Thank you for all that you do. @haejin I would love to get your feedback from the chart I have made. I am an extreme novice as I've been doing this for about 3 months and been reading the Elliott Wave book recommended just trying to apply and bounce what I've learned, or thought I've learned, from the book. Your feedback would be greatly appreciated and much needed probably:

You are viewing a single comment's thread from:

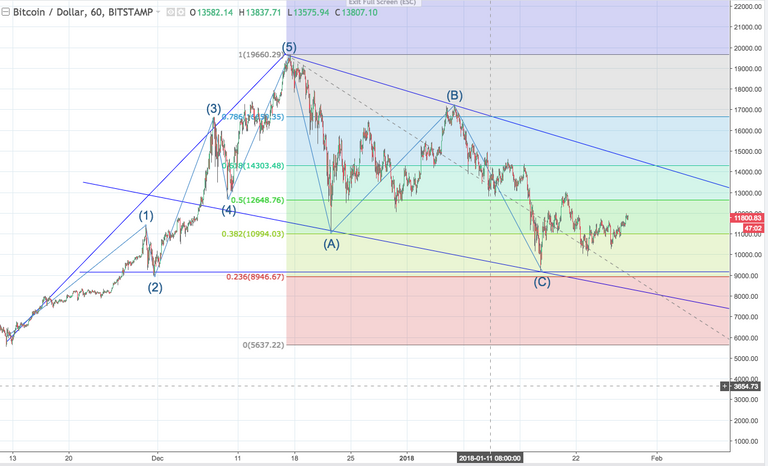

If this is a flag, then an a,b,c,d,e would be warranted. The e wave would land somewhere around $8,000 or $7,600 or so.

how do you decide what portion of our position to hold and what portion to sell while waiting for the dip. Do you employ a ladder strategy like in your tutorials on the down turn as well?

Maybe laddering would look like something like this?

Any position 'missed' during the laddering would provide for some cash in the portfolio.

So of what I understood, if we aim at let's say 10% cash, that would be the ladder for the most improbable scenario, let's say at 6000.

You would ladder the main % of your portfolio in the most probable position, etc.

Okay, thank you. So one of those scenarios of same destination but a potentially different path. I wish you massive profits and look forward to learning much more in the coming year from you!!!!

thanks so much for the alternate count and explanation. really clears up a lot. especially with the explanation of h&s on overall marketcap. Learning a lot brother! I'll be putting stops on all my positions ready to move to usdt incase drop occurs