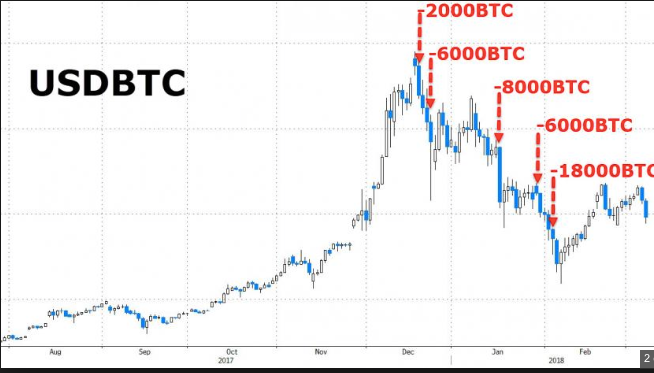

This week the news came out that the so called ‘Bear whale’ caused the recent bear market. The lawyer that is responsible for the settlement of the bankruptcy case of Mt. Gox sold almost 36.000 bitcoins (400 million USD) on the open market from December until Februari. In this period the BTC price fell 75% and the big selloffs took place at the same time that the Bear Whale moved his coins to the exchanges.

The court in Japan ruled that all the victims of the Mt. Gox fiasco had to be paid back 400 USD per lost bitcoin. The trustee was ordered to sell bitcoins that were owned by Mt. Gox for a as high as possible price to make this happen. The recently sold bitcoins are enough to pay the victims back, but there are still 160.000 unsold bitcoins left!

When 30.000 bitcoins can cause a 75% crash, what will 160.000 bitcoins do?!?!

The crash was overwhelming while only a small part of the bitcoins were sold, do we have to worry? The answer is yes: It is not a good thing that one single entity has the power to move the market that much. We want to use Bitcoin as a store of value, and we don't want to trust our value to one single person or entity and ‘hope’ that this person doesn't sell or sell it in a responsible way.

However, it is certainly not the end of Bitcoin and what doesn't kill it makes it stronger. The Bear Whale selling when the market was heavily overvalued, so beside his sell orders many others panicked and sold too. This made the effect way bigger and created a snowball effect on the sell side.

We are now around the 200 day moving average, and when it comes below this point traders will consider it undervalued. This will trigger many buy orders so that it can absorb the sell orders from the Bear Wale. Also all the weak hands that panicked in the previous selloffs are out of the market now, so less people will sell.

You can see that this happened when we hit the recent low of 6000, three times more BTC were sold than in the selloffs before, but the price effect was smaller and the bounce was huge. All 18.000 bitcoins got absorbed by the market because smart traders and investors who bought at a discount.

Beside the Bear Wale, there are many Bull Wales around that are always hunting for cheap bitcoins. The further the price of BTC sinks below the 200 day moving average, the more bitcoins the market can absorb and the Bear Wale can sell every bitcoin only once, finally his stack will be finished.

Short term there is a risk for more selloffs, but the market has spoken that the current price is around the fair value

The Bear Wale can cause more selloffs when he decides to sell more on the open market, but the effect will be way smaller because buyers are in line to buy cheap coins and the weak hands are already shaken out. It looks like there is a kind of an invisible hand under the 200 day moving average that will push the price back up when it dips below. In my opinion the market has spoken that the current price levels represent the real value and we have set a strong fundament.

(When) will the other 160.000 coins get sold?

It is not even sure when and if the rest of the coins will be sold. First it will have to go to court again. Selling the bitcoins on the open market was a very stupid move, when they had done it in an auction the market would not have crashed and the coins could be sold for an almost double price.

Kraken advised them in the past to organize over the counter sales and told them that they want to organize it for them, but they never heard from them and what happened next we all know…….

Now they have seen the result and lawsuits may follow. This makes me think that it is likely that the next court order will prescribe to sell the bitcoins in a proper way. Big amounts of bitcoin are sold in the past in auctions and this never had a relevant result on the price. I think there is a fair chance that the next sales will happen over the counter instead of on the open market.

The bigger Bitcoin becomes, the less vulnerable.

When the bitcoins don't get sold anytime soon, the risk will decrease over time. When Bitcoin adoption goes on and the network grows bigger the trading volume will increase. A bigger trading volume will decrease the effect on the market when big amounts get sold in once. When it takes years for the court to order the next sale it might not be a risk for the price anymore.

Conclusion:

The fact that one entity can decide the direction of the market is a bad thing. This will get solved over time, but can deliver us a periode of downside or sideway. The positive thing is that we know that the previous bear market was not driven on weak fundamentals and that we know there is a very strong upward forse under the 200 day moving average. It was scary to see the market collapse while knowing that fundamentally Bitcoin was doing better than ever. After his story came out everything made sense again………………..

Disclaimer:

This is my view on the current market and NO investment advise. Trading and investing can be risky, only invest what you can afford to lose.

Previous article:

https://steemit.com/bitcoin/@michiel/don-t-underestimate-the-store-of-value-feature-of-bitcoin

Store your bitcoins securely:

https://shop.trezor.io?a=bitcoinscout.nl

Like this post? Something to add? Upvote or comment!!

time for steemit to leave bitcoin's shadow

kinda spooky because if 40,000btc can drop the price 50% then 160,000 could drop it 90%

Why do you expect linearity?

good information

i dont think most of the Cryptos will reach the value they had in dec2017 again.....people have started losing interest again well most of people right now who are holding CryptoCurrencies right now are new people who have seen alot of growth in market and bought and after seeing whats happening right now this people are getting desperate for selling their Cryptos.

I really do not think the Crypto Market can be stable for at least next 4-5 months sad thing but i think thats exactly whats going to happen

Yeah I agree I think that it will take a few months to stabilize the market again but I don't agree on the fact that we wont see the highs of $19k again I think as the technology starts integrating itself into people lives they will start getting involved again

What I think analysing yout data is that more market crashes are imminent until a steady market is established. I believe the market will be stabilised by Q3 2018 where it will start to rise juat as what happened in 2017. By december 2018 we could hope to see that sweet trillion dollar mark and when the public hears about this, the market is gonna bull run even more.

As of now there are a lot of individuals owning a lot of Bitcoins which many see as the primary store value of the cryptocurrency market. Since it us limited in number, once these so called "Whales" lose majority of them, then only we could see a market with less manipulation.

P.S. these are just my thoughts.

J.D

Yes we certainly need a time of stability, where people are happy for Bitcoin to just build strong support at maybe 8k or something and then in the future we can see a big bull run again!

The recently sold bitcoins are enough to pay the victims back, but there are still 160.000 unsold bitcoins left!

I think there is nothing to worry about for 2 reasons: