1-1 ratio from the bottom 6000 to the current 11300 level - fit exactly forward waves up.... which can be either a 1-2-3 impulse wave up (to break above $12k in its 5th wave) or else all these are just a big zigzag ABC correction upward (the $5K scenario)?

Don't let the haters discourage you. I have lost quite a bit these last two night off shorting with the help of your TA. I def don't blame you, you have been spot on for months.

Great work, Philakone, as always. I am wondering, though: do Eliot Waves make sense in ALL cases? Can't what we're seeing right here be an exception?

upvoted, thank you!! :)

Good post!

New:

https://steemit.com/bitcoin/@analysisman/daily-report-btc-steem-eth-xmr-ltc-dash

upvoted

Thanks mama whale! Haters are usually louder than supporters unfortunately. If people don't like your TA, you have provided so many brilliant tutorials so they can do their own. Also I think its important for us baby whales to see that sometimes the unexpected happens and we have to readjust our TA based on the new information.

Please don't let the loud minority change what you do. I love all the TA, tutorials and just pure entertainment you provide! You are appreciated x

Philakone, the Crypto-community can be toxic. Immature, inexperienced people who won't take responsibility for there losses and blame others, or spread hate when you dare mention the "C" word (correction). I was watching your video today, lights were going of in my imagination. This last wave had me lost and I was beginning to get anxious. Your video was a godsend. Please stay strong, realise that within the community you're considered an idol and many of use appreciate what you do.

Yes, I charted this today and was asking traders in my group if this could work. I read in Frost and Prechter that ABCDE must be composed of 33333 and each can then be 535 ABC subwaves.

What do you think now?

This also

applied to the traditional markets... yea we all know that. But the question is...does crypto behave the same way

?

To answer the question from the first chart, if it is possible to be THAT bullish, I'd ask how does the current movement compare to the December run and its retracements? This current run certainly doesn't feel as a crazy parabolic one, so I'd expect its retracements to be more pronounced than in Dec.

(sorry, I got into crypto for less than 2 months, even less into TA and I have no idea what happened on December charts, nor am I able to analyze them unbiased and without hindsight :( )

Another great video. Thank you for all you do!!!!

Philakone, great analysis as usual. Many of us appreciate what you do. I finally got my Steemit account approved (after 2 months) so I was able to finally upvote you today.

I have one small request please: can you help me put an Elliott count on EOS? I have been banging my head trying to figure it out, and just don't know what is going on there.

Thanks again bro!