In light of the upcoming Easter Holiday in tandem with houseguests arriving tomorrow evening, tonight’s update will be a bit more like a weekend overview.

We Don’t Get Fooled Again

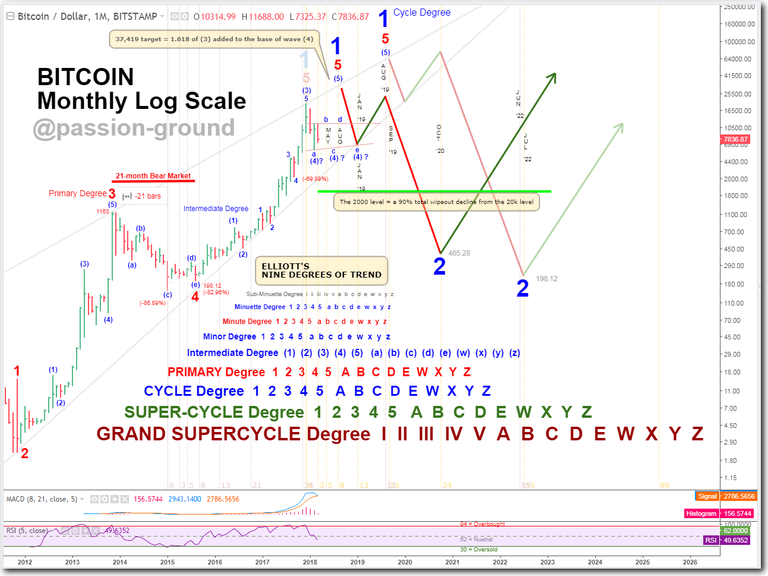

The big takeaway in this update surrounds using the largest of timeframes to aid in forming the structure of one’s technical thesis and to then translate and track the ongoing efficacy of said thesis onto the smaller timeframe charts.

Furthermore, both the “preferred” and “alternate” standing counts adopted should have equal plausibility in their respective possible outcomes. The essential discipline is to then track and reconcile each respective and viable pathway with the utmost of objectivity based solely upon the unfolding price action as it occurs in real-time.

I have already done this largely with my current analysis, however, tonight; I will bring to you an alternate count that may well facilitate the long slog of a 13-month bear market.

Representing my long-standing motto when it comes to wave-counts and technical analysis, “The Who” (these old fu!kers from my generation can still rock-it, man) sum it up quite well when they insist, “We Don’t Get Fooled Again!” I hope you enjoy tonight’s Special Pre-Holiday update.

Happy Easter!

…Key Statement:

Longer-term, given the possibility of the alternate count presented tonight, we should not be surprised to witness a torturous slow-burning sideways market punctuated by a series of false fits and starts for the remainder of 2018.

_As for the short-term, the trend remains down and enmeshed in what I believe to be a bottoming stage prior to the next rally attempt. 7297 and 7250 are two near-term downside targets to expect should 7742.11 fail to hold as an interim pivot low.

| Short-Term | Bias | Target | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|---|

| Hourly Chart | Bearish | 7,297 | 7,658 | 6,175 | 8,198 | 8,366.00 |

| Medium-Term | Bias | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|

| Daily Chart | Bearish | 7325.37 | 5920.72 | 9,188.10 | 11,688 |

| Long-Term | Position Bias | Date | Price |

|---|---|---|---|

| Weekly Chart | Short | 3-12-2018 | 9535.04 |

| SECULAR | Bias | Low 2018 | Target 2018 |

|---|---|---|---|

| Monthly Chart | Bullish | 5,920 | 12,235 min / 37,419 max |

…You Can’t Miss with Swiss-Chris!

Otherwise known as @famunger, Chris puts together a daily recap of all the top technical analysts across STEEMIT, and beyond. He does so in order to provide the community at large with the best possible forecasting guidance relative to the price of BITCOIN, and by default, the balance of the crypto-world at large.

In checking out @famunger’s daily recap, you simply can’t miss! His collective assessments of all the select analysts are akin to getting the very best snapshot of what the near and long-term future is likely to hold for those with a vested interest in BITCOIN and the multitude of coins, tokens, and alternative currencies that BITCOIN clearly paves the way for.

…BTC Update

Right Click and open in new tab to view full size image.

…Video Update

Select HD and “Full-Screen” for the utmost clarity in viewing this video update.

I trust that the preceding analysis was generally objective, explicitly actionable and informative, and of relative and meaningful value for all those who perceive such analysis as a backstop to their individual ends.

Until next time,

Peace, Love, and Justice for All

In closing, I’d like to impart the following shout-outs to all of my fellow analysts here on the STEEMIT platform and beyond:

They are in no particular order:

To Tone Vays for his incredible energy in producing a wide variety of valuable content along with his proprietary version of Tom DeMark’s sequential indicator.

To @ew-and-patterns for inspiring me to get back into TA, and for his level of professionalism and balance in sharing his views with the community.

To @lordoftruth for his always awesome graphics and his undeniable commitment to report on his latest sentiments with regard to the price of BTC.

To @philakonesteemit for his honesty and in-depth look at market structure via order-books, short-term trading dynamics, EWT, and the like.

To @haejin, despite the seemingly never-ending flag-wars associated with his account, he nonetheless imparts a measured assessment of BTC market dynamics relative to EWT theory that is worthy of consideration – in spite of anything else that might be going on with regard to the ongoing controversy surrounding “reward pool” dynamics.

DISCLAIMER: This post and all of the analysis contained herein serves general information purposes only. I am not a registered financial adviser. The material in this post does not constitute any trading or investment advice whatsoever. The trend-following strategies explained herein are for example only, and should not be construed as trading or investment advice in any way. The same thing goes for anyone subscribing to the Long-Term Trend Monitor. The subscription simply shares with subscribers what several automated trend-following systems are doing, and that’s all. The bullish and bearish alerts provided therein are for information purposes only, and they are not to be construed as advice to buy or sell. At the time of this writing, the author does not hold any positions in BITCOIN or any other crypto-currency. Please conduct your own due diligence, and seek counsel from an accredited financial advisor before making any trading or investment decisions. Should you decide to mirror or copy any investment or trading examples from this or any other related source, the decision to do so is entirely your own - as are the inherent risks involved in doing so. I am not responsible for any of your losses. By reading this post, you acknowledge and accept to never hold me accountable for any financial losses. Thank you.

Thank you for the excellent analysis, once again! And the Who music video was wonderful!

Cool, brother... so glad you enjoyed this, man... My hope is that the ancillary entertainment in concert with viable and objective technical analysis will keep all those whom I care about, and all those following along, in a most advantageous place from which to frame their respective "Hopes and Dreams."

You are the best!

Thank you for saying so, my friend! I try my best to deliver the goods in the most objective and unbiased way humanly possible.

hello. I do not know much about BTC, exactly this is the other point of the view about market development. thanks. the article is very informative.

Very interesting friends, you have a good talent in steem