Venezuela, the country that during the last years is submerged in one of the worst economic crises, never before seen in the country. Since the value of a barrel of oil fell from $ 100 in 2014 to less than $ 30 in 2016. Since then people have seen Bitcoin as an alternative to safeguard their capital.

Acquisition of Bitcoin in Venezuela has reached record levels while inflation increases more and more.

Venezuela faces one of the worst hyperinflation crises in the world. President Nicolás Maduro accuses the external factors and the "economic war" induced by the United States, as the culprits of this tragedy lived by Venezuelans.

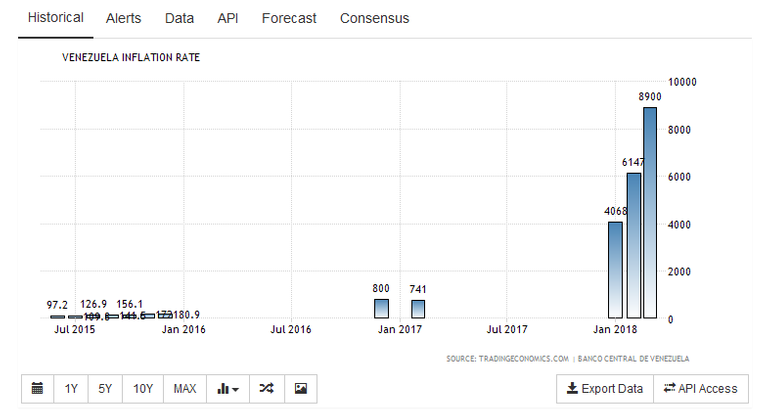

Hyperinflation has reached 8900% in the month of March 2018, according to tradingeconomics.com. As the Bolivar, the Venezuelan currency sinks, this has led to a loss of the purchasing power of Venezuelans, while the government issues more money without support to increase the minimum salary.

Data by tradingeconomics.com

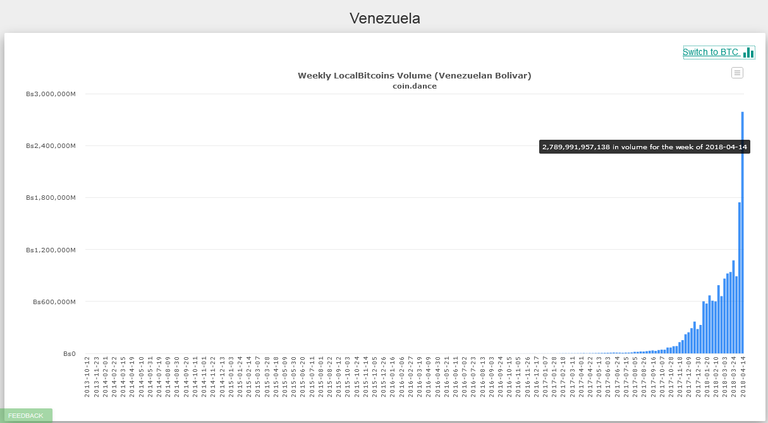

More and more Venezuelans are interested in using Bitcoin as the real alternative to get out of this crisis. According to Erik Voorhees, Fundoir and CEO of the Exchange of cryptocurrencies ShapeShift.io, He indicated some recent data provided by Coindance, which reflected the increasing adoption of Bitcoin, to the change of Bolivars.

"Bitcoin trading volume from person to person in #Venezuela reached record last week ... unfortunately both a measure of adoption of BTC and degradation #bolivar, "commented Erik Voorhees.

After this tweet a follower explained why the use of cryptocurrencies has been so important during this crisis.

"Thanks to cryptography and commerce, I can live here in Venezuela without suffering what most people suffer every day. But it is heartbreaking to see people eating directly from garbage (entire families) and see so much poverty ", dijo.

After this twett, another follower replied; "You say sadly, but is not this exactly what Bitcoin promises, to provide solid money, that works, for those who no longer have it? You should not be sad every time the next state money fails, as more and more coins fail, money finds its chance to prevail ".

The week of April 14, 2018, the volume of trade in LocalBitcoin was 2,789,991,957,138 VEF. Compared to the previous week that was below the 2 billion VEF, in 1,744,669,576,098 VEF. And long before this the volumes did not exceed one trillion VEF.

Data by coin.dance

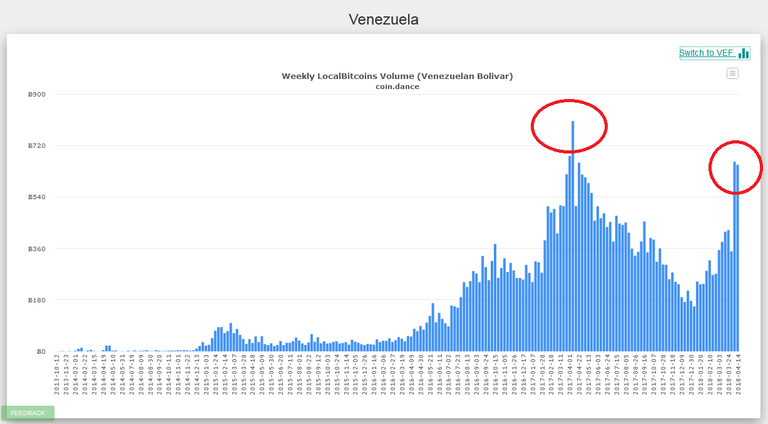

As Erik Voorhees points out, a large part of this volume increase is the result of the country's hyperinflation. In the last two weeks the volume in Bitcoin has been 663 and 654 in exchanges. Although its historical maximum was 805 Bitcoins in the week of April 8, 2017, already a year ago. The trade was steadily decreasing to 157 Bitcoins on January 6, 2018, until now it has increased significantly.

Data by coin.dance

Although the adoption of Bitcoin in Venezuela is not above its historical highs, it should be noted that the reduction after reaching these maximums was due to the loss of purchasing power of the Venezuelan population that led them to have less capacity to acquire cryptocurrency, but compared to the increase currently, clearly reflects that, is not that people are having more purchasing power, if not, that more and more people are joining this great alternative, fleeing hyperinflation .

We are aware of the following events that little by little will be more positive that will continue to drive the use of Blockchain technology.

Sources: newsbtc, tradingeconomics, coin.dance.

Thanks for visiting, we'll see you in a next post! says goodbye @moneyrevolutions