With the latest implementation of Desktop Scatter, Paytomat team is able to add more EOS dapps to our marketplace. This is why you might have noticed a variety of new dapps entering our wallet. On top of that, we try to diversify the categories of the dapps we’re working with.

This time we present a Zigzag project which is essentially a lending service based on EOS smart contracts. It is a mutual project between AtticLab, an EOS Block Producer, and Paytomat, the developer of Paytomat Wallet.

While we don’t want to focus on the technical details here, it’s important to understand the basics of stable coins and their application.

Application

Stable coins became really popular lately among IT companies (Facebook), as well as the biggest financial institutions (JP Morgan, Circle, Coinbase). This trend is rather intriguing since the core concept of decentralization is not as vivid as for Bitcoin/altcoins holders. However, most of the people find this approach rather promising because it prevents volatility and stress issues. It’s a lot simpler to pay salary in TUSD, rather than Bitcoin, because a person doesn’t have to rely on the market’s condition and worry about the price appreciation/depreciation.

Apparently, the actual process of collateralization of any asset (fiat currency, commodity, stock, ownership) comes with a major drawback. Turns out you can use only one native token as collateral. It depends on the blockchain you’ve chosen to issue your asset-pegged tokens on, and you simply can’t change it. This becomes very expensive and time-consuming if you need to collateralize digital assets of other blockchains. Therefore, the demand for collateralized stablecoins across multiple blockchain networks is still untapped.

The solution

To solve this issue Zigzag introduces collateralized debt positions (CDPs). CDPs can be opened by depositing digital assets into the service’s smart contract, which issues and transfers ZIGs in return. Borrowers then can either convert their ZIGs into fiat currencies or buy more digital assets with them, thus, leveraging their long positions. Borrowers pay a daily fixed interest charged in ZIGs. Its rate is determined at the inception of the CDP.

The platform is powered by two tokens — ZIG and ZAG. While the former is a stablecoin backed by collateralized digital assets with the exchange rate target zone at 1 USD/ZIG, the latter is a security token serving governance purposes and profit distribution. ZigZag primarily targets traders, offering them an instrument for adding leverage to their long positions in digital assets in a transparent way.

The dapp

The easiest way to show how this model works is to go to the Zigzag dapp. As we already mentioned, you can find it in the Finance section of Paytomat EOS dapp marketplace.

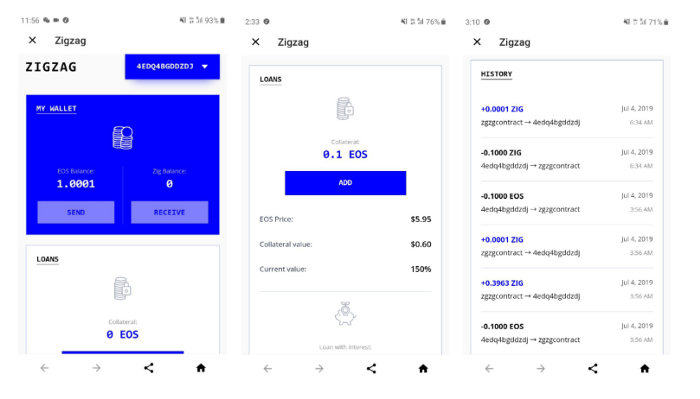

The interface of Zigzag is very straightforward and has 3 blocks.

- My wallet — shows your balance in EOS and ZIG.

- Loans — shows the collateral value in both EOS and dollars, as well as the interest for your loans.

- History — shows your lending history.

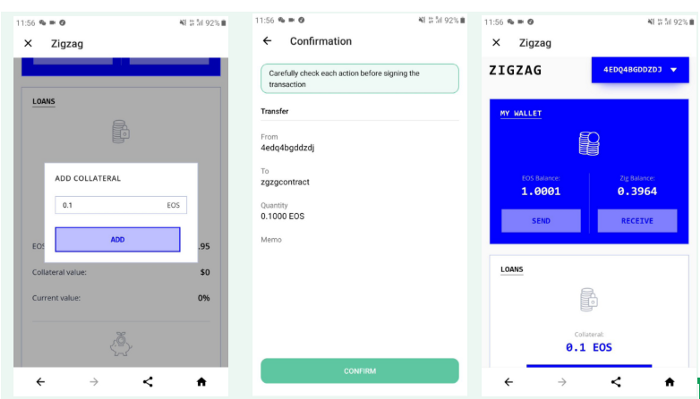

Adding a new loan

To add a new load, you simply scroll to the Loans block and click ADD. You’ll see a popup window where you need to input the amount of EOS you’re willing to use as a collateral to receive your loan. Then you need to verify transaction with your fingerprint/password and you’re good to go.

It is always a good idea to double check you balance first, just to be sure that you actually have the amount of EOS you want to use for your loan. If everything went according to plan, your Zig balance will be changed in the following exchange ratio: $1.5 deposited = 1 ZIG. Notice, the exchange ratio can be adjusted over time due to a flexible collateralization ratio (CR). Please, read Zigzag whitepaper for more details on CR.

How to use ZIG

There are multiple potential use cases for ZIG:

use it as a leverage to buy more cryptocurrencies (EOS, Bitcoin, Ethereum);

convert it to fiat currency (USD, EUR, CNY) and use for business/personal needs;

hold during the times of extreme volatility to have a chance of buying an asset at a lower price;

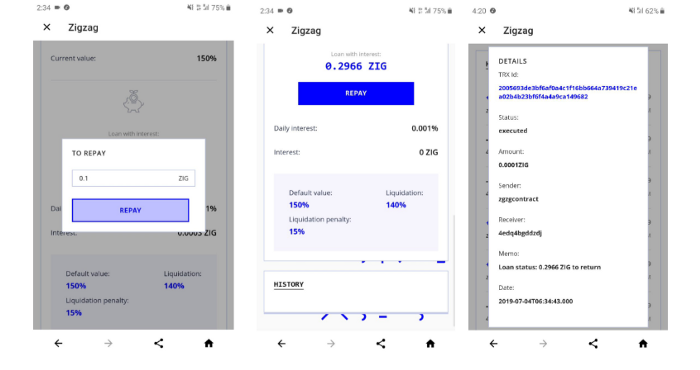

Repaying the interest

In order to have a profitable business model, each loan service is charging an interest. It can vary from daily to monthly but the purpose is the same. Zigzag has a daily interest model, (0.001% daily) . The payment is made in ZIG to decrease volatility issues of EOS or any other asset that will be added in the future as collateral.

In order to repay the interest, you click the REPAY button in LOANS block, enter a ZIG amount you want to pay back to Zigzag for using loan services and verify your transaction. The process is very similar to adding a new loan, thus you shouldn’t experience any difficulties.

After you repay, you’ll see that ZIG balance has decreased, which means you paid back a certain amount of ZIG to Zigzag platform (in our case we had 0.3964 ZIG and left with 0.2966 ZIG).

By the way, you may notice frequent transactions with a memo which shows Loan status. These occur every 24 hours to notify that you need to repay your interest.

As you can see, taking a loan doesn’t have to be a complex and long procedure. By removing the middlemen and putting everything on smart contracts, we achieved a decent level of transparency and decentralization in this niche. To learn more about Zigzag, please visit zigzag.finance

Congratulations @paytomat! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

AMAZING little feature in the wallet!!!!

hey is there STEEM on paytomat yet?!?!?!