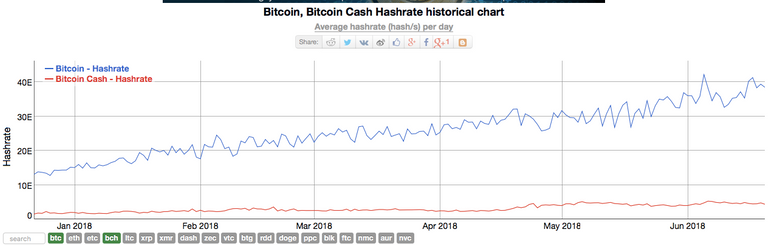

Bitcoin mining becomes less profitable when the price goes down, but despite the bear market the hash rate behind bitcoin is skyrocketing. Nine exahash, more than two times the total BCH hash rate was added to BTC in the last month while the hash rate on BCH remained steady. Many see this as a bullish sign and think that it will push the price up. It this assumption true?

https://bitinfocharts.com/comparison/hashrate-btc-bch.html#6m

How does mining work

Mining is the solution for a payment network to process transactions in a secure way without the need to trust anyone. Miners compete for the chance to process the next block by sacrificing real world resources like electricity and hardware and will be rewarded when they win and create a block. This creates the incentive to play by the rules since cheating will lead to loss of invested funds while not being rewarded.

This mechanism is called Proof of Work (PoW) and enables the network to be truly peer to peer, extremely secure and decentralised and thus without a single point of failure. This is one of the most important pillars that makes Bitcoin successful and when you don’t fully understand it you MUST educate yourself on this subject if you want to be successful in the crypto world. Here my article focussed on PoW:

https://steemit.com/bitcoin/@michiel/proof-of-work-pow-a-critical-pillar-for-the-strength-of-bitcoin

Miners solve certain math problems by allocating computing power to the network and the miner who solves it first can create the next block and is rewarded with 12.5 BTC + network fees (at the time of writing). A block takes around ten minutes to be found. When the BTC price goes up more miners will join the network because it becomes more profitable and blocks will be found faster.

This is where the difficulty adjustment comes in: Every 2016 blocks the math problem becomes more or less difficult to solve so that the moderate time that a block is found remains ten minutes. The result is that the addition of hash power will not increase the supply of bitcoins, but only increase the security level of the network.

Does hash rate follow price or price follow hash rate?

In the scaling debate and the discussion before the (cancelled) Segwit 2x hardfork there were different opinions whether the price follows hash rate or vice versa. Around 95% of the miners were signalling for S2X and their supporters claimed that the price of S2X would skyrocket after the fork because they had much more hash power behind and that the legacy chain should tank.

The other camp was claiming the opposite: Since the future market revealed that the users valued the legacy chain much higher (85/15), miners would shift to the most profitable coin and in no time most of the hash rate would be back on the legacy chain because miners will eventually always choose for the most profitable option even if it is against their political stand.

Directly after the cancelation of the S2X hardfork we got the answer when the flippening attack of BCH on BTC happened. BCH managed to take 70% of the total hash rate by using the cancellation of S2X, market manipulation and the flawed EDA. In this event the hash rate was almost instantly following the profitability (would be the price in a normal situations without EDA). Added hash rate does increase the value of the network and eventually the price will follow, but hash rate follows price instantly and price follows hash rate delayed.

The BCH flippening attack on BTC has proven that hash rate follows price, this means that miners are mainly driven by greed and politics are of lower priority. The game theory works!

Why is more hash power added despite the lower price?

In theory the hash power should go up when the price goes up and should go down when the price goes down. Obviously this is not the case for the last 6 months, it is rising faster than ever. Since it is not possible to see who exactly the miners are (only what pool they use), we can only speculate about the reasons and it could be bullish, bearish and neutral as well.

Delayed hardware delivery (Neutral)

When you order a miner today you won’t receive it tomorrow. Mining hardware was very scarce during the bull run and delivery times were long and when they are finally delivered they have to be installed too. The miners added today could be ordered in the bull run when it was extremely profitable, but just now delivered and added to the network hoping to be (come) profitable through future price increase.

I think this is the most likely reason whether or not in combination with other factors described below. When the rise is caused by delayed delivery it will not really be bullish for the price. The only bullish fact is that miners will probably sell less on the market because they expect to get more for it later and because the network is more secure and thus more valuable. However, I expect these effects to be small and maybe not even relevant.

Use of more durable energy sources

When mining becomes less profitable it will be more important to be efficient. Since electricity is the biggest cost in the process miners will start to search for cheaper sources. It is possible that the lower Bitcoin price drove miners to renewable sources and places with a surplus of electricity. By lowering the cost of mining more hash power can be created with a lower Bitcoin price. Also replacing old with more efficient and newer miners can contribute to the rise in hash rate.

Miners know something (Bullish)

Some people are speculating that miners know something that the market doesn’t know yet (e.g they could have heard that the China ban will be lifted) and are already anticipating on a future price rise because when a new bull market is coming soon this is the best time to start mining since it is now easy to get cheap miners. If this is true it could signal that a new bull run is coming soon, but I think it is not so likely that this is the reason.

Monopoly Bitmain broken (Bullish)

Bitmain was in a monopoly position as mining hardware manufacturer and as miner as well. It is possible that they were limiting their production / supply of miners to enable themselves to mine an as big as possible part of the available supply of bitcoins while the competitors were not able to buy miners for a proper price.

Since competition is coming out now and among them the Japanese internet giant GMO with more efficient miners and deep pockets, it would be dumb for Bitmain to keep restricting the supply of miners since competitors will fill the gap and Bitmain will lose market share. It is very possible that this created a higher supply of miners while the demand is still not filled.

I think it is quite likely that this is (partly) the reason that the hash rate is growing because competition will increase the supply while lowering the price and it is a fact that the supply was tight during the uptrend. The bullish effect will not influence the price in the short term, but in the long term it is extremely good for Bitcoin that behaviour of miners is influenced by upcoming competition.

Big coordinated attack (Bearish)

When a powerful attacker like a government or a group of bankers want to attack Bitcoin this is the best time. Miners are easily available now and when you are willing to mine at al loss this is the time to drive out the current miners and displace them by a group of controlled miners. By mining at a loss you will drive up the difficulty and with a low price it will become unprofitable for more and more miners and some will take their hardware offline and sell it (to the attacker).

When the group of controlled miners is big enough they can attack the network by jumping off (or to BCH) just after the difficulty adjustment and hugely extend the block time and thus make the network slow and mining less profitable for a while. They can also attack Bitcoin by organising a huge 51% attack and let the mainstream media write that Bitcoin is hacked. However, it is not so likely to happen because it will only damage and not destroy Bitcoin while the costs are enormously. The existence of BCH makes it more likely because the expensive hardware will not be useless after this attack, it can used to mine Bitcoin Cash.

So actually BCH is a HUGE attack vector for Bitcoin

Conclusion:

It is hard to say what the reason behind the skyrocketing hash rate is and when there is no malicious player behind it it is in general bullish. However, when it is just because of delayed delivery of hardware the bullishness could be heavily overdone since the influence will be minimal. Anyway, the hash rate is a measure of security of the network and still growing!

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Does Bitcoin's mining difficulty in terms of pure computational power (not in USD terms and not in BTC terms) adjust downwards, or is it monotonically increasing?

I got contradicting replies.

What dictates the hashrate?

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

You got a 50.00% upvote from @luckyvotes courtesy of @stimialiti!

You got a 51.46% upvote from @sleeplesswhale courtesy of @stimialiti!

This comment has received a 83.33 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.1 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

Bulls are coming

I actually think the increased hashrate is causing the difficulty to rise, causing fewer and smaller payouts for everyone involved. I hope people stop trying to mine and buy bitcoin on the exchanges, it's more profitable and if fewer people mine, then the difficulty can actually decrease, to keep the generation time at 600 secs. The more people mine, trying to strike it rich, ignoring the market value, it will just cause stagnation of the price and inflation of the difficulty. If people buy the coins and hold them the worth would go up and the difficulty would become manageble and profitable. I do think it's great that there is increased interest in mining but only with moderation will anyone actually benefit from bitcoin's popularity.

Hashrate is not only the sign of bullish market it can be decided after comparing the previous market trend. But I hope it will cross the previous high till October 18

This post has received a 26.45 % upvote from @boomerang.

Bitmain sell more asic, then more user start mining, then the hashrate growing. The price is secondary for the "true believers" :)

Could be that the miners are anticipating a bullish run. Remains to be seen thought, am hoping they're right

Nice write up

You got a 10.81% upvote from @postpromoter courtesy of @michiel!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Hm, good observation. Also, the mining hardware gets more and more efficient. Tipuvote!

This post received 0.62 SBD upvote from @tipU funded by @cardboard | @michiel now has a chance to win free @steembasicincome share :) | For vote buyers | For investors.

pls vote my blog

https://steemit.com/bitcoin/@gautamlike/grammy-winner-akon-going-to-lunch-cryptocurrency-akoin-build-crypto-city-in-senegal

Bitcoin had already crashed so much and will definately boom again in 2018

My target levels till end 2018 is 13000$

Damn, I just got hit in the ass by a randomly thrown dart. Take it easy crypto dude, and stop throwing random darts that just piss me off when they land in my ass

Don't worry

Good days will come and every thing will be all right. Remember my words

Bitcoin will be bullish soon , all events and graphs point towards it.. just sit back and relax

Coming months are bullish but we have to very careful as market is difficult to predict at this moment

The finance world is becoming increasingly aware of the growing presence and influence of Bitcoin. Bitcoin’s hashrate has been growing exponentially in the last few months. While its price dropped from a nearly $20,000 all-time high in mid-December to about $6,750 at press time, its hashrate hasn’t stopped surging.

The over 600 percent increase saw various experts let out bullish forecasts, as an increment in hashrate means a growing number of entities are investing in the cryptocurrency.

Bitcoin has fallen more than 65% from its all time high at the end of 2017 and it is a sign that selling has exhausted and all Cryptocurrencies are at a verge of uptrend which can ignite at any time. As we have witnessed that despite of 30 million hack of bithumb on 20 Jun 2018, Crypto market did not see sheer drop as it is assumed that maximum sell pressure is over which is again a good sign for Uptrend soon. We must expect rise at any time now.

https://steemit.com/cryptocurrency/@jatinvicky/lloyd-blankfein-ceo-of-goldman-sachs-thinks-because-of-cryptocurrency-s-unfamiliar-it-won-t-work-out

check it out

i think bitcoin going up and beat last high so what you this this is right time to buy or not give me your opinion

Bitcoin mining difficulty will go on increasing as more and more bitcoins will be mined. One should look at mining of good coins which are still profitable and has bright future. Thus the mining profitability will be balanced in the crypto world, as per my understanding. I may be wrong. :)

Good writing :) thanks

Mining companies investing for future price of bitcoin besides their losses for mining bitcoin and there is no doubt that the price of bitcoin will cross $20000 in 2018

I am newbie in cryptocurrency. So don't know all about this, but after reading your post got some idea on mining and some facts. It was pretty big post but really informative and worthy of time. Thanks for sharing. Hope it is the bull sign so finally HODLERS have some profits in their bucket and new people who afraid that BTC not going to work they come in this market too. Thanks again for sharing the info.

"Does hash rate follow price or price follow hash rate?"

I don´t think they are immediately related, but I truly think that might be a sign of a bullish market evolution. There is definitely a lot of speculation in relation to this data!

I think their is no correlation of Hash rate and Bitcoin price Hashrate increase is different concept but increase in hashrate is bullish sign for bitcoin future.

In india final verdict from supreme court will come 5th july........ I hope btc won't ban in india.

Never thought that way... interesting...

Bitcoin to the mooooon! Keep up the good work and original content, everyone appreciates it!

Your post had been curated by the @buildawhale team and mentioned here:

https://steemit.com/curation/@buildawhale/buildawhale-curation-digest-06-22-18

Really good post, I think all of these are factors, but you've identified and asked a lot of questions here I've been thinking about as well - particularly related to mining and energy sources/cost. Following :)

great job!!!! just logged in to see this article

This is the sign of big bull run