CAP! Is this the next Compound?

We have seen in the last couple of months, a "Gold Rush" for Defi projects. So many new terms that we have never experienced in the crypto field before like Interest Farming or Defi yield Farming.

This new type of Finance is revolutionized the crypto eco-system by providing incentives for all Crypto hodlers as they can earn interest along the way.

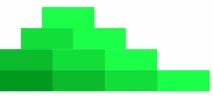

We have seen a couple of projects that most of the active enthusiast has seen such as Compound, Maker, Aave, Balancer... and so many others.

Even Coinmarketcap.com has Created a new tab for those Defi projects.

0c7c2cecd61167cb3e431696ac2afe2ba04cbd08903e6652ab1037836e36fbb7.jpeg

0c7c2cecd61167cb3e431696ac2afe2ba04cbd08903e6652ab1037836e36fbb7.jpeg

What is CAP?

https://cap.finance/

CAP is a new protocol to trade the markets withs stable coins. It's based on (Launching in Q4 2020)

5f37a3243128cb85af5f69646a27ffd5f0772d76a6c450c5b4078d90b6105442.jpeg

5f37a3243128cb85af5f69646a27ffd5f0772d76a6c450c5b4078d90b6105442.jpeg

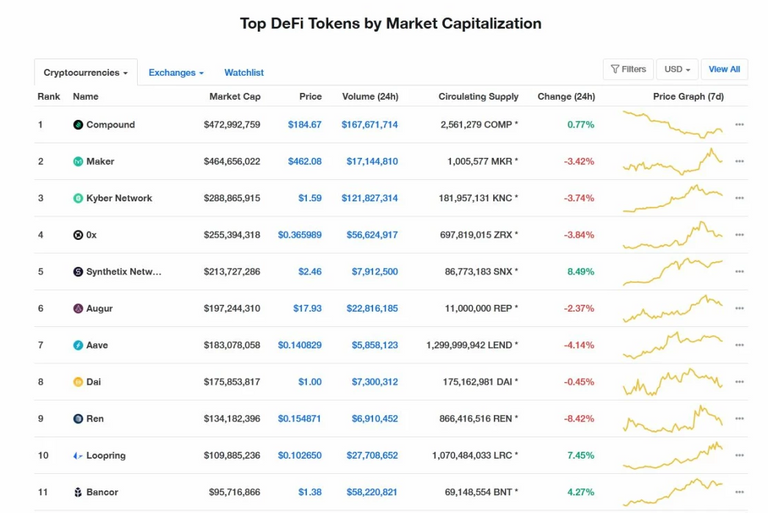

CAP will be giving you the opportunity to trade stocks, ETFs, Cryptos, and foreign exchange with 0 fees.

As long as getting 100% APY on Harvesting high yields in providing liquidity to margin traders.

CAP does not require any identity verification or KYC as all transactions are recorded on the Ethereum blockchain that will be validated by the network nodes.

Cap uses an automated market maker to quote liquidity around an asset's last price. A liquidity pool that anyone can participate in receives losses and pays out profits. Ref: cap.finance

It's that simple. Learn more in the whitepapers.

Crypto-Synthetic Trading

General · Abe Osten, 2020 (16p,v1)

Crypto-Synthetic Market Making

Technical · Abe Osten, 2020 (10p,v1)

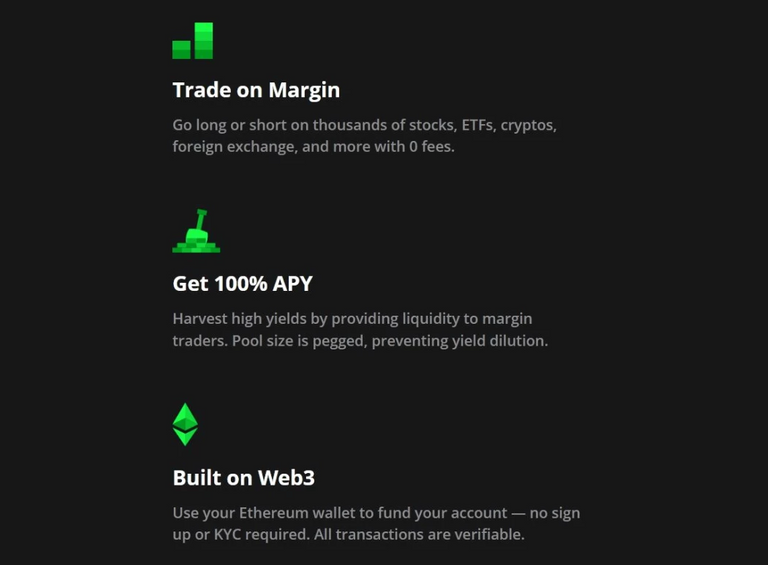

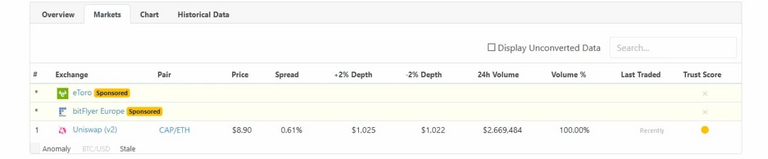

Where can we Trade CAP?

CAP can be traded on Uniswap Exchange (Uniswap is a decentralized exchange in the form of two smart contracts hosted on the Ethereum blockchain, as well as a public, open source front-end client. It's a 100% on-chain market maker allowing the swapping of ERC20 tokens, as well as ETH to an ERC20, and vice-versa).

d080a788af1750dd3cab76ef9a7d508802d00f9825e19b8b089b2322f51b8460.jpeg

d080a788af1750dd3cab76ef9a7d508802d00f9825e19b8b089b2322f51b8460.jpeg

Buy Cap on Uniswap

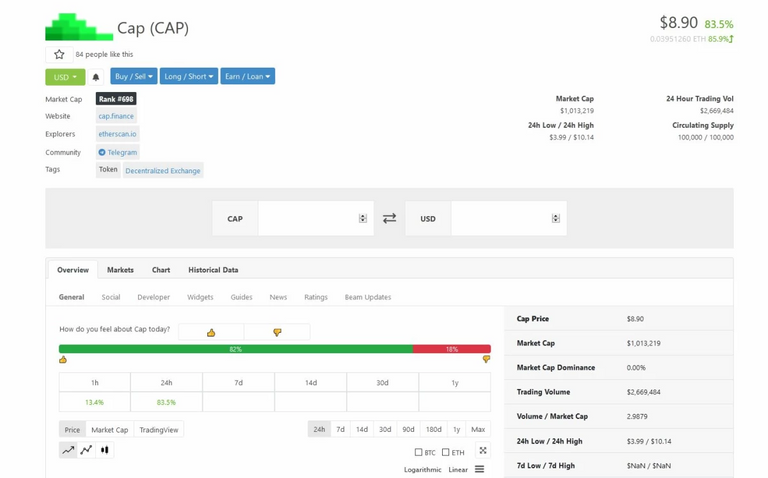

Coingecko Listing

coingecko.com/en/coins/cap

d5ff07eb584ebf9297b5b55162e3fd3f5b518bc5d83478317d6d107507c9cc05.jpeg

d5ff07eb584ebf9297b5b55162e3fd3f5b518bc5d83478317d6d107507c9cc05.jpeg

9776c2e8aa5d571cb4777728a0b57a938f911a64ea408ee7770996c9149b2bd5.jpeg

9776c2e8aa5d571cb4777728a0b57a938f911a64ea408ee7770996c9149b2bd5.jpeg

Currently, all the CAP token are traded on Uniswap V2 exchange, as long as the CAP grow it will expend to more and more exchanges therefore will be having more traded volume.

Contract on EtherScan:

Etherscan.io CAP Finance Contract

FAQ!

What's a crypto-synthetic?

Crypto-synthetics are cryptocurrency backed instruments that track the value of an underlying asset (e.g. a stock). They let you gain exposure to an asset without needing to own it or interacting with the traditional financial system, saving time and money.

How do I harvest the 100% yield?

When you provide stablecoins to the liquidity pool, you receive CAP, a token that tracks your ownership stake in the pool. New CAP are made available weekly in limited quantities. You redeem your CAP to get back your stake in the pool plus yield.

Only 1 million CAP will be made available to the public. Restricting supply means consistently high yields for CAP holders.

How do I get CAP tokens?

There are several ways to get CAP, our native LP token.

You can contribute directly to the liquidity pool. 80% of CAP are distributed this way.

You can margin trade and receive CAP as cash back in proportion to your trading volume. 20% of CAP are distributed this way.

You can also buy CAP directly on a DEX like Uniswap.

What markets can be traded on Cap?

Cap lets you trade any asset using stablecoins. For example, you can trade AAPL using DAI or Gold using USDT.

What stablecoins does Cap support?

At launch, DAI, USDT, and USDC will be supported.

How does Cap's AMM work?

Liquidity is distributed on each side of an asset's price along a liquidity curve, which is a Gaussian function whose properties are automatically adjusted based on volatility and the AMM's inventory. The system is open-source, eliminating conflict of interest. For more details, see our technical whitepaper.

What are the fees?

There are no fees to place trades or provide liquidity. Liquidity providers generate revenue from the effective spread quoted by Cap's AMM. For margin traders, a 5% interest per year applies.

Does Cap run entirely on Ethereum?

Non-leveraged trading of assets that have reliable price oracles ("Asset Tokens") is done entirely on-chain. Margin trading, where speed and low costs are vital, is partially built on conventional architecture that is fast, secure, and distributed.

Is Cap transparent and auditable?

Yes. All aspects of Cap — deposits, trades, withdrawals, profits, losses, account balances, hot and cold pool transactions, liquidity curve parameters, and more — are publicly verifiable.

Community:

The community is growing so fast after CAP is listed on Uniswap Decentralized exchange, currently, there are 474 Members in Cap Finance Telegram chat room.

Please check and join the community for more info and announcements.

https://t.me/capfin

Team:

Abe Osten

15 years of experience building software and financial products. Versed in Web3. Met Tony in college.

Tony Hadeed

15 years of experience building mass consumer software products. Security expert. Met Abe in college.

Info sources: https://cap.finance/