As the public attention turns towards bitcoin and other cryptocurrencies, the most common lament heard is in regards to its volatility. As most readers are aware, a ten, twenty or even thirty percent fluctuation in price is commonly the norm, with smaller cryptos changes over 100 percent. The uninitiated are sure to question entering such turbulent waters.

The explanations for this volatility has so far focused on it being a somewhat new and novel product. The small market cap causes the price to be pushed around easily by large investors because it moves so much. This movement also attracts speculators, which amplifies any movement, and since the oscillations of price are so varied, those who get involved in it are prone to risk and make erratic and daring moves. All of these reasons tend to set up chicken or egg logic when examined thoughtfully, and do little to explain why other new technologies, while certainly not immune to volatility, never suffered from such extreme daily, weekly and monthly swings. I propose another theory as to why cryptocurrencies are so volatile when compared to traditional fiat, and it calls not for comparing bitcoins to dollars, but on examining the base structure of both: the satoshi and the penny.

One of the least noted yet innovative aspects of this new currency is that it is divided into 100 millionths instead of hundredths, like the American dollar. This structure makes its base instrument of value—the satoshi—vastly more sensitive to fluctuations in value. Let me explain with an example.

A quick search on eBay shows a list of things still purchasable with just one penny. For today's experiment, I’ll use the ad below for fifty broken game controllers. At time of writing, one penny is worth roughly 78 satoshis, so that is what we will price the controllers in as well.

But let's say the winds of value change direction for these orphaned controllers in a minute way, perhaps one or two more people pick up the hobby of fixing outdated and broken controllers (increased demand), or the family dog chews up five of them (decreased supply). We will use the later for this experiment. This ten percent loss of supply and the corresponding increase in value is not strong enough to move the price of the controllers if they are priced in pennies. They must double in value ( to 2 cents) for the penny to express the increase.

When the controllers are priced in satoshis the story is different. The value, starting at 78 satoshis, could easily demonstrate the ten percent increase in value; the price would rise to 85.

A ten percent increase in value is a happy outcome according to traditional stocks and bonds, and so a savvy investor might attempt to exploit this now visible increase, particularly if he can easily find many repeat circumstances—the kind that are provided daily on crypto exchanges. This increased sensitivity ends up allowing people to “see” movements in value that under the normal ticker tape people could not before, and this encourages stronger speculative outcomes both on the upside and downside. If you see a currency like SIA rise from 50 to 60 you might assume an upward trend has started and invest accordingly when this change would not even register in the penny system. This translating from one to the other allows for a kind of micro leveraging effect of sort to go on as one borrows from a heavy currency to invest in a lighter one.

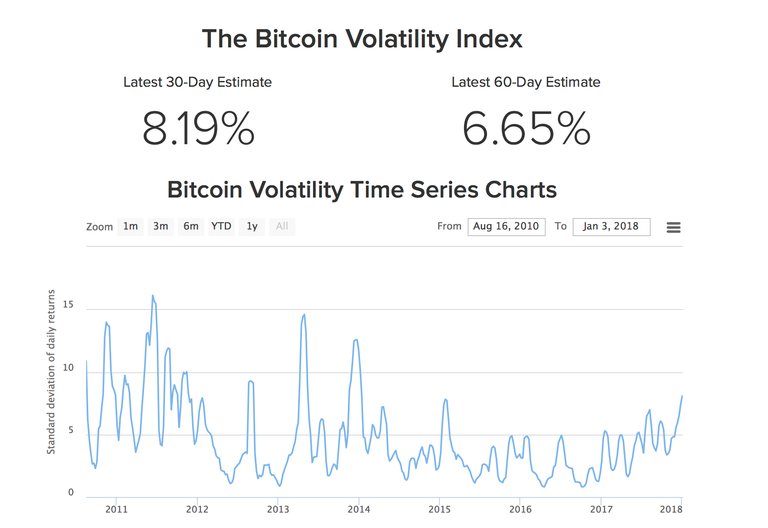

You might think of it as weighted objects against a breeze. A penny is relatively “heavy” and, therefore, will resist the lighter wind of changing value, while satoshi, being light, will easily be blown around by them. And of course this phenomenon is even stronger in younger and lighter cryptocurriences. A graph of bitcoins volatility since its nascence lends credence to this idea—for as it has gained in value—and therefore satoshis have become "heavier," the volatility has slowly started to decrease.

This might also give us some insights in predicting when bitcoin volatility might begin to diminish to more standard levels: once it gains parity with the penny. This also implies that the ultimate value of bitcoin will be around one million dollars, as this would be a mathematical outcome of penny parity. Of course, it is not a certainly that bitcoin will be the first to reach this parity, but whatever currency reaches it first is likely to discover itself the real winner of the title of “gold” standard of the cryptocurrencies. I also do not want to imply that this will necessarily be a golden outcome for all those bitcoin holders out there. It must be considered that penny parity will not likely come from simply a rise in the value of bitcoin, but also depreciation in the dollar's value, and perhaps a dramatic, even violent one. So yes, bitcoin holders may become millionaires, but a loaf of bread might cost you a grand.

Congratulations @oldmenandfire! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @oldmenandfire! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!